THE “GOOD REASONS” OF LOCKDOWN

When a minister of health, who has governed during the greatest deaths of people since the war to date, by discouraging autopsies, medical examinations, treatments, etc., or by doing the opposite of what presumably should have been done, is confirmed by the new government , it means that he worked "well".

When a prime minister, responsible for the Greek massacre, blatantly violates the Constitution and European provisions (including CoE 2361/21 and EU Regulation 953/21 recital 36) by introducing clearly discriminatory rules, he is even promoted to candidate "In pectore" for the presidency of the Republic means that he has worked "well".

Do you think this is a contradiction? It is not. In fact, you must know that the euro is a patient in a pharmacological coma, kept alive artificially thanks to the continuous violations of the European regulations started in 2015 by Mario Draghi with the "quantitative easing" (see the Karlsruhe ruling of 5 May 2020) and continued with PEPP, or the pandemic plan, by the Draghi-Lagarde duo. Without these crutches, the euro would have ended, but its demise would drag much of the European banking system with it. It is clear that this scenario should be avoided AT ALL COSTS. Who cares if 10,000 or 100,000 or a million people die, an even greater good must be saved!

Yes, because, while early care is denied to SARS-CoV-2 virus patients and we must wait for the situation to worsen before being able to enter the hospital (when it is sometimes too late!), Single currency care cannot be interrupted. There is a small problem: such cures ( "quantitative easing" and PEPP) were introduced under the pretext of raising euro zone inflation to close to 2%, but current supply-side bottlenecks have increased the prices of many raw materials and so inflation has even reached 3%.

Even the approach of the German elections (the Germans have always been opposed to "quantitative easing" ) does not play in favor of the continuation of monetary stimuli and the most probable consequence could be, as Bloomberg News says, a reduction in purchases of government bonds from the current 80 billion euros per month to 50 billion.

The reduction in purchases by the ECB paves the way for the increase in interest rates (the famous spread which, as everyone should know, does not depend on the debt / GDP or deficit / GDP ratio as the mainstream information told us, but primarily the guarantee offered by the central bank through its purchases). But changes in the interest rate of government bonds affect their price. It is mathematical: if the interest rate rises, the price falls; if the interest rate goes down, the price goes up.

Since European banks, and in particular Italian ones, are full of government bonds, an increase in the interest rate, or a reduction in the price of the bonds, would determine a reduction in the capital they hold. These capital losses, if not compensated (by what?!?), Lead straight to bankruptcy. Then the virus, the closures, the discrimination, the permanent state of exception, the lack of compensation, the war between the poor are welcome. Everything is broth to bring inflation back to below 2% . Draghi (formerly Goldman Sachs) and Macron (formerly Rothschild & Cie Banque) know this well and are doing everything to impoverish the populations, save the euro and with it the banking system from which they come. It is no coincidence that Italy and France hold the European record of brutality for the (alleged) fight against the virus. Even Merkel's advisers know this, but very soon there will be federal elections for which they cannot pull too hard.

Of course, they are not the only ones to destroy small businesses, even in other parts of the world there is a similar "killing spree" towards these and towards "non-tradable" services. It's liberalism, beauty. They tell us this in the face: without bothering Klaus Schwab and the “Great Reset”, it is enough to refer to Michele Boldrin's profound intellectual honesty and his desire for the destruction of micro and small businesses (the wet dream of the globalist elites).

That's right: the virus, premeditated or escaped "by mistake" from a laboratory in China, is the most extraordinary opportunity to carry on the project of the globalist elites, headed by the big investment banks. As it happens, the latter are precisely the shareholders of the pharmaceutical companies that produce vaccines against covid, vaccines with respect to which, to use the words of a person who should be the guarantor of constitutional rights, freedom cannot be invoked to escape them. . The "bank" vaccines are mandatory in the absence of mandatory.

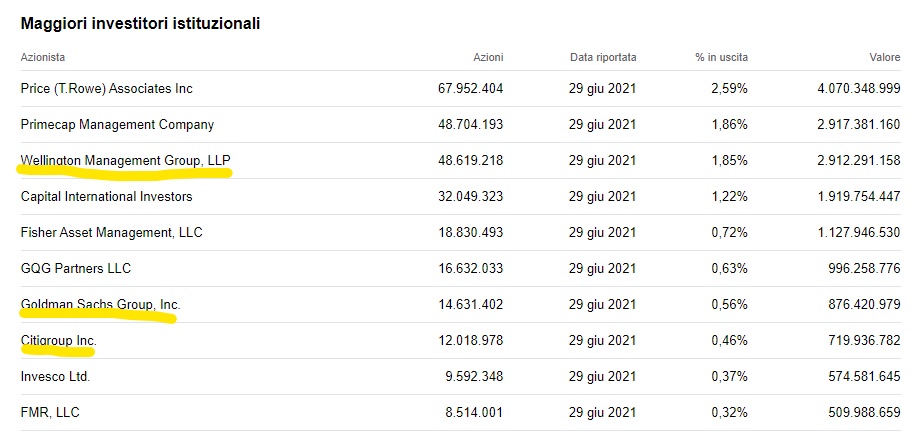

Let's start with AstraZenaca: among the major institutional investors there are Wellington Management, Goldman Sachs and Citigroup .

