The FED is still not convinced that rates should not be raised further and US government bonds fall

Yesterday Powell held a press conference in which he showed his more aggressive side from a monetary point of view. The “Hawk” showed its claws and things did not go well.

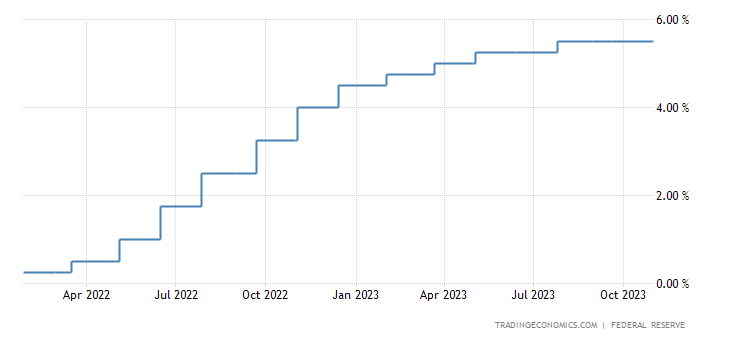

The Federal Reserve held its target range for the federal funds rate at a 22-year high of 5.25%-5.5% for the second straight time in November, reflecting policymakers' dual focus on reporting inflation to the 2% target while avoiding excessive monetary tightening.

Monetary policy engineers stressed that the extent of any further policy tightening would take into account the cumulative impact of previous interest rate increases, lags associated with how monetary policy affects economic activity, and the inflation, and developments in both the economy and financial markets.

During the press conference, Powell signaled that the September dot-plot showing most participants expecting a further rate hike this year may no longer be accurate. He further said that the FOMC has not yet discussed any rate cuts, while the main focus remains on whether or not the central bank should implement further rate hikes.

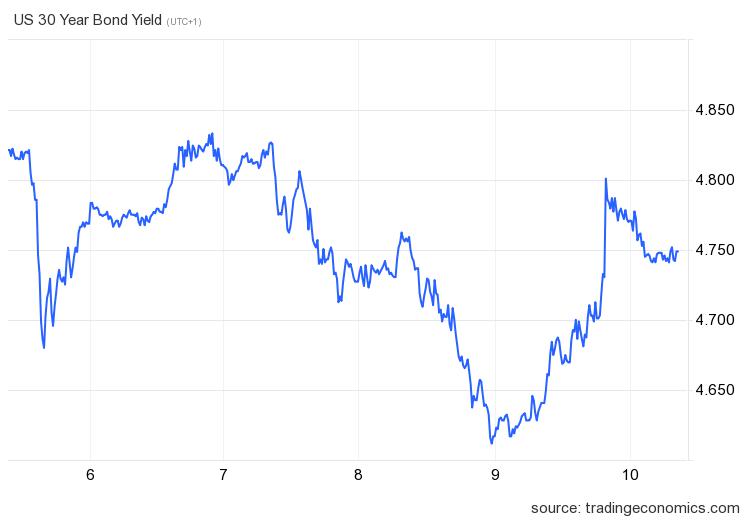

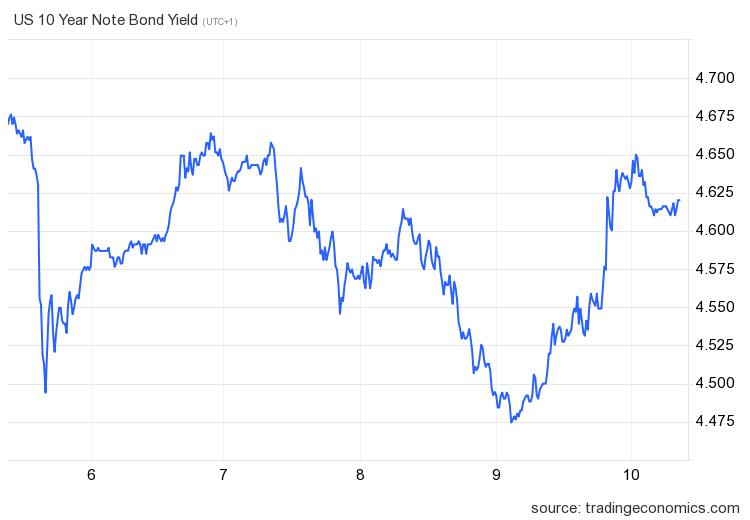

So Powell has not closed the way to further increases, while, for now, he has closed it to cuts, and the effects have been seen on the yields of US government bonds. Among other things, yesterday there was a terrible performance in the auction of thirty-year US bonds.

After reaching a peak of 4.8%, the stock stabilized at 4.75%. The ten-year anniversary had a similar trend, although less pronounced.

Every time Powell talks, even vaguely, about raising rates, about continuing a restrictive monetary policy, then US government bonds increase in yield, decrease in value and drag the stock market with them. The risk is that all of this will also bring with it economic growth, due to the effect on commercial rates. In short, the situation is not easy, and risks becoming even more complicated.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article The FED is still not convinced that rates should not be raised further and US government bonds fall comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-fed-non-e-ancora-convinta-che-non-si-debbano-aumentare-ancora-i-tassi-e-i-titoli-di-stato-usa-cadono/ on Fri, 10 Nov 2023 10:00:01 +0000.