The (immediate) price of Erdogan’s policies with the Lira

The idea of offsetting the devaluation losses of Turkish Lira account holders will certainly lead to disasters in the medium / long term. After all, someone will have to pay for these promises. In the end it is a sharp rise in interest rates, only the central bank or the state pays them to the citizens. But there are also possible short-term effects so far ignored even by the Sultan.

According to preliminary calculations, sales of foreign assets against Turkish Lira to keep the currency safe from a terminal crash is between $ 6 and $ 13.5 billion, this week alone.

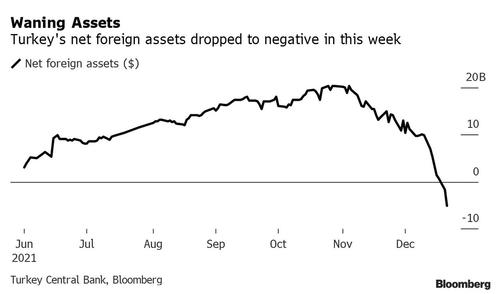

As reported by Bloomberg , Turkey's net foreign assets fell by nearly $ 6 billion earlier this week due to President Erdogan's plans to strengthen the lira, suggesting that Turkey has taken more unannounced interventions in foreign exchange markets. The “Without Notice” is intended for owners of assets in foreign currency, dollars, whose assets have been sold without any information for their owners.

Bloomberg notes that while the government said it did not intervene, it lied and the $ 5.9 billion downside likely signals a covert intervention similar to two-year deals starting in October 2018, with banks making they sold their clients' assets in foreign currency to support the Lira …

As Bloomberg shows, net foreign claims fell $ 5.9 billion on Tuesday to less than $ 5.1 billion from $ 817 million on Friday, a number confirmed separately by the FT . A good joke, no doubt about it.

The estimates of others are even more surprising. According to the Turkish website Ahval – which used data provided by a leading economist and the main opposition Republican People's Party (CHP) – the Turkish central bank has spent up to $ 13.5 billion on its foreign exchange reserves to help defend the lira from the record losses of December. and then to help plan a rally this week, according to data provided by a leading economist and the main opposition Republican People's Party (CHP).

So Erdogan's "Whatever it takes", and the reason why the lira has risen from 18 to 12 is because Erdogan has given the green light to drain billions of Turkish assets to offset the consequences of his catastrophic Erdoganomica, because while the Erdogan's intervention on FX shoring up the lira may have been a secret, everyone knows that Erdogan's monetary policy and bizarre economic theories were behind the collapse of the lira.

Truth be told, blasting all those billions has worked, for now: the lira appreciated up to 25% on Monday after Erdogan's speech, his biggest daily jump since 1983, and this week it gained over 40%. against the dollar.

However, we now know that this move was not the result of Turkish depositors voluntarily converting their dollars into lira, but was the result of emergency actions taken by state banks, with at least one private lender also involved, they claimed. less than four Bloomberg sources. Sales continued on Tuesday, people said.

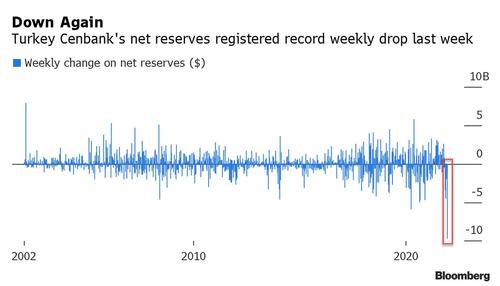

Meanwhile, the best representation of Erdogan's historic intervention, which was first of all supposed to keep the authoritarian ruler in power and delay a public uprising by a population angry and furious at the collapse of the Turkish economy, is that Turkish net reserves they fell a record $ 9 billion to $ 12.2 billion as of Friday, the largest weekly decline in data dating back to at least 2002.

But let's move on to consider the reserves of the Turkish central bank, as shown in the upper image. According to Goldman Sachs, more than $ 100 billion of central bank reserves were spent on preventing a messy depreciation of the lira last year alone, when the currency came under pressure after a series of sharp rate cuts to support the economy. affected by the pandemic. So the ghost of Carlo Azeglio Ciampi, who destroyed the reserves of the Bank of Italy in a useless defense of the Italian Lira, which enriched Soros, hovers in the Central Banks. Erdogan could use another $ 165 billion in currency and gold reserves this year to defend the Turkish currency. At the end of this whole thing, by the time it emerges sooner or later, all of Turkey's reserves and gold may have been zeroed just to keep Erdogan in power a few more months. The effect of a world where the "long-term perspective" lasts for a month.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article The (immediate) price of Erdogan's policies with the Lira comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/il-prezzo-immediato-delle-politiche-di-erdogan-con-la-lira/ on Sat, 25 Dec 2021 08:00:24 +0000.