The ECB raises rates by 0.75%, the highest jump in 20 years. So we are sure that we will go into depression

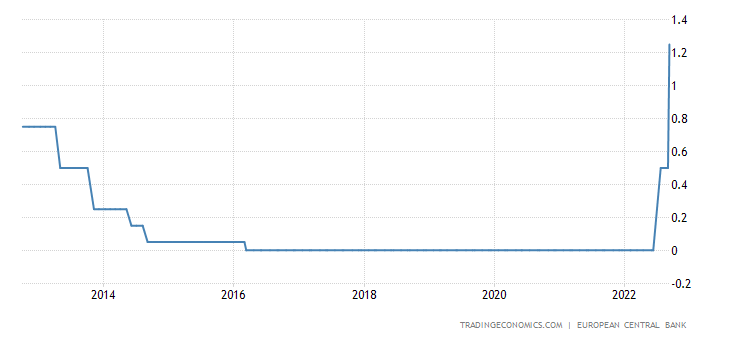

Eventually it thundered so much that it rained, and the ECB raised its interest rate by 0.75% (75 basis points) to positive for the first time since 2016 and making the biggest leap in its 20-year history. Not being the depressive push enough, the ECB also stated that "future decisions of the Governing Council on policy rates will continue to depend on data and will follow a meeting-to-meeting approach" adding a touch of uncertainty that always hurts. The ECB itself described today's move as an "important step" anticipating the transition to a more neutral policy and stated that, following the rise in the deposit rate above zero, "the two-tier system for the remuneration of excess reserves is no longer necessary ”and“ the Governing Council has therefore decided today to suspend the two-tier system by setting the multiplier to zero ”. An obvious decision, given that there is no longer any negative remuneration. here is the interest chart:

And since today's hike is paltry when compared to the European inflation rush, which is nearly double-digit, the central bank has said – not once but twice – that it plans to raise interest rates further at upcoming meetings " because inflation remains too high and is likely to remain above target for an extended period ”and“ to dampen demand and protect against the risk of a persistent upward shift in inflation expectations ”.

The language about what the ECB will do in upcoming meetings has changed. Previously, it was said that "normalization of interest rates will be appropriate". There are now more details on why more hikes are expected: " The Governing Council plans to raise interest rates further to dampen demand and to guard against the risk of a persistent upward shift in inflation expectations."

Also note that there is no news on the Transmission Protection Tool. It is still there to “contrast unjustified and disordered market dynamics”. A nice way to say nothing and let the countries go their own way to crash happily.

After a rebound in the first half of 2022, recent data indicate a substantial slowdown in euro area economic growth, which is expected to stagnate over the course of the year and into the first quarter of 2023. Very high energy prices are reducing the purchasing power of people's incomes and, although supply bottlenecks are easing, they continue to limit economic activity. Furthermore, the adverse geopolitical situation, in particular Russia's unwarranted aggression against Ukraine, is weighing on business and consumer confidence. These outlooks are reflected in the latest personnel projections for economic growth, which have been revised downwards for the rest of the current year and throughout 2023. Now the economy is expected to grow by 3.1% in 2022, by 0.9% in 2023 and 1.9% in 2024. With this rate decision, the ECB sends European countries directly into depression, all to contain consumption. We want to give Lagarde a suggestion: the dead do not consume anything, rather they fertilize.

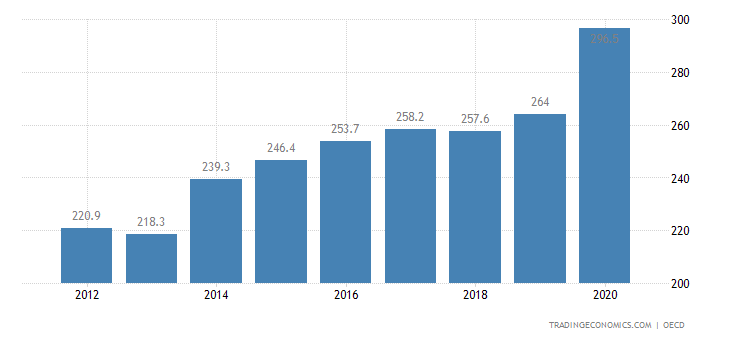

We would also like to point out a small point: we always talk about Italy, but France has a private debt on GDP of 300%

With the public one we easily reach 400%. Italy, by comparison, reaches only 330% (180 + 150). Private debt is also more sensitive to interest rate developments. The Netherlands has a total debt approximately equal to Italy, but with a strong prevalence of private debt. What will happen to the banking system as soon as holders of variable rate debt start failing to cope with the devastating mix of bills and mortgage payments? Ah, mystery …

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article The ECB raises rates by 0.75%, the highest jump in 20 years. So we are sure that we will go into depression comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-bce-alza-i-tassi-dello-075-il-salto-piu-alto-in-20-anni-cosi-siamo-sicuri-che-andremo-in-depressione/ on Thu, 08 Sep 2022 16:13:46 +0000.