The real tax evasion in Italy: that towards EU tax havens

While the PD would like to hunt down the taxi driver or the plumber, and the Revenue Agency goes after undeclared revenues from POS , causing a semi-disaster, the real tax evasion in Italy is carried out, practically legally, by bringing the offices and corporate profits outside the country, with complex control schemes and which have as their only justification that of declaring the smallest amount of profits possible in our country.

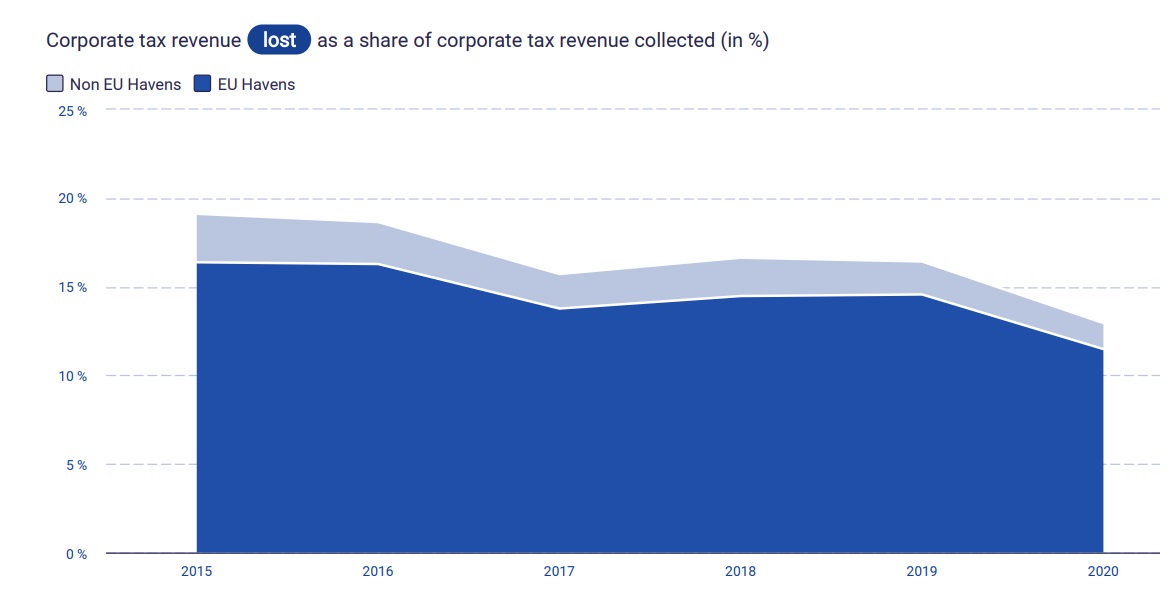

According to the site https://atlas-offshore.world/ which calculates the percentage of profits that multinationals are able to subtract from the taxes of their home countries by exporting their business, Italian companies or multinationals have subtracted 13% of its profits by taking them to tax havens:

As you can see, 13% of Italian corporate taxes would be lost through foreign investment and this happens not so much towards exotic locations, where only 1.5% of our taxes go, a frankly small value, but towards other EU countries, such as Luxembourg , Ireland or the Netherlands is 11.5% of the profit.

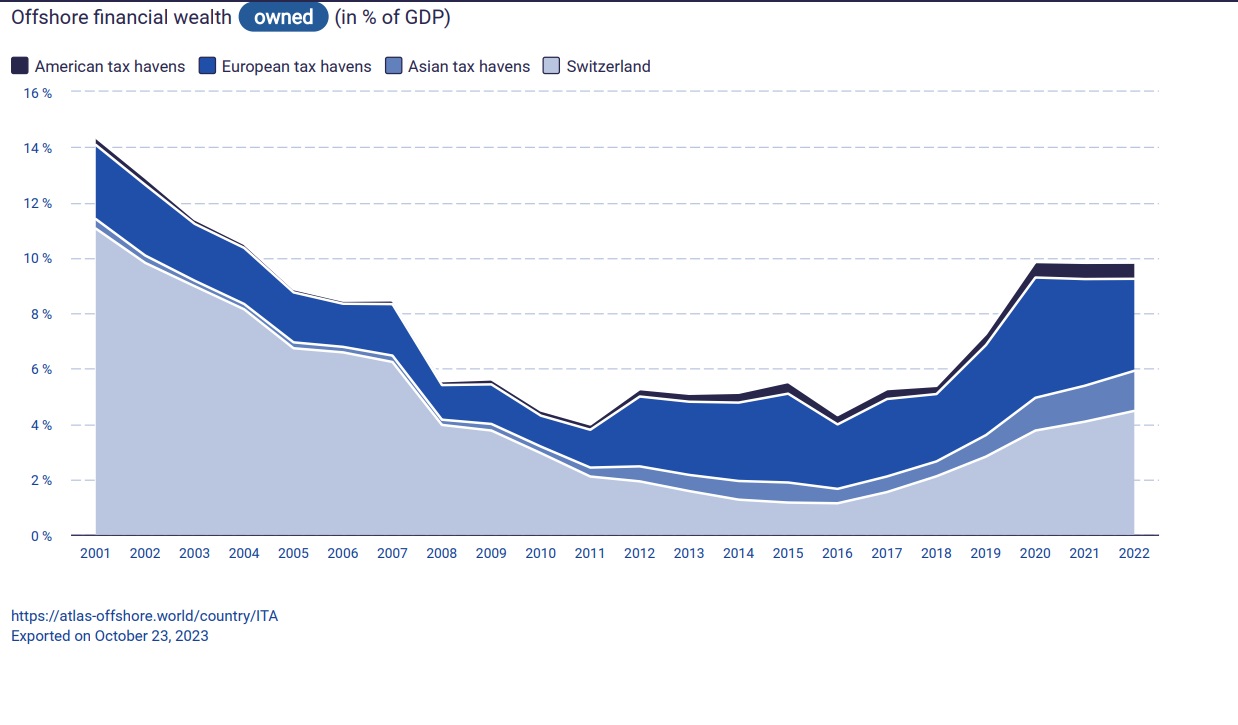

Italians also have a certain amount of financial assets abroad. A percentage that is not enormous, but significant and which, above all, is interesting to follow due to its evolution over time.

The financial resources attributable to Italians deposited abroad fell until 2011, to remain constant, or with limited growth, until 2016. Probably the basis of this change was the famous, and at the time contested, law of “Tax shield”, which allowed the return of important financial resources.

We note that starting from 2016, financial resources began to flow back into Switzerland while, in general, the financial resources of Italians abroad increased. After Switzerland, also in this case, there is a very important role of European tax havens.

To conclude, there is significant damage to Italian taxation resulting from the diversion abroad of the profits of Italian companies, and that this occurs towards the EU, not towards non-EU countries. In the same way, the financial resources of Italians abroad, after a minimum in 2011, have started to rise again and, in this case, EU countries and Switzerland are the favorite destinations for Italians' money.

PS: why don't the newspapers talk about these numbers? Don't their holding companies take money abroad?

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article The real tax evasion in Italy: that towards EU tax havens comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-vera-evasione-fiscale-in-italia-quella-verso-i-paradisi-fiscali-ue/ on Mon, 23 Oct 2023 13:58:47 +0000.