The history of the 10Y BTP-Bund spread from the 90s to today

The term spread refers to the difference in yield between Italian ten-year government bonds and German equivalents, respectively BTP 10Y and Bund 10Y

We trace the yield history of these securities through the OECD database , available under “ long-term interest rates ” as monthly, quarterly and annual average.

The OECD also offers a short definition, let's read it:

« Long-term interest rates refer to government bonds that mature in ten years.

The rates are mainly determined by the price charged by the lender , the borrower's risk and the reduction in the capital value .

Long-term interest rates are generally averages of daily rates, measured as a percentage.

These interest rates are implied by the prices at which government bonds are traded on the financial markets , not by the interest rates at which the loans were issued.

In all cases, they refer to bonds whose principal repayment is guaranteed by governments .

Long-term interest rates are one of the key determinants of business investment .

Low long-term interest rates encourage investment in new equipment and high interest rates discourage it . Investments are, in turn, a major source of economic growth. "

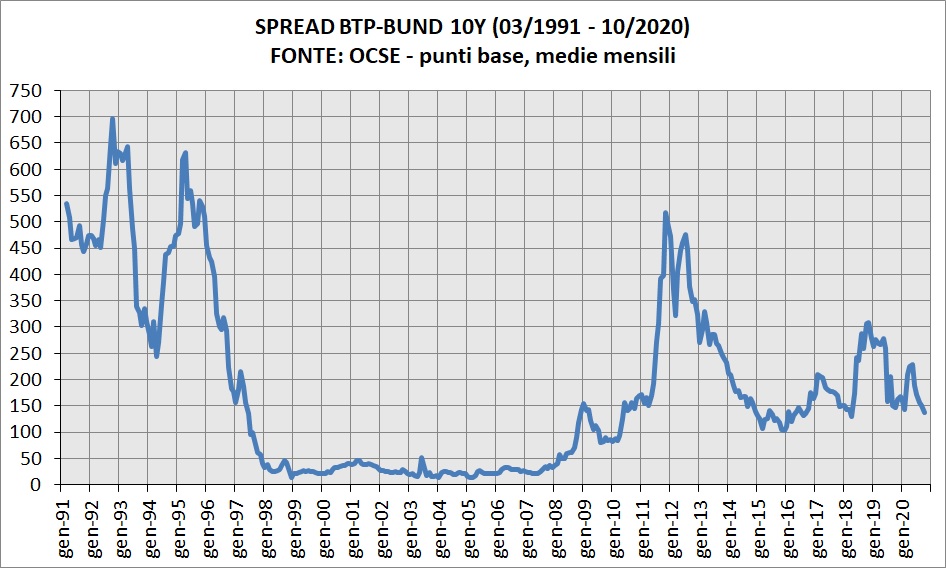

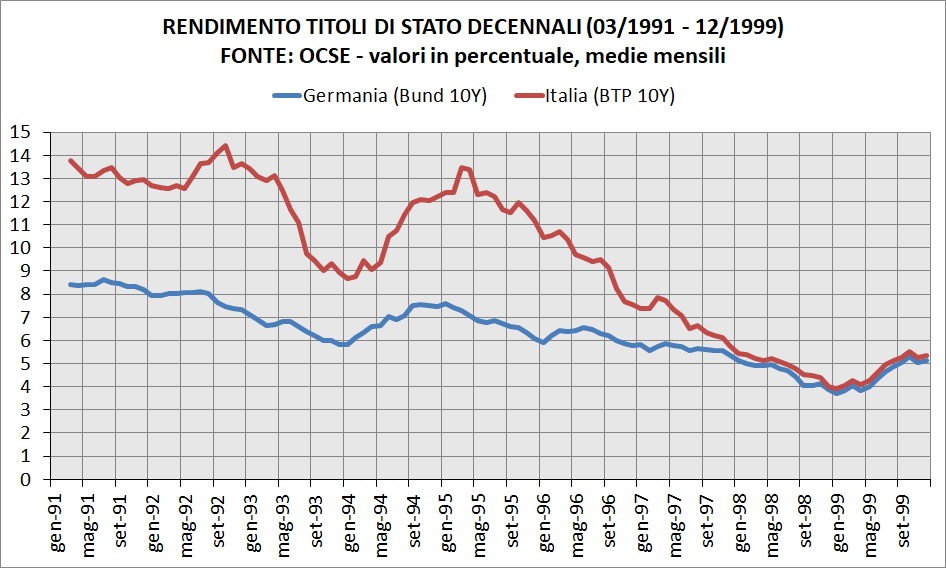

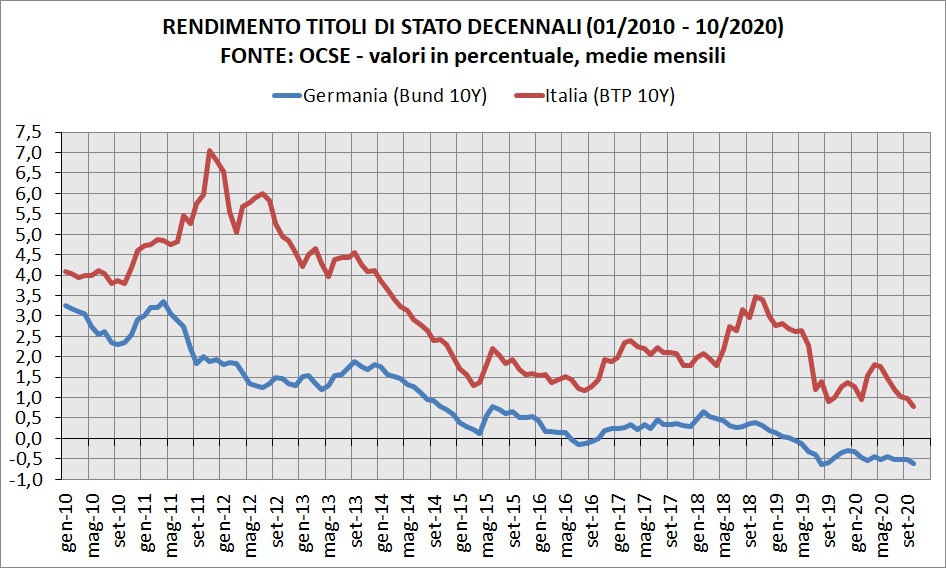

Below is a graph on the monthly averages of the yield of BTPs and Bunds .

The top red line is Italy: the further away from the blue line (Germany), the higher the spread .

Here is the reconstruction of this indicator from March 1991 until October 2020.

Let's examine the spread trend in chronological order: 90s , 2000s and 2010s to date.

