THE ONLY ROUTE TO INFLATION (But it will not be a victory for freedom)

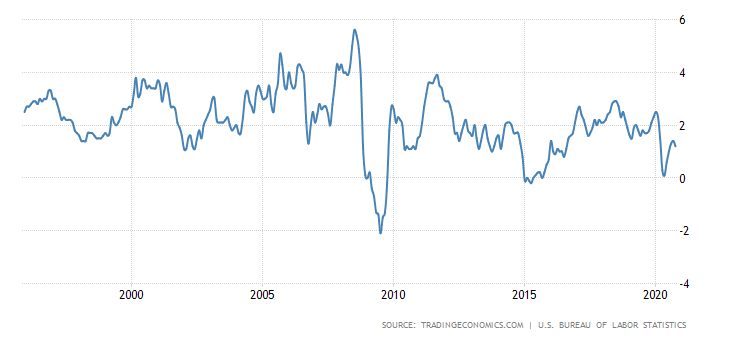

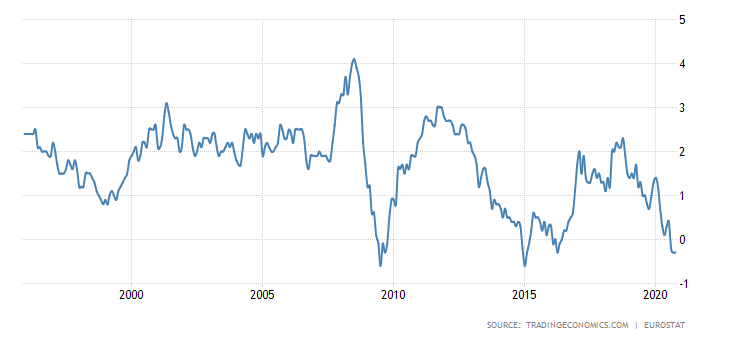

Since 2008 we have had, in the USA and in Europe, two powerful waves (at least two, because in the USA we could also speak of three) of Quantitative Easing, of issuing money against the purchase of government or private bonds. With these conditions we should have seen an explosion in inflation, but this has not happened, as we can see in the following graphs relating to the US and the Euro area:

And here instead Euro

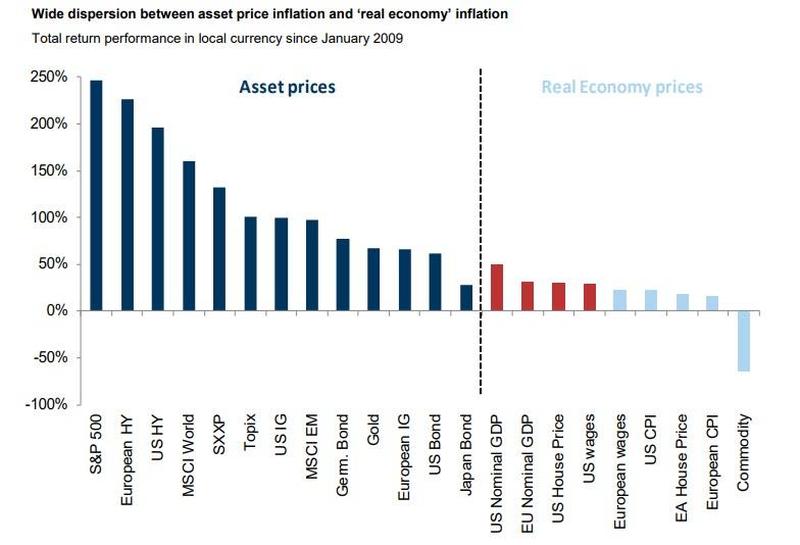

Why,. despite the monetary injection, did not inflation explode? because it is discharged on the value of the assets, of the investment goods, which, since the 2008 crisis have grown significantly:

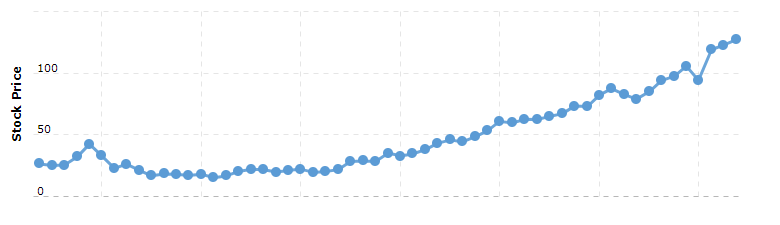

therefore the money supply did not pour into the purchasing capacity of goods, therefore into the possibility of consumption of people (and this can be seen from the collapse in the value of commodities, raw materials), but only on the value of investment goods. However, without an adequate increase in income, the increase in the value of assets converts into a decline in their almost vertical return: in fact, the increase in prices is only speculative, it does not reflect any real increase in demand for the assets underlying the asset itself and not even a widespread capacity for higher remuneration of the asset, such as, for example, the possibility of paying higher rents for a property. To give an example of the collapse in yields, let's take the P / E (Price / Dividend) of the NASDAQ and remember that the higher the P / E, the lower the yield:

So the modern equation is: Monetary Mass – Income unchanged – asset value growth – yield decline. Negative rates are also children of this distortion.

If the central bank could directly increase demand, then this effect would not occur, and here is the big news, the CBDC, Central Bank Digital Currency, the digital currencies issued by central banks, which reach the consumer directly by skipping the banking intermediation. .

The Popular Bank of China carried out the largest experiment related to this type of currency in October. It issued $ 1.5 million, 10 million yuan, which was offered to 50,000 people through a lottery in Shenzhen which was attended by 2 million people. Each of the winners of the lottery had the opportunity to download a wallet, a digital wallet to be installed on the phone or on the PC, with about 30 dollars in digital Yuan, which was then spent in 3000 points of sale and affiliated online stores.

In this way, the Chinese Central Bank is able to directly push consumption without issuing currency in the credit system and therefore avoiding, at least apparently and in its expectations, to increase the value of assets, but potentially intervening on the demand for goods and on inflation. Of course, the precondition is that there is still a link between wages and the demand for goods, and this is a factor to be evaluated.

The disadvantages of CBDCs?

- the banking sector loses its function and significance with CBDCs. What will we do with these ruins of a bygone era?

- if tomorrow you do not agree with the Chinese Communist Party (or with the European Commission, if the digital euro will be born) it will be able to block your wallet depriving you of money and the possibility to spend it. The authorities will have total control over people's lives.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article THE ONLY WAY FOR INFLATION (But it will not be a victory for freedom) comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/lunica-via-per-linflazione-pero-non-sara-una-vittoria-per-la-liberta/ on Mon, 30 Nov 2020 08:04:16 +0000.