The main world real estate bubbles are European, but not Italian. An ignored time bomb

Identifying real estate bubbles is a tricky business. After all, as Visual Capitalist's Nick Routley notes , even though many of us "recognize a bubble when we see it," we have no tangible evidence that it is until it bursts. And by then it's too late.

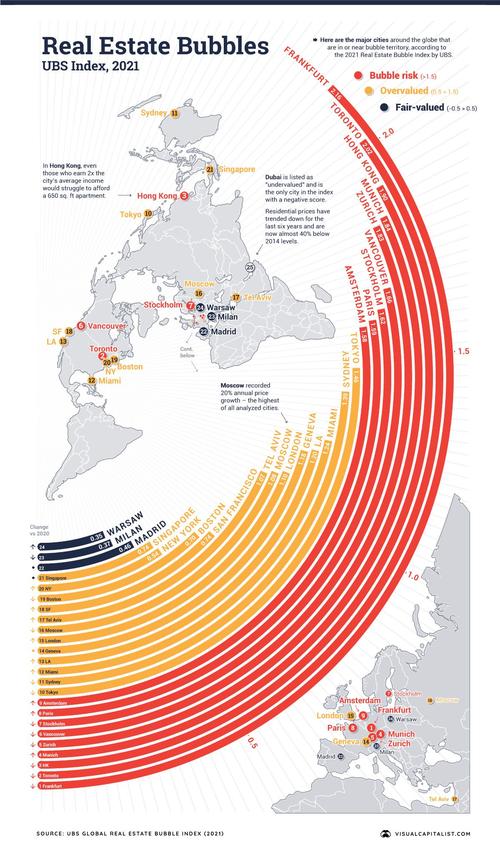

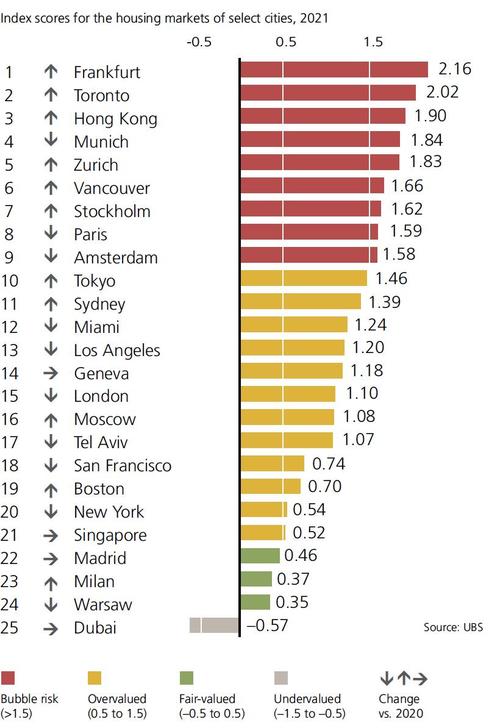

The map above, based on UBS's Real Estate Bubble Index data, acts as an early warning system, evaluating 25 global cities and scoring them based on their bubble risk. Of course this is an approximate assessment, but the data presented should already be scary, both economically and socially.

Evaluating whether a real estate market is in a bubble is difficult: it is necessary to predict future income flows and compare them with other investment hypotheses, so it is, in general, a very forecasting and speculative job. However, there are a number of very useful indicators.

For example, the decoupling of prices from local incomes and rents is a common wake-up call. In addition, imbalances in the real economy, such as excessive housing and lending, can signal a bubble in the making.

With this in mind, which global markets are signaling the greatest risk of property bubbles?

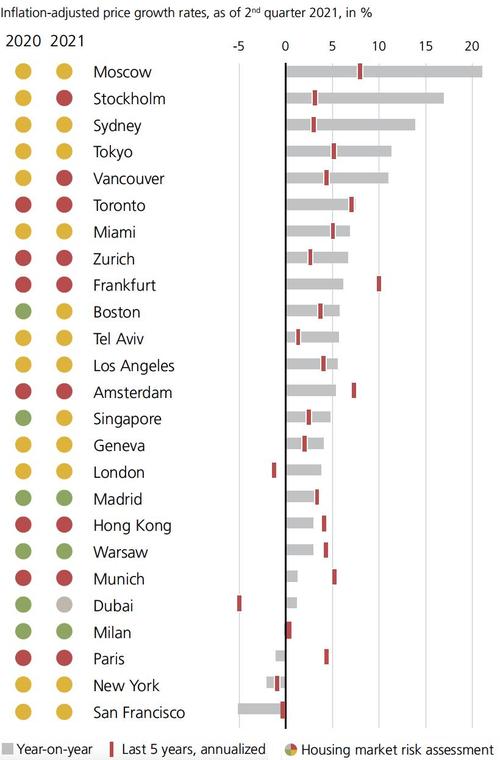

Europe is home to a number of cities that have extreme bubble risk, with Frankfurt topping the list this year. Germany's financial hub has seen real house prices rise by 10% per year on average since 2016, the highest rate of any city rated.

Two Canadian cities are also located in bubble territory: Toronto and Vancouver. In the first, nearly 30% of purchases in 2021 went to buyers with multiple properties, demonstrating that real estate investments are alive and well and perhaps excessive. Despite efforts to cool the overheating of the sector, Canadian markets rebounded and continued their upward march. Indeed, over the past three decades, residential home prices in Canada have been growing at the fastest rates in the G7.

Despite civil unrest and unease over new policies, Hong Kong still has the second highest score in this index. Meanwhile, Dubai is listed as "undervalued" and is the only city in the index with a negative score. Residential prices have fallen in the last six years and have now fallen by almost 40% compared to 2014 levels. Unfortunately, the index does not include Chinese cities, otherwise we would have had an interesting indication also from an Evergrande perspective.

Property bubbles are a constant in history, at least from the 20th century onwards measured in a scientific way. The Florida bubble of 1925 remains famous. This trend continues today, although the COVID-19 pandemic has changed the dynamics of the real estate markets.

Below are the growth rates for 2021 so far and the comparison with the past five years.

For years, the rise in housing prices in urban centers was almost guaranteed as construction exploded and people were eager to live an urban lifestyle. Remote working options and office scaling are changing the equation of value for many, and as a result, home prices in non-urban areas have risen faster than in cities for the first time since the 1990s.

Real estate bubbles, often fueled by credit, put the soundness of credit systems at risk. From this point of view, Germany and Canada must not provide a good night's sleep.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article The main world real estate bubbles are European, but not Italian. An ignored time bomb comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/le-principali-bolle-immobiliari-mondiali-sono-europee-ma-non-italiane-una-bomba-a-tempo-ignorata/ on Sun, 24 Oct 2021 09:00:00 +0000.