THE FIRST 10Y BTP ISSUES IN 1991

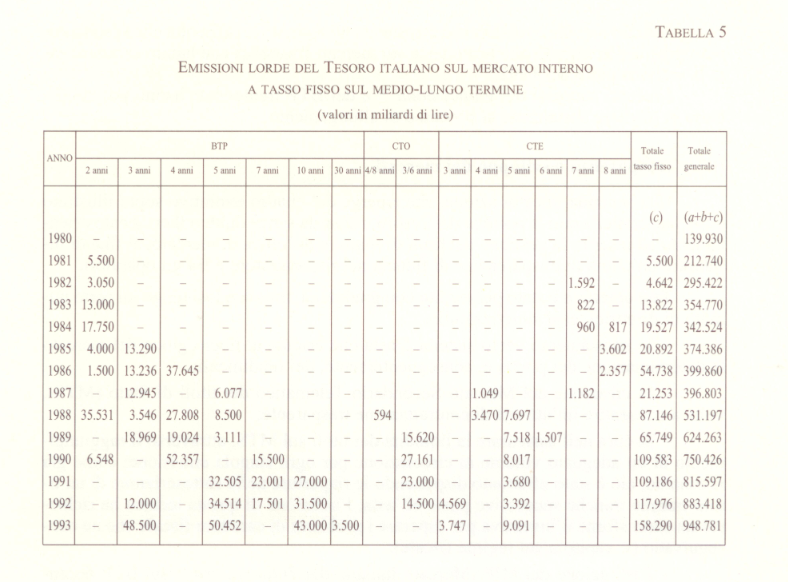

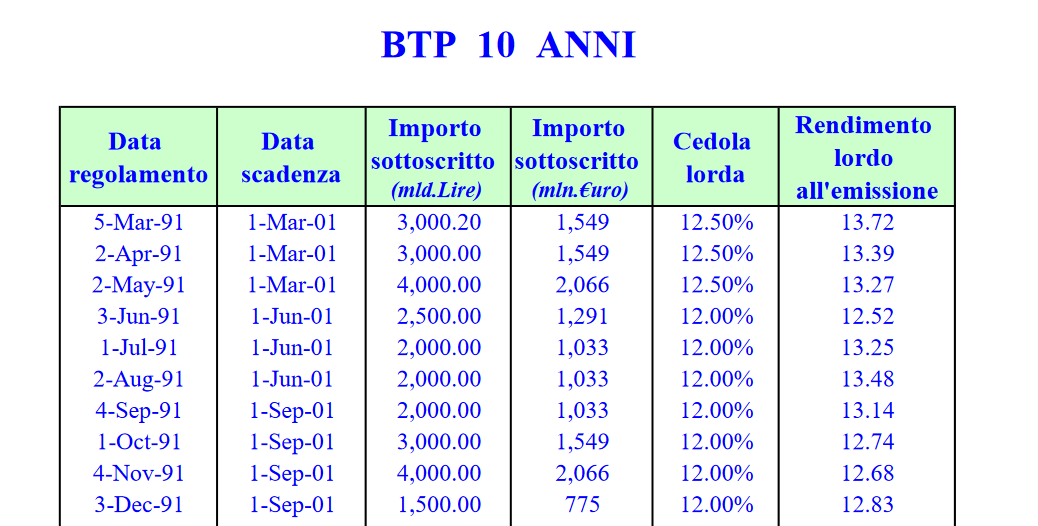

In March 1991 the first ten-year BTPs were issued, for an amount equal to 27,000 billion lire.

The yield on issue was 12.5%, the effective yield (ie negotiated on the market) of 13.7% .

Below is a table of the MEF with the details of the BTP auctions (3, 5, 10, 30 years) from 1979 to 2000. Under the “screen” of the section dedicated to the 10-year period.

On the other hand, Germany , again according to the OECD historical series , issues bonds with a ten-year maturity from the very distant May 1956 .

To calculate the spread, let's start from March 1991: in this month the Bund yielded 8.4% against 13.7% in Italy.

Therefore, the spread at the debut of the ten-year BTPs was 5.3% or around 530 basis points , again on the average of March 91.

THE SPREAD IN THE 90's

The first consideration – quite obvious – is that the spread was much higher in the 1990s , but then why was no one yelling at the risk of default?

Quite simply because we had the lira , therefore the redemption of securities denominated in national currency had never been questioned.

Yet in the month of October 92 , the average was almost 700 basis points. The maximum daily peak (according to sources such as Reuters ) was 769.8 points on October 7, 1992.

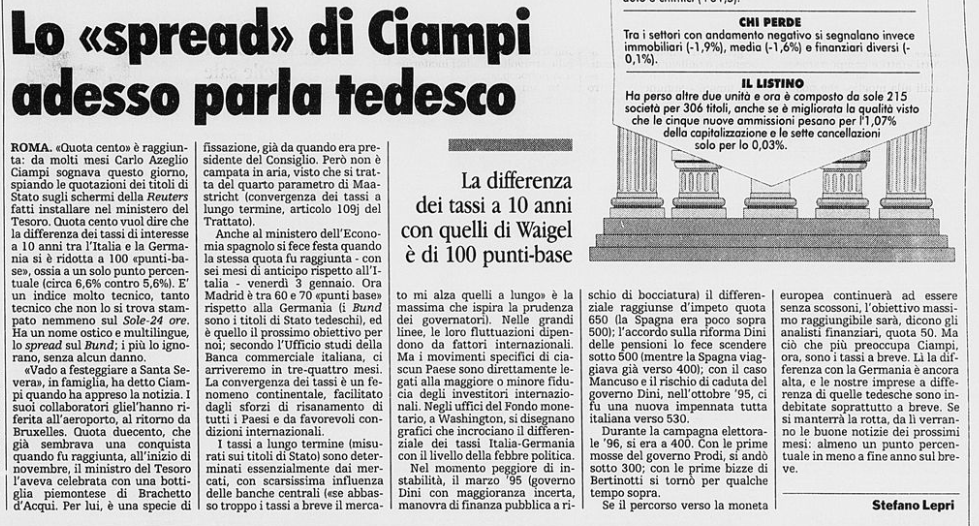

But there was a new peak in the spread in 1995 and then it finally collapsed. This article in La Stampa dated 8 July 1997, entitled “ Ciampi's spread now speaks German ”, talks about it .

The full transcription follows.

ROME. "Quota hundred" has been reached: for many months Carlo Azeglio Ciampi had been dreaming of this day, spying on the prices of government bonds on the Reuters screens installed in the Treasury Ministry. Percentage means that the difference in 10-year interest rates between Italy and Germany has been reduced to 100 "basis points", that is to a single percentage point (about 6.6% versus 5.6%) . It is a very technical index , so technical that it is not even printed in the Sole 24 ore. It has a difficult and multilingual name, the spread on the Bund; most ignore it, without any harm.

