The Chinese crisis threatens to send the world into a vicious debt-deflation cycle

According to Morgan Stanley, the Chinese crisis risks triggering a global debt-deflation crisis.

China is facing the 3D risks of debt, demographics and deflation.

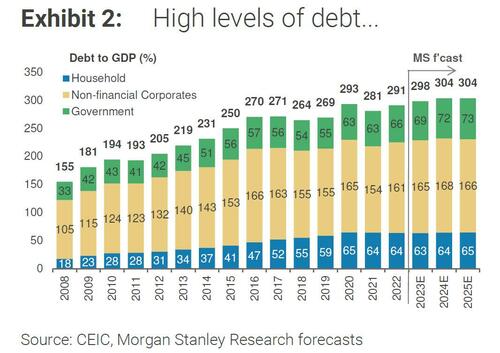

China's debt-to-GDP ratio has risen sharply, by about 30 percentage points since Covid, reaching 300% of GDP in Q1 2003. There are European countries that exceed these values (France and the Netherlands, for example), but for China this is an absolute novelty:

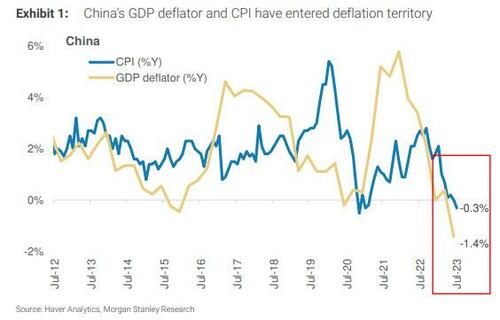

Long-term demographic trends are reducing the workforce and therefore potential economic growth. Deflationary pressures are rife in the economy, exacerbated by deleveraging in real estate and local government financing vehicles, which together account for about 70% of GDP; the GDP deflator fell to -1.4% a year in 2Q23, despite above-target inflation in the rest of the world. We recall that the deflator, by focusing only on the gross domestic product, excludes inflation linked to imports and concentrates on the price trend of the domestic economy.

For now, demographics are predetermined, a datum that cannot be changed in the medium-short term, in order to understand how Beijing's politicians should reduce the economy without pushing it into a vicious debt-deflation cycle.

The debt-deflation vicious circle envisages that the fight against debt passes through a reduction in public spending and an increase in fiscal policies, but this leads to a contraction in growth which, in turn, causes deflation. Deflation leads to a worsening of the debt/GDP ratio, because it intervenes by reducing the denominator, which is a value to be corrected for inflation, through the GDP deflator, and because the GDP contracts due to restrictive policies. At this point the government decides further restrictive fiscal policies, fueling the vicious circle.

Looking at past episodes of deleveraging in other economies around the world, three key observations emerge:

- First, successful deleveraging requires economic growth in excess of the interest rate on debt. Under these conditions, the economy can grow out of debt. In economics language, this requires holding a negative value (r – g) for an extended period, where r is the rate of inflation and g the rate of growth. Deleveraging is not possible if debt grows faster than income.

- Second, and somewhat counterintuitively, this gap needs to be sustained with expansionary monetary and fiscal policies. Success requires that policy orientation be changed only after the economy has reached a self-sustaining path that yields lower debt ratios over time. In practice, to avoid exacerbating the debt level, fiscal policy must have as high a Keynesian multiplier as possible.

- Third, historical data from other economies reveals two common biases. Policy makers' fears of reigniting bubbles through too accommodative policy often lead to a hawkish stance in the initial stages of deleveraging. Subsequently, at the first signs of recovery, policymakers tend to become too quickly false, which inadvertently leads to a double decline. Just look at what the ECB is up to in Europe, in competition with the bad European fiscal policy.

For now, Chinese growth has outpaced interest rates by more than 2 percentage points – a favorable starting point. In the last three months, however, growth has slowed significantly and, according to our estimates, China's r/g gap will decrease to an average of 1.2 percentage points in the second half of 2012. Beijing should compensate for the weakness in demand aggregate and revitalize the economy to support the rg gap.

But so far, politics has focused more on reforms than on reflation. Of course, structural reforms are needed, but reforms alone cannot break the debt-deflation cycle. Monetary policy has tightened by just 20 bps since June 2023, while fiscal policy has tightened, net. The increased fiscal deficit contracted by 3.8pp of GDP in the first half of 2023.

The risk that China avoids a vicious debt-deflation cycle remains high. Otherwise, the Chinese economy would face a protracted period of rising debt-to-GDP ratio despite slowing debt growth. Persistent deflation would weigh on nominal GDP growth, slowing corporate revenue growth and making debt service more difficult, suggesting that inflation is an uncertain evil, but deflation is a certain evil. Falling corporate profits would push the private sector to cut investment and slow wage growth. With weaker growth in consumption and especially investment, the multi-decade increase in China's per capita income in USD terms would stagnate.

If China enters a debt-deflation loop, it will be a disinflationary force for the rest of the world through trade, commodity prices and currency movements. Weakening investment would hurt export demand from China's major trading partners, with Asia and Europe more exposed. Furthermore, Chinese exports of manufactured goods, especially if accompanied by significant currency depreciation, would spread disinflation globally.

The key to China's macro outlook is its fiscal policy over the coming weeks and months. Until there is significant easing of fiscal policy, the economy is likely to lose momentum and increase the risk of a debt-deflation loop.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article The Chinese crisis risks sending the world into a vicious debt-deflation cycle comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-crisi-cinese-rischia-di-mandare-il-mondo-in-un-circolo-vizioso-debito-deflazione/ on Mon, 21 Aug 2023 07:00:49 +0000.