The ongoing sovereignty clash over cash

The Government, defending cash as the only legal tender , has not only taken a position in stark contrast with Bank of Italy, which is more in favor of the use of private electronic money in the banking circuit, but has also lit a light on the monetary issue. taboo subject for a large part of politics and communication.

Brussels then also joined the clash, reminding Giorgia Meloni that electronic payments are among the objectives of the PNRR to force her to maintain the fines on refusals of the POS without thresholds, but also the ECB , which by raising the cost of money and reducing the QE wants to push Italy to ratify the ESM to save European banks.

What is behind this clash? Corruption or tax evasion have little to do with it.

The choice of which currency to favor has large and substantial implications and repercussions in our political and daily life; let's see them closely.

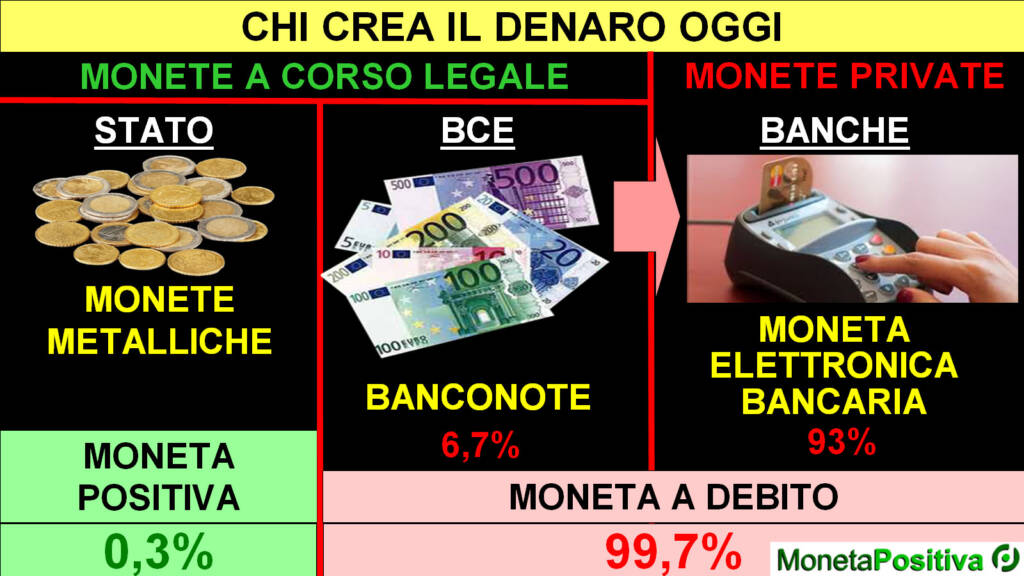

These are the coins we use today:

- 0.3% are metal coins minted by the State, they are the only ones that do not generate debt;

- 6.7% are banknotes issued by the ECB and lent to private banks;

- the vast majority, 93% is electronic money , created out of thin air by private banks when they take out a mortgage or make loans.

Cash , i.e. coins and banknotes, are the only legal tender in the Eurozone , connected to the sovereignty of the State and the only form of payment with obligatory acceptance, while bank electronic money is private and with voluntary acceptance , but with caps on cash and the obligation to accept payments with POS, an attempt is being made to make its acceptance essentially mandatory, in clear contrast with the legal aspects.

First problem: electronic money is created by private banks using banknotes as an underlying asset. On the basis of article 1834 of the CC: "When depositing a sum of money with a bank, this acquires ownership and is obliged to return it in the same monetary form". So electronic money has value because the bank is obliged to give it back to us in cash; but if we eliminate them, what will the bank give us back for the electronic money created?

Second problem : while cash has no cost in exchanges, each use of electronic money has a cost, equal to about 2% of the value, which reduces the value every time we make a transaction.

Third problem: banknotes and electronic money are 99.7% of the total money we use; all this money is created by private banks with loans and must be repaid with interest, what are the consequences of this within the economic system?

Let 's make the analogy between coin and blood . If the blood we need, instead of being created by the body itself, is "borrowed" from an external blood bank and has to be repaid with interest, the body will bleed to death.

The same happens in our economic system where the currency is all lent by the banking system and the financial markets, but must be repaid with interest. We have a mathematical problem: the loaned money is always less than the debt plus the interest generated. Regardless of everyone's goodwill it is an unpayable debt that continually grows exponentially.

This mechanism gives immense power to those who create electronic money, especially if under an absolute monopoly and with a "substantial obligation" to use it instead of cash.

Private electronic money , if it is currently the only one in the system, but has several problems:

- lack of democratic control over the newly issued currency;

- it is procyclical , i.e. it increases in the expansive phases and decreases in the recessive phases;

- the destination of the new money created is decided by private interests ;

- it has a huge cost to the company which has to pay the interest;

- unpayable debt produces instability in the system and periodic crises.

To solve the problem, we can take a cue from another system used in the financial sector to create money through government bonds, placing them as collateral for a loan in equivalent electronic money. The same securities can then be used by those who receive them as a guarantee for another loan and so on, multiplying the money created by n-fold.

If government bonds can be used as underlying to create money, then they can also be transformed into CdR Savings Accounts with the Treasury and only for residents in Italy, which can be used directly as a payment instrument between CdRs, with online transfers or magnetic cards, without the need to divest, as happens today with BTPs.

The Savings Accounts have capital guaranteed by the State , not subject to bail-in and stable because they are not listed on the markets, and a good yield, exempt from any taxation.

They are a sort of “ public electronic money ” able to circulate freely in the real economy. In addition to protecting citizens' savings, the CoR allow the State to finance public debt internally , without the blackmail of the "markets" with the spread and the increase in yields on new securities issued, foreseeable with the new monetary policies of the ECB.

Savings Accounts are a solution that has the advantages of cash , because it is risk-free and without transaction costs, but also of electronic money , because it is traceable and easy to use. They are also perfectly compatible with the EU Treaties.

The Government has a historic opportunity to protect the savings of Italians, defend the national interest, and make our large public debt more sustainable.

Fabio Conditioni

President of the Positive Money Association

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article The ongoing clash over cash sovereignty comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/lo-scontro-sulla-sovranita-in-corso-sui-contanti/ on Wed, 21 Dec 2022 19:24:41 +0000.