"I'm going to celebrate in Santa Severa," Ciampi said in the family when he heard the news. His collaborators reported it to him at the airport on his return from Brussels. Quota two hundred, which already seemed a conquest when it was reached, at the beginning of November, the Minister of the Treasury celebrated it with a Piedmontese bottle of Brachetto d'Acqui. For him, it's a kind of fixation , ever since he was Prime Minister. However, it is not far-fetched, given that it is the fourth Maastricht parameter (convergence of long-term rates, Article 109j of the Treaty).

The Spanish Ministry of Economy also celebrated when the same quota was reached – six months earlier than in Italy – on Friday 3 January. Now Madrid is between 60 and 70 "basis points" compared to Germany ( Bunds are German government bonds), and that is the next goal for us; according to the Research Department of the Italian Commercial Bank, we will get there in three to four months. Rate convergence is a continental phenomenon, facilitated by the consolidation efforts of all countries and by favorable international conditions.

Long-term rates (measured on government bonds) are essentially determined by the markets, with very little influence from central banks ("if I lower the short rates too much, the market raises the long ones" is the maxim that inspires the prudence of the governors ). Broadly speaking, their fluctuations depend on international factors . But the specific movements of each country are directly linked to the greater or lesser confidence of international investors. In the offices of the Monetary Fund, in Washington, graphs are drawn that cross the Italy-Germany rate differential with the level of political fever.

In the worst moment of instability, in March '95 ( Dini government with an uncertain majority, public finance maneuver at risk of rejection) the differential reached a sudden height of 650 (Spain was just above 500); the agreement on the Dini pension reform caused it to drop below 500 (while Spain was already traveling towards 400); with the Mancuso case and the risk of the fall of the Dini government, in October '95 , there was a new all-Italian surge towards 530 .

During the '96 election campaign , it was 400 . With the first moves of the Prodi government, it went under 300 ; with the first tantrums of Bertinotti we went back over for some time.

If the path towards the European currency continues to be smooth, the maximum achievable target will be, say financial analysts, 50 . But what Ciampi worries most now are short-term rates. There the difference with Germany is still high, and our companies, unlike the German ones, are mainly in short-term debt. If we keep the course, the good news of the next few months will come from there: at least one percentage point less at the end of the year in the short term. Stefano Lepri

In summary: in the 90s practically no one knew the spread , except Ciampi , the International Monetary Fund and a few other insiders.

In the article we read that certain actions by politicians increased this differential and that the central bank can do almost nothing about it, but is this really the case?

Go on.

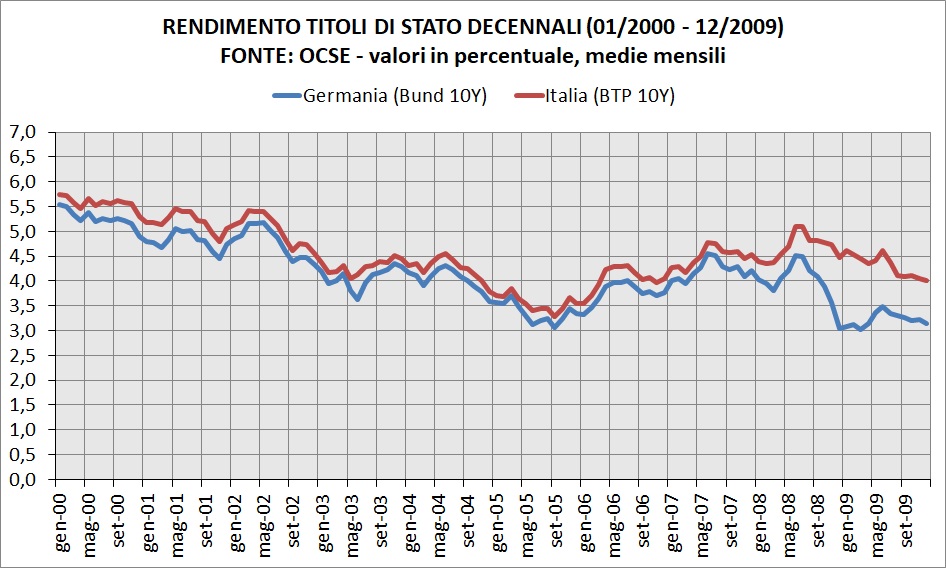

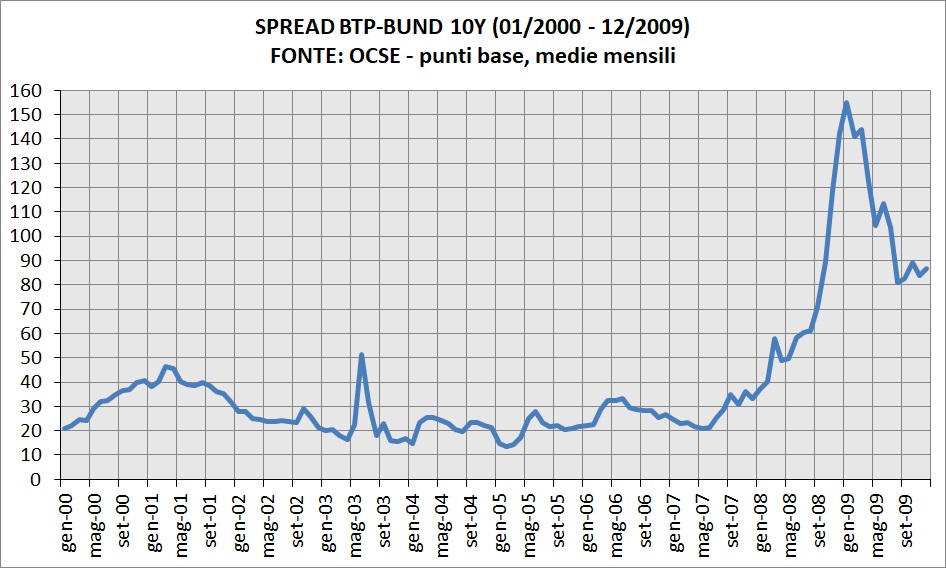

SPREAD IN THE YEARS 2000

In December 1998, the spread touched an all-time low of 13.1 points.

