THE HOT CHALLENGE TO THE ECB

European policymakers, often paralyzed by divisions, ended 2020 on a positive note. They finalized the € 750 billion European Recovery Fund, agreed on ambitious climate targets (a focus on fiscal spending) and announced new measures to ensure easy financing conditions in the coming year. Together with a reliable vaccine pipeline and delivery system, this all adds up to a much stronger outlook for 2021.

Will a robust economic recovery spell the end of the ECB's stimulus, which, barring a brief interlude, has been underway since 2015? Too bad this would show an epochal failure: the chronic inability of the ECB to reach its inflation target "below, but close to 2%".

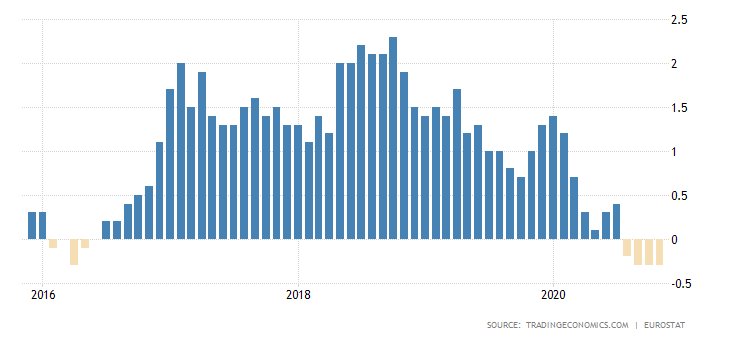

Euro area inflation

Zero inflation poses a serious problem for any central bank: the classic instrument of central banks, the action on interest by operating on the government bond and bond markets, becomes difficult, indeed impossible, making the central bank useless. With its effectiveness compromised, the ECB could soon be the Bank of Japan's fighting partner, perpetually at war with the risk of deflation.

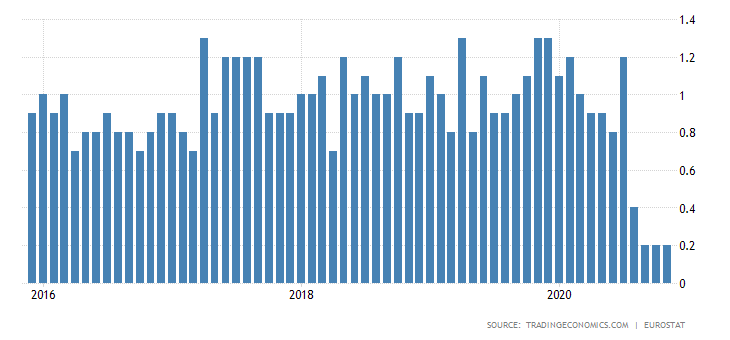

Inflation in the strict sense of the euro area

Of course, the inflationary target can be lowered, as would a powerful minority in the ECB . The problem with too low an inflation target, in addition to increasing real debt burdens, is that it leaves no room for wage dynamics both within individual states and as a system of economic adjustment between the various economies of the countries of the EU. But the Fed is moving in exactly the opposite direction, raising the inflation target, albeit in a covert and progressive way, and this will leave the ECB as the only restrictive central bank on the planet. Result: skyrocketing euros, peak German exports…. Who knows if at that point the Teutonic bankers will rethink their position.

Probably in the end, even in the ECB, as in the FED, doves will prevail and a less rigid inflationary target will be set, perhaps not like the American one, which envisages long-term average inflation at 2%, which justifies even considerable overruns, but short period.

But how to achieve these objectives, given that the usual market tools are now exhausted? The most powerful tool would be coordination with fiscal policy. The ban on mixing the two policies made sense in a world of strong growth, when there was a risk of high inflation.But in the world of secular stagnation, public investments financed by monetary policy will be essential to increase aggregate demand and inflation. The ECB must decide to continue on the same path after the pandemic, otherwise it will be a disaster.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article THE HOT CHALLENGE TO THE ECB comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-sfida-rovente-alla-bce/ on Mon, 21 Dec 2020 19:37:31 +0000.