The cost of shipping containers in the Pacific drops. Chinese growth is less strong than one thinks

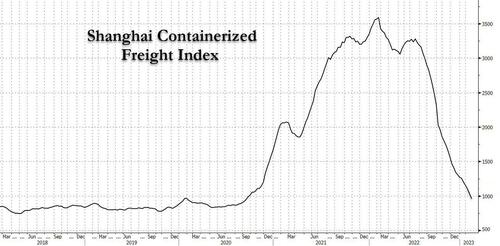

The Shanghai Containerized Freight Index (SCFI) issued after the Chinese New Year 2 023 saw the index drop into triple digits, closing at $995 for the week ending February 10, 2023.

This is a level last reached in January 2020, in the opening days of the pandemic phase. However, it wasn't the first time. These levels were seen in 2012, 2015 and 2017, indicating that spot rates have reached at least pre-pandemic levels. Sending containers across the Pacific has returned to cost as soon as possible.

This trend suggests that the end of the Chinese manufacturing crisis was talked about a little too soon with the end of the lockdowns linked to the covid. It seems that the good signs of January and February are not yet such as to be able to speak of a trend reversal.

While inflation in Europe is recovering from its low at the end of the third quarter of 2022, global growth estimates for 2023 remain bland and optimistic. Add to this the scenario of the maritime transport world which in 2023, starting from 2022, saw some of the highest congestion, while 40 days from the beginning of 2023, ports have rarely recorded more than 10 days of waiting, for except for a few, such as the Port of Baltimore in the United States.

A number of new container ships will join the existing fleet in 2023, with total growth of around 10% by the end of the year, if delivery timelines remain intact. The fleet growth will amount to just over a quarter of the existing fleet capacity, including the possible scrapping of older vessels, by 2027, given the yards' robust order book activity.

The world's largest ship operator, MSC, has a size of around 39% of existing fleet capacity in various stages of construction. All of this may try to contain inflation over the medium term, but it will also make it difficult to raise prices if demand increases, as demand has increased.

According to Bloomberg columnist Chris Bryant, Maersk expects global container demand for the current year to drop by 2.5%. He also expects contract rates to fall and settle in line with the spot market. (It should be noted that long-term rates on Xeneta fell 13% the previous month, recording the fifth consecutive month of losses). This could be a big hit in terms of overall returns.

Rightly so, even the numbers in the logistics giant's guidance state this. Its 2023 operating profits are seen at $2 to $5 billion for 2023, just 6 to 15 percent of its 2022 numbers of $31 billion. In fact, they are just a little better than 2019's $1.7 billion.

On the other hand, though, the rate of decline has decreased significantly, at least on the trade routes that bore the brunt. The steepest declines in recent weeks were attributed to US-China trade on the East Coast and transatlantic trade.

While the former did not correct much in line with China-Europe and China-USWC trades, thanks to shifting cargo routes from the US West Coast to the East Coast due to waiting times at ports, the latter did a maximum in terms of tariffs in the fourth quarter of 2022.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Drops the cost of shipping containers in the Pacific. Chinese growth is less strong than you think comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/cala-il-prezzo-di-spedizione-dei-container-nel-pacifico-la-crescita-cinese-e-meno-forte-di-quanto-si-pensi/ on Sun, 12 Feb 2023 08:43:02 +0000.