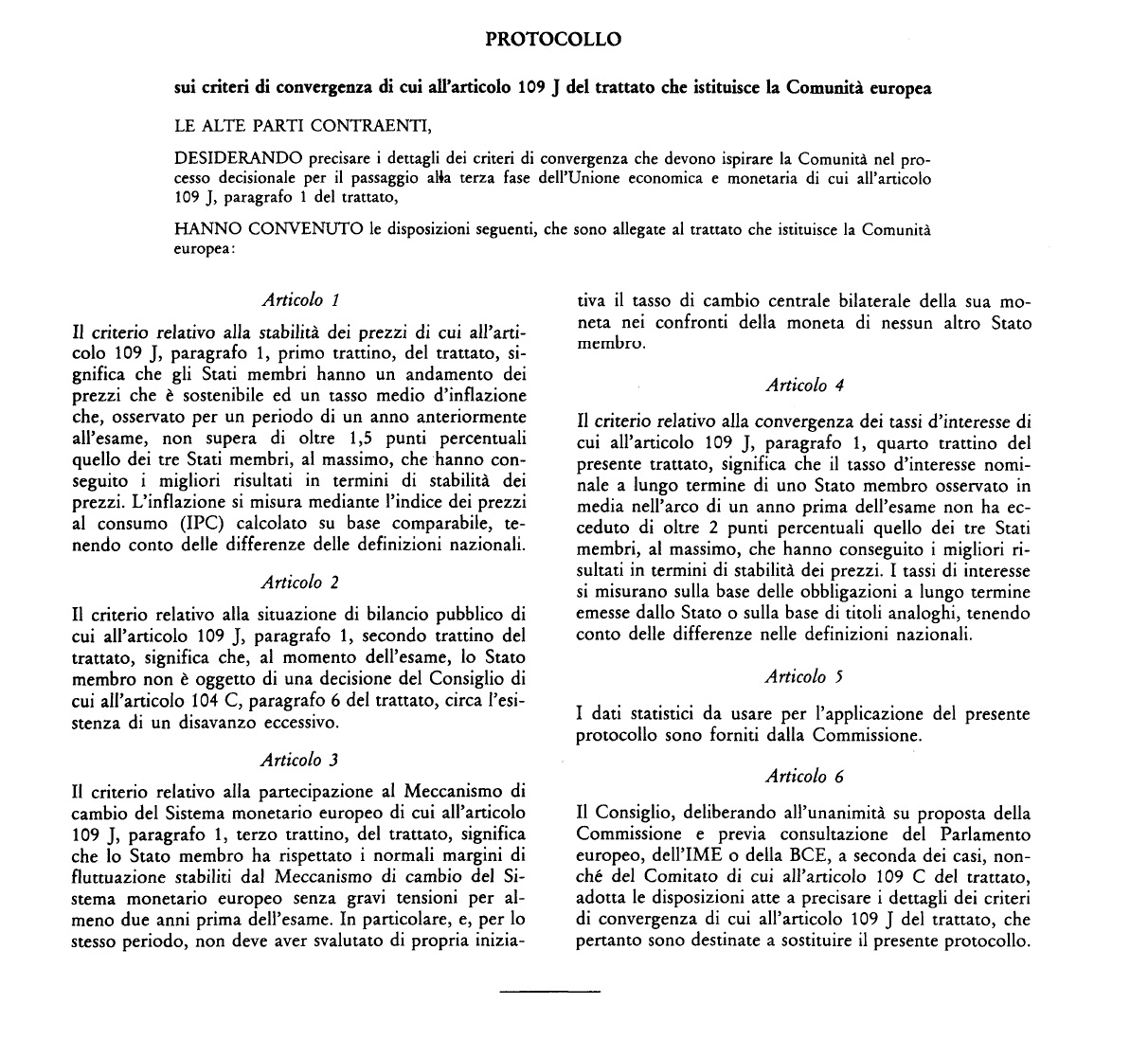

The third phase of Economic and Monetary Union (EMU) begins on 1 January 1999 and after three years the euro arrives in the form of coins and banknotes.

On the eve of the " changeover ", the then economy minister Giulio Tremonti , was interviewed by La Stampa on December 31, 2001, here is a small passage.

QUESTION : Are you also willing to recognize the merits of the center-left for Italy's entry into the single currency?

ANSWER : “ It would be unfair to deny that the left played a role. Let's be clear: it is not that Italy has made 3 percent , so it has entered the euro; the political choice was made to let Italy join the euro , and for this reason Italy made 3 percent. The Italian public finances had greatly improved due to the worldwide fall in interest rates . The choice of inclusion in the euro caused a further fall in the negative " spread " on the lira; because it became clear that the lira was no longer there ».

QUESTION : Who made that choice?

ANSWER : “Internal and external factors counted. Ciampi's credibility . The will of the Germans. It is an Italian establishment that led the dialogue between inside and outside. The game began during the Dini government , when it was understood that a two-speed Europe with Italy in external orbit could not work, because it presupposed stability ».

For the record, the " Euroretoric " that challenged Tremonti was that the euro brings peace , referring to recent statements by German Chancellor Kohl .

Closed parenthesis, in the new millennium the differential between Italian ten-year bonds and German equivalents remains at minimum levels , and this until the beginning of 2008.

Over this period of time, the spread remains in a range between 13.4 points in February 2005 and 51.3 points in June 2003 .

The rise after September 2008 , when Lehman Brothers crashed, due to a drop in the yield of German Bunds, much higher than that of BTPs, was remarkable.

SPREAD FROM 2010 TO TODAY

If in 2009 the whole world went into recession, a few years later a new crisis was about to hit the eurozone alone.

A crisis that would have mainly affected the so-called PIIGS (Portugal, Italy, Ireland, Spain, Greece), the spreads of these nations soar between 2011 and 2012

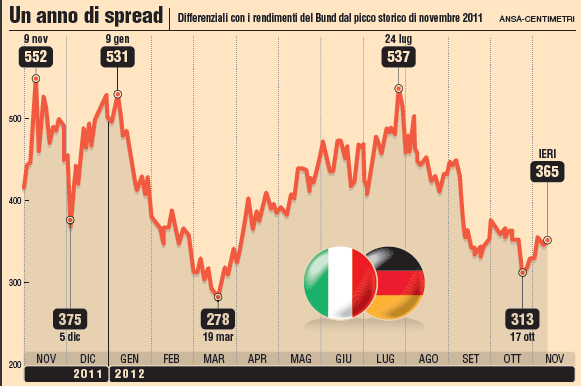

We have therefore arrived at the "highlight" and among the symbols that made the history of that period stands the " do soon " of the Sole 24 Ore.

The " spread ", an indicator previously unknown to public opinion, enters the homes of Italians with a decidedly alarmist connotation.

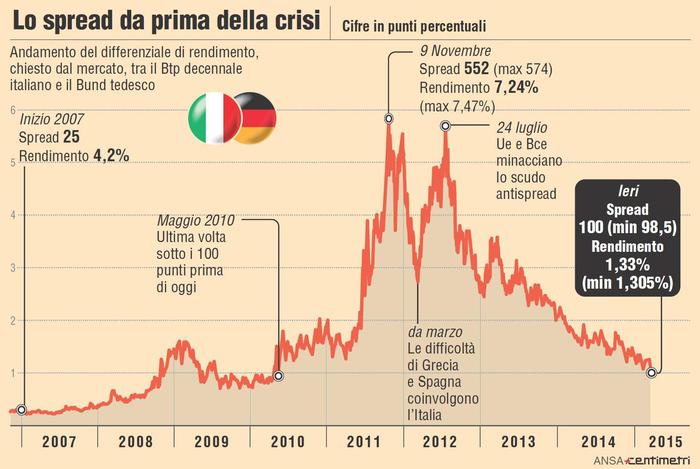

On 10 November 2011, as stated above, it had reached 552 basis points with ten-year BTPs yielding at 7.25%.