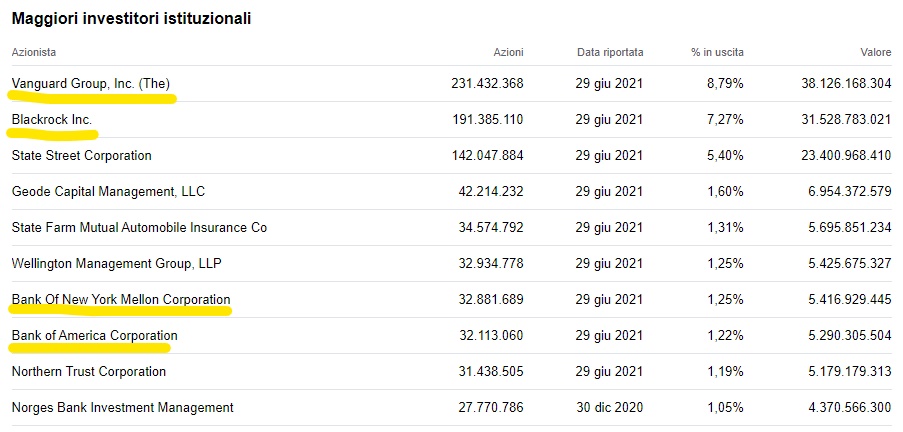

We continue with Johnson & Johnson: we have Vanguard , Blackrock , Bank of America, etc.

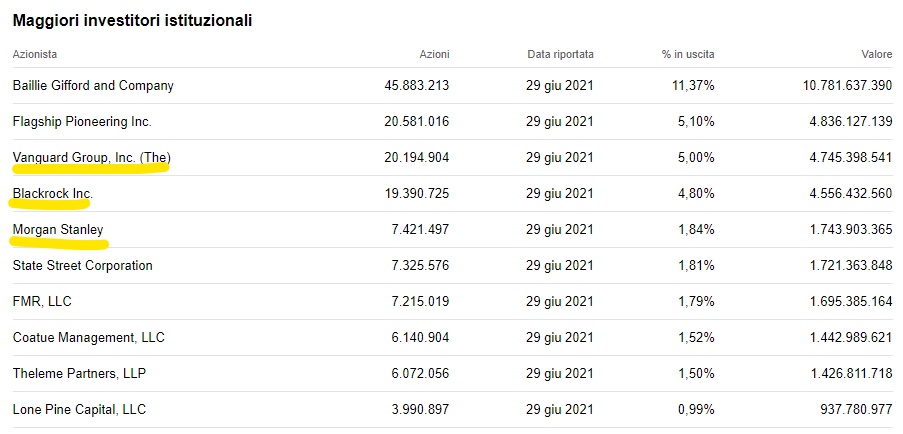

Let's see Moderna: again Vanguard , Blackrock and Morgan Stanley .

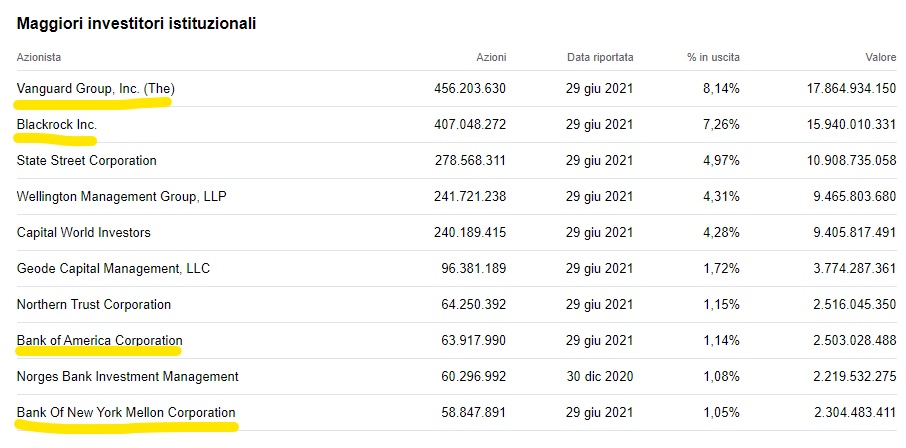

Pfizer: Vanguard , Blackrock and Bank of America.

As it happens, the lackeys of the big investment banks are willing to do anything, EVERYTHING, just to impose (their) vaccines (those of the banks). Yes, because there is a vaccine that has a big flaw: Sputnik V is financed by the Russian state, multinationals don't get a cent. Ironically, this very vaccine is not recognized in the EU. How strange, don't you think?

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article "GOOD REASONS" OF LOCKDOWN comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/le-buone-ragioni-dei-lockdown/ on Thu, 09 Sep 2021 15:10:29 +0000.