The five raw materials destined to rise in price with the Russian crisis

Rising tensions in Eastern Europe over Russia's impending invasion of Ukraine and prospects for sanctions against Russia fuel fears of supply-side shocks in commodity markets. Of course the extent of the shock would depend on the political and, God forbid, military evolution of the situation.

The US plans to stop the invasion with economic sanctions. A self-defeating and, at least, very particular idea. US lawmakers have said they are devising the "mother of all sanctions" against Russia as a method to defend Ukraine that would "cripple the [Russian] economy". We don't know if it exists, but the conflict will surely skyrocket five commodities linked to the conflict in Russia.

Here are the five key commodities that are likely to be most affected if Russia invades Ukraine:

- ALUMINUM Russia accounts for about 6% of the global aluminum supply, and an escalation of tensions between Russia and Ukraine increases the likelihood of a supply shock in an already tense aluminum market. Russia produced around 3.7 million tons of aluminum in 2021, with a world production of the metal of around 68 million tons. Data from the CIA World Factbook shows that China is the world's largest producer of aluminum, producing around 39 million tons in 2021, but also that Russia is a major exporter of the commodity. A conflict, with a cut in its supplies, would send an already very high price into orbit.

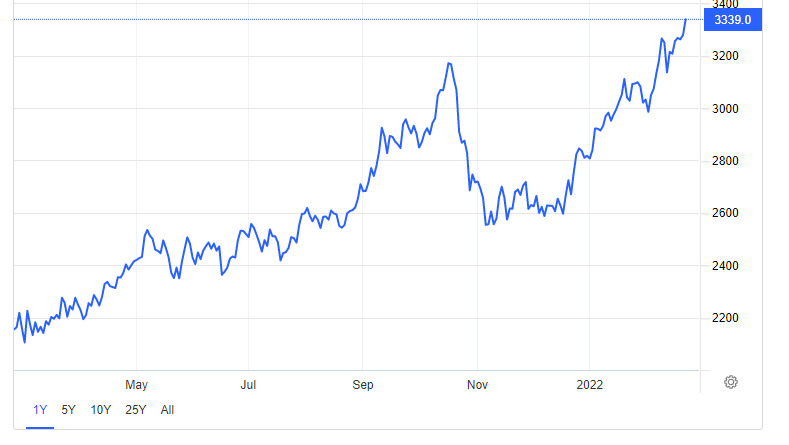

- OIL: Russia is one of the largest producers of oil and gas, and extracts about 9 million barrels of crude oil per day. By comparison, the U.S. pumps around 11.6 million barrels while global oil production comes in at around 96 million barrels per day. close to the highs of the last seven years, with oil markets facing winds against supply.

OPEC + has set itself a high level, increasing production quotas by 400kb / d every month since mid-2021. The group has consistently lacked budget and there are signs that things are getting worse. The "OPEC 10", countries within OPEC but excluding Venezuela, Libya and Iran, were expected to increase production by 254kb / d in January, with the rest of the 400kb / d quota assigned to Russia and others. Official results published a few weeks ago indicate that OPEC 10 has increased production by just 135kb / d and is now well 748kb / d below self-imposed quota levels. So the political crisis is triggered on a difficult situation, also due to the scarce previous investments, of which our readers are already very well informed.

- NATURAL GAS Russia is a major producer of natural gas, pumping around 639 billion cubic meters of natural gas in 2021, or nearly 17% of global production of 3,854 trillion cubic meters according to BP data.

Natural gas prices in Europe reached new highs after a pipeline carrying Russian gas to Germany changed flows eastward. Westward gas flows through the 2,607-mile Yamal-Europe pipeline, one of the main routes for Russian gas to Europe, have gradually declined, a move the Kremlin says has no political implications.

Some Western politicians argue that Russia is using its natural gas as a weapon in the Ukrainian question, which the Russians have always denied.

In the event that Russia's gas supplies to Europe run out, US gas producers are likely to step in to supply Europe with liquefied natural gas, which would imply a large increase in demand and potentially cause a rapid reduction in inventories. USA of natural gas and a net increase in gas also overseas.

- COPPER USGS data shows that Russia produced 920,000 tons of refined copper in 2021, about 3.5% of the world total, of which Nornickel produced 406,841 tons. UMMC and Russian Copper Company are the other two major producers, with Asia and Europe being Russia's main export markets. Prices for metals, including copper, are expected to reach historic highs for an unprecedented period. and sustained in a net zero emissions scenario. Copper prices are at all-time highs thanks to rising demand, especially in developed countries, with the increasing use of electric vehicles and wind farms, solar panels and the power grid, combined with reduced supply.

- COBALT According to data from the US Geological Survey (USGS), last year Russia produced 7,600 tons of cobalt, more than 4% of the world total; however, Russia was a distant second to the Democratic Republic of the Congo which produced it. 120,000 tons. Nornickel (GMKN.MM) is the largest producer in Russia, selling 5,000 tons in 2021. Nornickel sells most of its production to Europe. Nornickel is also the world's leading producer of refined nickel, with a production of 193,006 tons in 2021, or approximately 7% of global mining production, estimated at 2.7 million tons. The company sells to global industrial consumers on long-term contracts. Strong penalties could stop these supplies.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article The five raw materials destined to rise in price with the Russian crisis comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/le-cinque-materie-prime-destinate-a-crescere-di-prezzo-con-la-crisi-russa/ on Wed, 23 Feb 2022 07:00:25 +0000.