According to the mainstream narrative of now 9 years ago, the prime minister in office, Silvio Berlusconi , due to a few too many "feasts" would have lost credibility , thus triggering the adverse reaction of the "financial markets".

This is a really stupid narrative, because as already mentioned, the spread was much higher in the 90s and nobody cared.

In the second and third Berlusconi governments the spread was at a minimum, so we are talking about the same person.

In times not yet suspicious, a possible solution to the growing speculation had already been proposed on May 10, 2010 , by the economist Luigi Spaventa in his piece on Repubblica

Here is the text of the article ( SOURCE )

“ WHAT does speculation consist of? In an impressive concentration of financial means capable of provoking an outcome which, even if not otherwise justified, wins the bet. Speculation fights not with deprecations or by sending marines, but by making those who have tried to cry: the tears of those who have tried are the money they lose. To make speculation lose money, the authorities must be decisive and forget the rules of etiquette for a moment. (…)

Don't sound heresy: the only entity that has more means than any diabolical speculator is a central bank with the power to issue money . Only that central bank can be the buyer of last resort of any financial asset that is subject to a bearish speculative attack, provided that asset is denominated in the currency it issues (for the ECB a euro bond, for the Federal Reserve a security in dollars).

Of course this is an extreme remedy for extreme evils : to put it into action one must be convinced that the value targeted by speculation is not the "right" one; that without turbulence a different value could be achieved and more orderly procedures implemented. It seems clear to me that these conditions are present today : it takes time to verify the functioning of the plan set up for Greece; Spain and Portugal do not deserve the lashes inflicted on them by the markets just to beat the euro; the functioning of the euro will have to be rethought, but not in a frantic emergency.

The European Central Bank is called upon to do its part (“all institutions… agree to use the full range of instruments available to ensure stability”, reads the European Council communiqué on Friday).

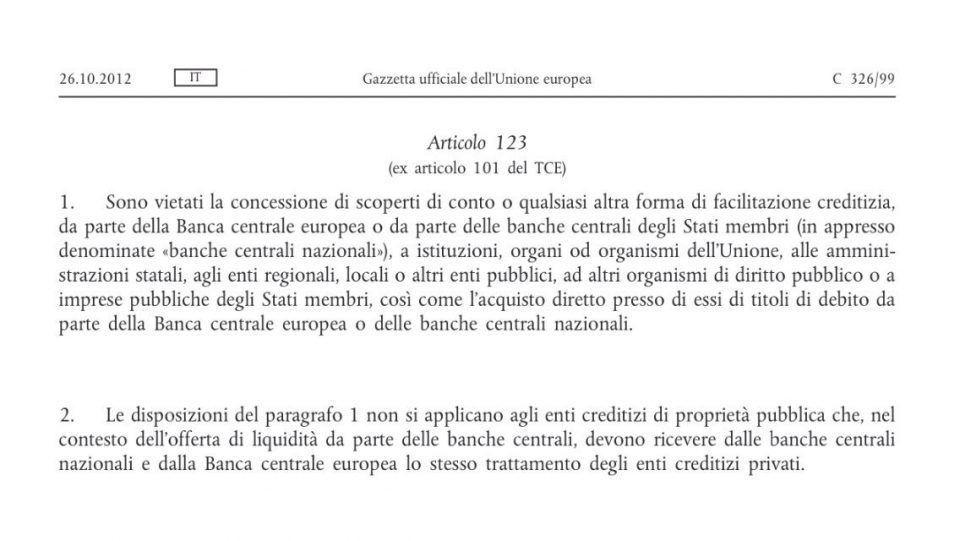

The art. 123 of the Lisbon Treaty explicitly prohibits the ECB from purchasing debt securities issued by governments or other public sector entities directly, but does not prevent their purchase on the market , with operations that were once defined as open market . (…) "

Thus, in unsuspecting times an economist who certainly could not be accused of Euroscepticism knew perfectly well that the only thing that was needed was simply a central bank doing its central banking work .

However, as correctly highlighted, in the rules of the European treaties, the ECB can act as the so-called “lender of last resort”, only on the secondary market .

And here we come to what happened after Berlusconi's resignation and Mario Monti's ascent to Palazzo Chigi.

THE CREDIBILITY OF THE PREMIER

In the summer of 2012, when Mario Monti was firmly in the government, the spread returned above 500, more precisely 537 points on 24 July 2012.

There are two options: either Monti has been caught to go to "little women" or simply the credibility of the premier has absolutely nothing to do with it.

In a conference in April 2019, Claudio Borghi pointed out this small detail to Monti, and the "rector" can only make a silent scene.

This is simply because the only "Mario" able to lower the spread was the president of the ECB Draghi with only three words " Whatever it takes " pronounced on July 26, 2012

And immediately the yields of the TdS collapse, until March 2015, that is when the Quantitative Easing operations begin , or the purchase of securities on the secondary market.

THE SPREAD DURING THE YELLOW AND GREEN GOVERNMENT

Let's briefly recap the main events from 2018 to today

March 4, 2018 : National elections, the 5-star movement is by far the most voted party.

28 May – 1 June 2018 : veto to Paolo Savona as economy minister and birth of the yellow-green government .

October-December 2018 : budget maneuver, the government started from a deficit of 2.4% then fell to 2.04% (but the actual one was 1.6%)

May 26, 2019 : European elections, the League becomes the first party.

8 August 2019 : beginning of the government crisis

5 September 2019 : birth of the Conte II government

Let's take a daily graph on the spread from the end of 2017 to today, below that of Borsa Italiana .

The spread after the March 4 elections tends to decrease until it reaches the lows of April 25 (114 points) but in all of May it rises steeply to reach 268 points on May 28.

the maximum daily peak was reached on November 20, 2018 with 325 basis points .

At the end of May 2019 – after the European ones – the spread ( 283 bp on May 31) decreased throughout June and July. New peak on 9 August ( 239 bps) and then the collapse to 131 points on 17 September 2019.

With the first Conte government the spread remained on average at 259 points (June 18 – August 19).

With the Conte bis calm is restored on the markets, but only for a few months.

SPREAD AND CORONAVIRUS

Even before the covid emergency it was clear to the "sovereignists" that the spread depends mainly on the work of the central bank . See for example the popular video “ Is it true that Monti saved the country? ”Available on Youtube.

From September 2019 with the yellow-fuchsia government until the end of February 2020, the spread remains around 154 basis points .

