The Big Problem of China’s “Hidden Debt”

As China tries to bounce back by reopening the economy, a recent restructuring of local government debt has exposed the existence of $7 trillion of “hidden” local debt. Even though none of the borrowers have defaulted so far, this has started to create tensions.

With Beijing's change of course on key policies, such as on covid, a cyclical recovery seems to be underway. But structural problems, such as the heavy debt burden of local governments, have not gone away. On December 30, the Zunyi Road & Bridge Construction Group of Guizhou Province, one of the poorest regions, extended the maturity of its bank loans by two decades. The company has committed to honor its bond payments.

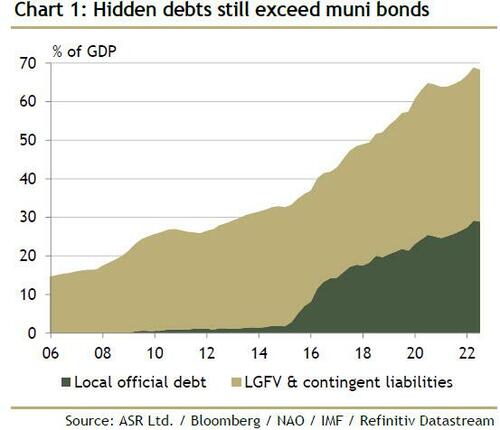

The restructuring has caused a wave of controversy among market players. Local Government Financing Vehicles, or LGFVs, are mostly linked to local infrastructure investment projects. They allow local authorities to raise funds without the debt appearing in the state budget. According to Adam Wolfe, an economist at Absolute Strategy Research, “hidden” debts and contingent liabilities rose to 47 trillion yuan ($7 trillion and 39% of GDP) in September, up from 20 trillion yuan at the end of 2019. 2016.

So far, these state borrowers – with the perception of an implicit guarantee from local governments – have avoided default on the government bond markets. But plummeting land sales and high Covid-induced spending weaken local government finances and raise questions about their ability to pay, as demonstrated by the restructuring of Zhunyi.

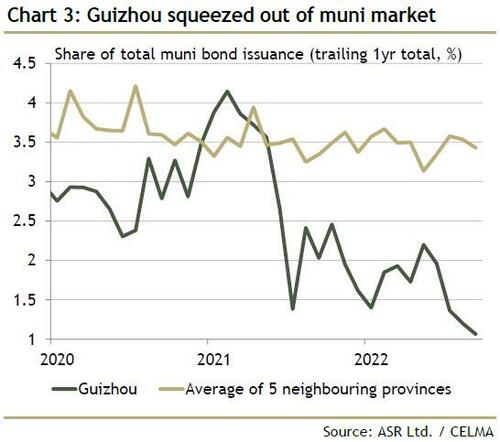

Investors have already shown some concern for the sector, avoiding LGFVs and weaker muni bonds. For example, Guizhou Province was literally pushed out of the municipal debt market:

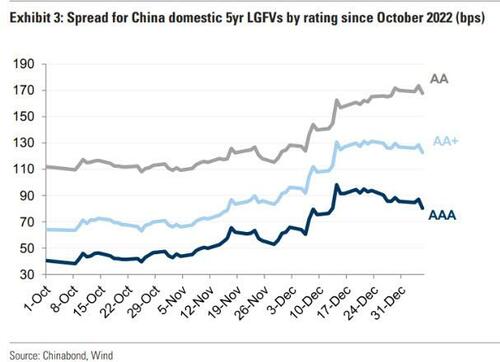

Furthermore, as in all cases of increased risk, we are witnessing a real "race towards quality, i.e. towards less risky securities, with an increase in the spread between the triple and double A LGFVs.

LGFV bonds – known as “chengtou zhai” or “city investment debt” – are huge, accounting for about a third of total issuance. The tensions in this sector could easily spread to the rest of the credit market, with results that you can imagine also due to the current fragility of the real estate sector.

Furthermore, the inability to borrow could reduce local government spending and, above all, their ability to meet payments to other financial operators, such as private and public banks, setting the stage for a systemic crisis.

Few expect a real crisis. As Bloomberg economist David Qu has noted, many LGFVs have diversified away from real estate and government-related businesses, and those still financially dependent on local governments would likely receive official aid in some form in the event of a crisis. However, this hidden debt remains the so-called "grey rhino", a high-risk threat that is often ignored until it's too late. In Wolfe's words, Guizhou's debt restructuring is just "the tip of the iceberg."

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The articleThe big problem of China's "hidden debt" comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/il-grosso-problema-del-debito-nascosto-cinese/ on Fri, 13 Jan 2023 10:00:57 +0000.