The ECB gets it wrong again and again

The narrative that has guided the meetings of the ECB in the last period, coinciding with the new restrictive monetary policy which has brought rates to 3% and will continue to make them rise further, sees in the excess of growth in wages and therefore in demand, the source of high inflation.

For this reason, the ECB has decided to raise rates to curb credit and therefore indirectly consumer demand, guilty, according to him, of having triggered an inflationary spiral.

Furthermore, the prevailing macroeconomic narrative over the past nine months has been that sharp price increases, from energy to food to computer chips to semi-finished products, were raising production costs for companies in eurozone component countries, reducing so the profits.

However, the reality that is taking hold is radically opposed to the idea according to which the ECB is moving.

Let's go step by step.

A few days ago, in a meeting reserved for a few financial operators held in Finland, it emerged that the spiral of inflation has resulted in record growth in corporate profits, rather than a reduction as expected by the ECB.

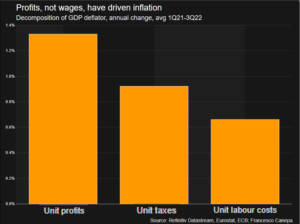

Several slides, such as the following one, have shown how the inflation component is mainly due to the increase in corporate profits, then to the level of taxation and finally, lastly, to the increase in wages.

In short, the ECB does not seem to have once again understood absolutely nothing.

Eurozone consumer goods companies, for example, increased operating margins by an average of 10.7% last year, a significant increase from previous years.

But in Lagarde's speeches, in the minutes of the ECB, there is no trace of corporate profits, they are never mentioned, while increasingly insistent calls are made to limit the growth of workers' wages.

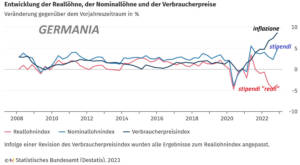

In reality, wages have grown much slower than inflation, implying a 5% drop in living standards for the average employee in the eurozone compared to 2021, according to ECB calculations.

In Italy, for example, wage growth does not reach 2%, while inflation is 10%, with a loss of purchasing power of 8%.

In Germany, things are slightly better for the workers, but the loss in real terms is still 5%, as can be seen in the graph below.

So to clarify and summarize the real story about inflation we can say that:

1 – it all begins with the demented Green “Fit for 55” policy of summer 2021 which triggered an increase in both the price of raw materials, energy and CO2 emission quotas, which, however, no one seemed to notice for months on end, although the price increases were already significant;

2- in February 2022, with the launch of the Russian military campaign in Ukraine and the Tafazzi sanctions on Russia desired by the EU, the cost of energy continued to rise for businesses and households to levels never seen before;

3 – the companies have almost totally passed on the higher production costs to consumers through the increase in prices and this has generated record profits for the same companies (ENI, Enel, Stellantis… just to name a few examples);

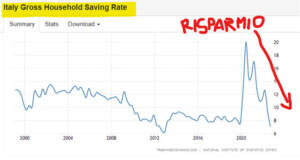

4 – consumers, workers and families have instead seen in recent months a very modest increase in wages and to maintain the same standard of living, have significantly reduced their savings component, which collapsed in the last year;

5 – in addition to all this, the ECB's very wrong rate-raising policies are penalizing those who are in debt, causing a reduction in disposable income and therefore in consumption, which will eventually lead to a contraction in corporate profits with all that this will entail (stock increase, production reduction, working hours reduction, unemployment,….).

Continuing to follow this wrong logic of the ECB, we will not come out well and soon also the Italian public debt will be put to the test with yields that could return to 2011 levels.

Will the Meloni government go the way of the Berlusconi government of 2011?.. bets are accepted.

Stephen DiFrancesco

Vice-President of the Moneta Positiva association

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article The ECB is wrong again and again comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-bce-sbaglia-ancora-ed-ancora/ on Sun, 05 Mar 2023 12:29:26 +0000.