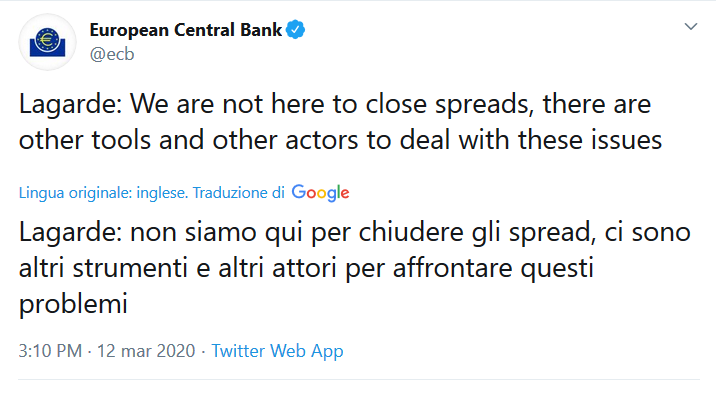

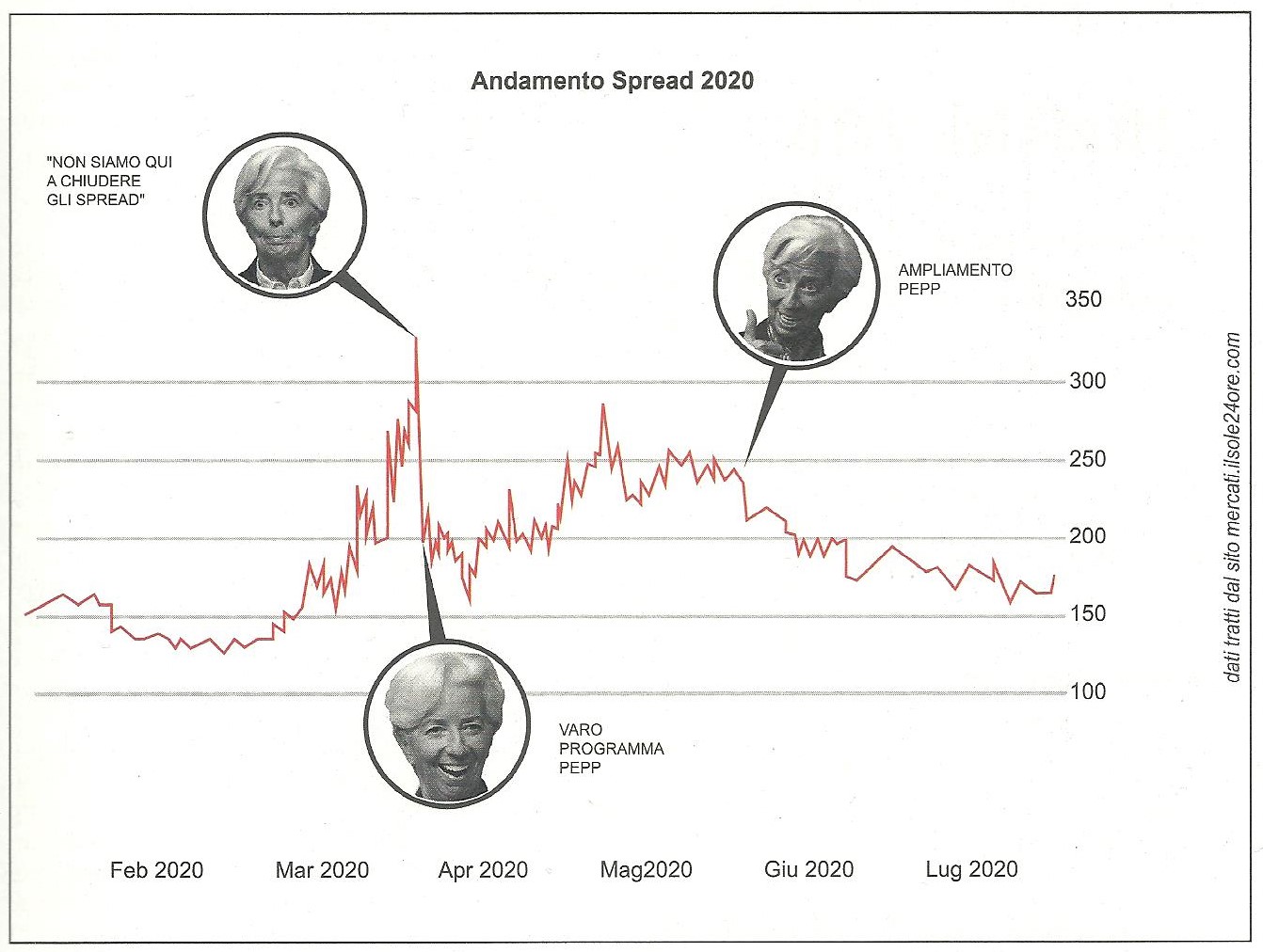

In the midst of the coronavirus pandemic, here's what happens. On 12 March 2020, the president of the ECB comes up with these statements :

" We are not here to close the spreads ", the result was the collapse of the stock market, as well as making the PD remain " thrilled ".

But until then the spread was a kind of divine voice that measured the credibility of governments and that the only way to get it down were tears and blood measures .

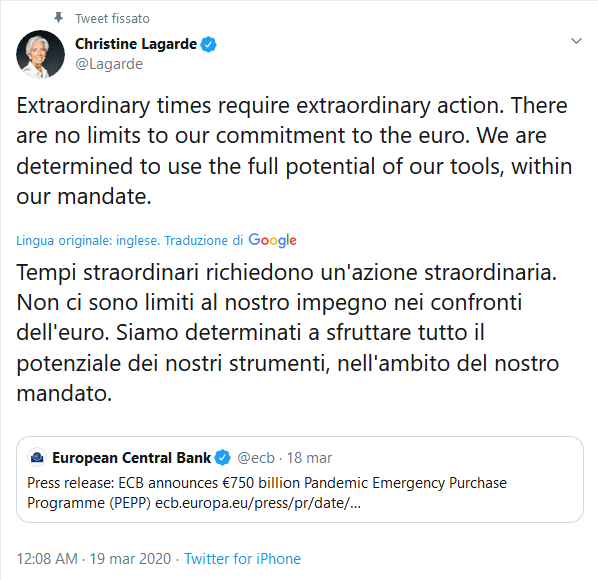

The spread reached its maximum on March 17, 2020 at 276 basis points . The ECB on 18 March announces the € 750 billion PEPP program .

And finally, the expansion of the PEPP by another 600 billion euros, announced on 4 June , thus reaching 1,350 billion.

