THE FIVE UNEXPECTED THAT FOR BofA could revive volatility in 2021

2021 seems to be heading towards a sort of sad predictability in the trend of assets, linked to the trillions that the central banks will in any case inject into the system and which will carry on the scarce profit swelling in the value of the assets. Yet, despite this spleen, there are 5 events that, according to BofA analysts, could bring some movement to the markets, and not absolutely, at least in some of them.

Let's analyze them:

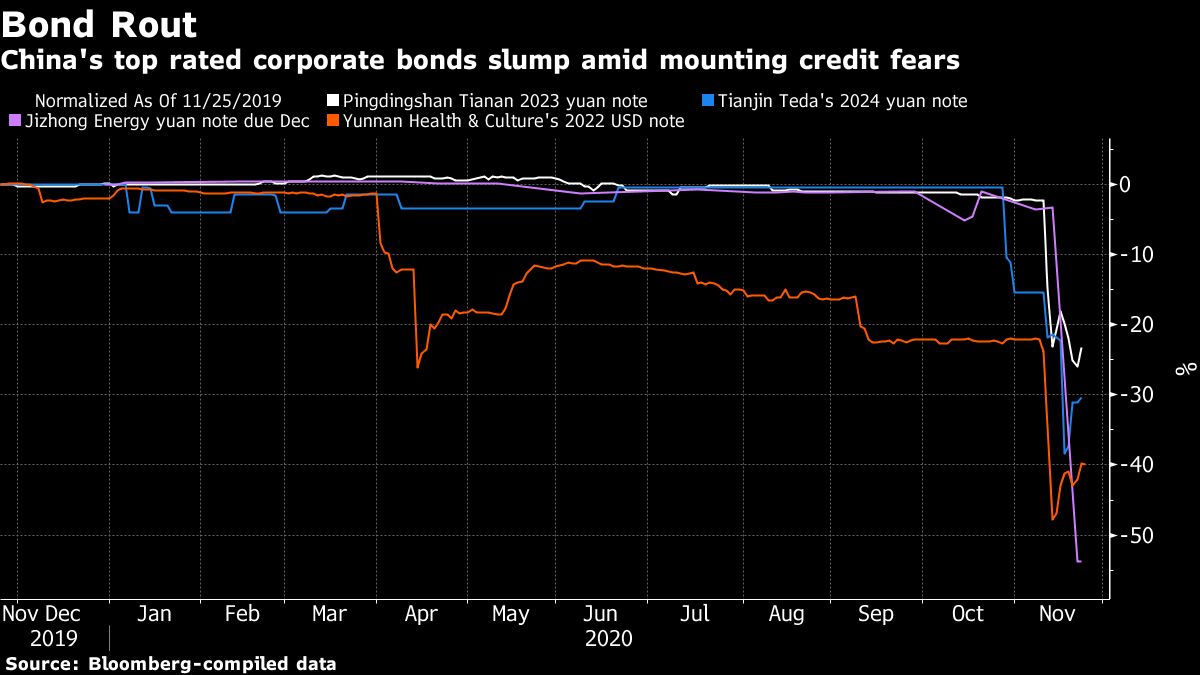

1. China's debt defaults impose tighter credit, strangling global recovery

China is having another record year of corporate bond defaults, including by some state-owned enterprises that investors had assumed were implicitly guaranteed by the central government. Winnie Wu notes that the overall default rate is low, but given the spike of 27 percentage points in debt-to-GDP this year, it also signals the likelihood of policy tightening in 2020 to levels that previously triggered a category A share. market crash, trade tensions and great pain for the private sector. So we could see instability due to restrictive policies in China.

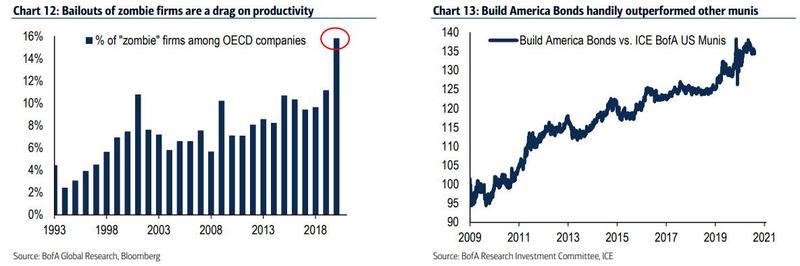

2. Zombie business bailouts limit productivity and GDP

In 2020, 21 trillion dollars of global stimulus were needed, but a cost of the policy is that "bad" companies, with practically zero EBIT and therefore unable to pay their debt, are saved along with the good ones . The big risk is not a dramatic debt crisis, but a long-term drag on productivity. 16% of OECD companies are now "zombies," which means that even in a rebound, revenues go to balance sheet repair instead of investment. The only cure for the zombies is higher aggregate demand, or be prepared to see the market tear them apart.

3. Work from home contains wages

As more and more companies relocate high-cost-of-living workers out of town they reduce wages accordingly, so one wonders whether global labor arbitrage is coming to limit even higher wages. The containment of the wings resulting from these policies could lead to a decline in the growth of expenditure for the highest paid workers, or to a worsening of living and consumption conditions for workers of the lower classes.

4. Great boom in bipartisan industrial policy

The problem for the US, torn apart by a sota of civil war, is the need for investments: infrastructural, in the kitchen, in digital structures. It is a question of understanding the need for major bipartisan industrial policies and acting accordingly. You could use instruments like R&D bonds priced higher than Treasuries and made available only to US citizens would be tempting, following the story of Build America Bonds (Graph 13).

5. Climate reformers let nuclear power join the party

Clean energy is one of the most popular investment themes this year, but some policy makers are raising questions about the achievability of climate goals using renewable energy alone. Those who want nuclear power argue that nuclear power plants are necessary to meet backup needs when wind and solar are not available and are nearly emission-free during operation. Uranium is trading around $ 30 / pound; it was $ 70 in 2011 and $ 136 in 2007. If they pass their thesis there could be a rebound

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article THE FIVE UNEXPECTED THAT FOR BofA could relaunch volatility in 2021 comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/i-cinque-imprevisti-che-per-bofa-potrebbero-rilanciare-la-volatilita-nel-2021/ on Tue, 15 Dec 2020 07:00:32 +0000.