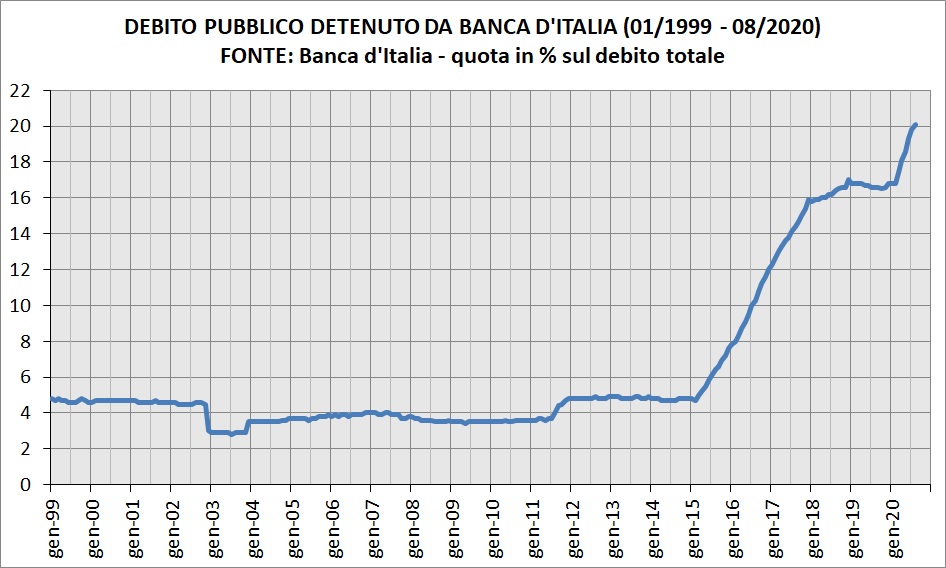

The synthesis of these three statements can be found in the graph published in the National Primacy in the August 2020 issue , which I republish with the kind permission of the author Filippo Burla.

THE DEFAULT RISK

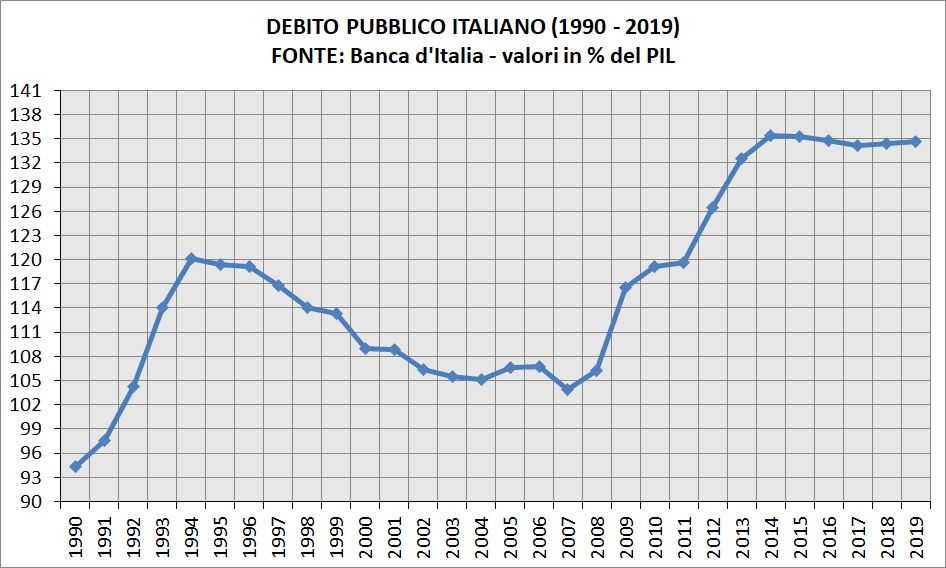

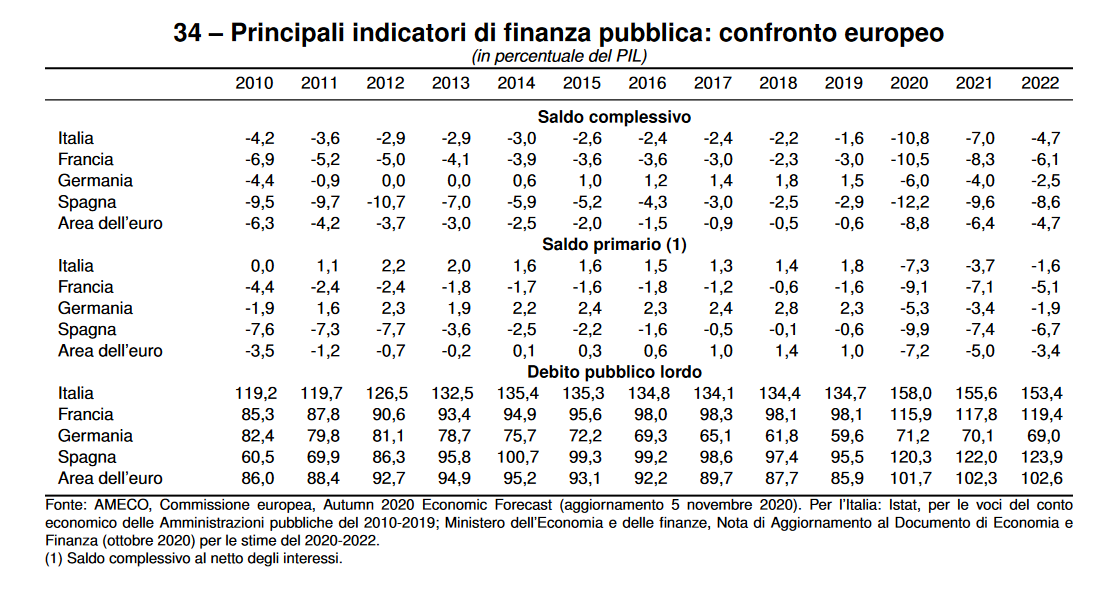

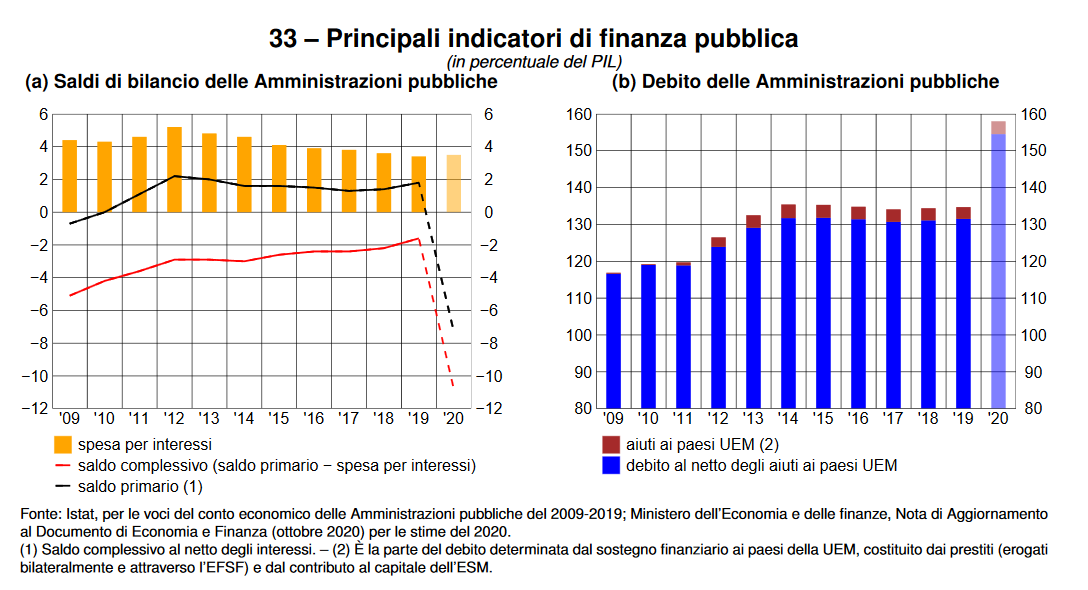

A similar argument could be made for public debt : exactly as for the spread, Italy in 1994-95-96 had a debt / GDP ratio of around 119-120%

That is to say the same level of debt as in 2010-2011 and even with the Prime Minister himself, given that the first Berlusconi government took place in 94.

If in 2011 119.7% of public debt was considered to be "unsustainable", well now in 2020 158% of GDP is expected

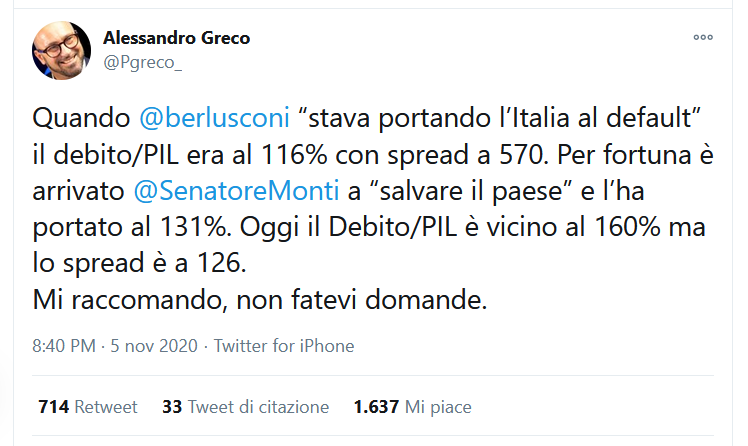

The moral of the story is Alessandro Greco well with this tweet .

« When Berlusconi “ was bringing Italy to default ”the debt / GDP was 116% with a spread of 570. Fortunately, Monti came to“ save the country ”and took it to 131%. Today the Debt / GDP is close to 160% but the spread is at 126. Don't ask yourself any questions. "

Nine years after the “be quick”, on 10 November 2020 the spread marks 121 basis points .

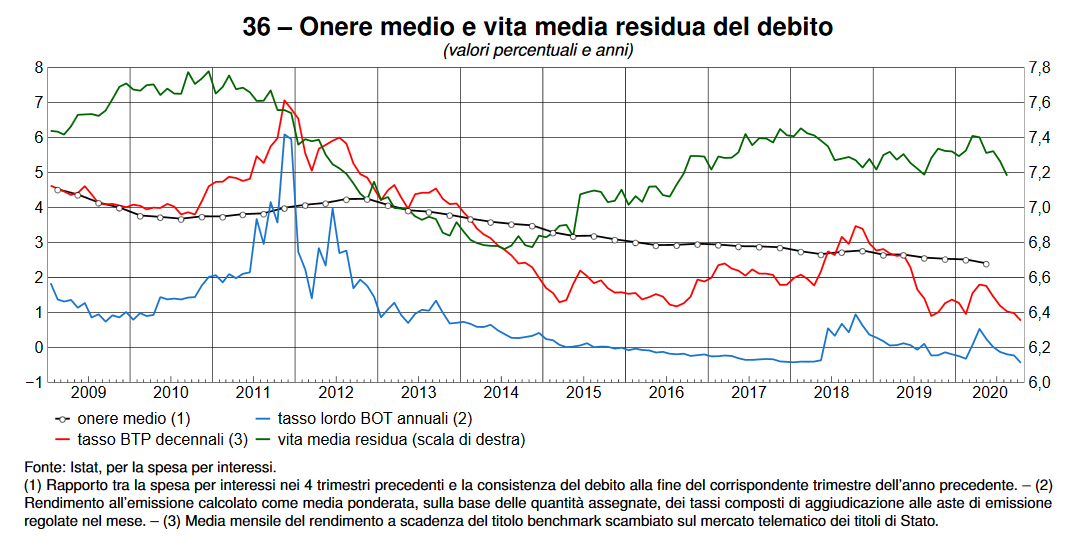

The yield of 10Y BTPs is at an all-time low, other stocks such as BOTs are in negative territory.

And despite the fact that the much feared “debt explosion” has come true, interest expenditure is expected to be close to the historic lows of the last 40 years, always measured in points of GDP.

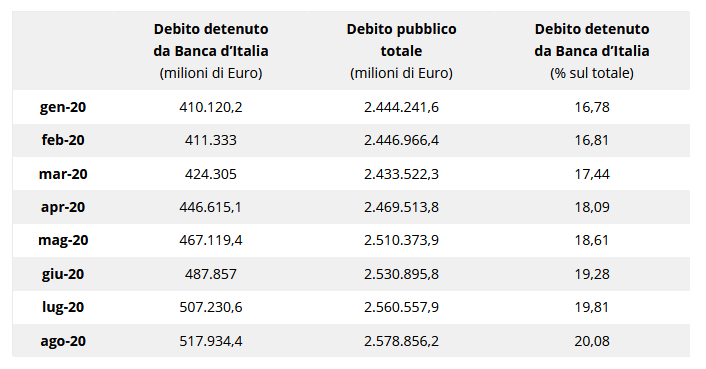

In February 2020 , the share of public debt held by the Bank of Italy was 16.8% of the total, in August 2020 it rose to 20.1% .

From February to August, the public debt increased by 132 billion , at the same time the Bank of Italy's share rose by 107 billion euros .

The data is taken from the latest issue of " Needs and Debt ", on page 10.

The data is taken from the latest issue of " Needs and Debt ", on page 10.

So the "new debt", for about 81%, was monetized by the central bank. Do you know how much is the real cost of this operation? Almost nil , even Cottarelli recently admitted it.

The "positive" side of the coronavirus is that, one by one, it is evaporating one by one the " caxxate of neoliberalism " that have been repeated for 30 years (semi-cit Calenda).

We have also got rid of those on spreads and public debt.

ORIGINAL ARTICLE https://canalesovranista.altervista.org/lo-spread-btp-bund-10y-dagli-anni-90-ad-oggi/

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article The story of the 10Y BTP-Bund spread from the 90s to today comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-storia-dello-spread-btp-bund-10y-dagli-anni-90-ad-oggi/ on Sun, 15 Nov 2020 14:12:52 +0000.