The Single Resolution Fund: that is, the true protection of the European credit system

It is stated that, with the rejection of the ESM, a system of protection for the European credit complex would have been given up. In reality, the reformed ESM, more than a system of protection of the banking system, was an undertaker of the same: its possible intervention to recapitalize the banks in crisis was subsequent to the application of the so-called Bail-in, i.e. the cancellation of the capital and the subordinated bonds issued by the bank itself. At that point, the intervention of the ESM was expected, if necessary, but the disaster would have already been accomplished.

To prevent the crisis of the banking system, in reality, there is a fund that will come into operation on January 1, 2024, and which, unlike the ESM, does not ask for money from the states, and therefore from taxpayers, but is financed by the banks and call SRF, Single Resolution Fund, or single resolution fund, in Italian.

What is SRF

The Single Resolution Fund (SRF) is an emergency fund that can be used in the event of a crisis. It can be used to ensure the efficient application of resolution tools to resolve ailing banks, after other options, such as the bail-in tool, have been exhausted, so, like the ESM, it is a bit of an undertaker of the credit institution, but this is the basic, wrong construct with which European systems are built.

The SRF ensures that the financial sector as a whole ensures the stabilization of the financial system. All banks in the 21 countries of the Banking Union must pay a fee to the SRF annually. These taxes are called contributions. The fund means that taxpayers are not the first to have to pay money into a bank, in case further funding is needed, as EU law requires all banks to pay into the fund annually.

The SRF is established over 8 years (2016-2023) and reaches at least 1% of the amount of covered deposits of credit institutions in all twenty-one countries of the Banking Union. As of July 2021, the SRF will amount to approximately €52 billion and is expected to reach €60 billion in 2024.

The individual amount that each bank owes is calculated in proportion to the amount of its liabilities (excluding own funds and covered deposits) compared to the aggregate liabilities (excluding own funds and covered deposits) of all credit institutions and some businesses of investment in the 21 countries of the Banking Union. The amounts that banks owe to the fund are adjusted in proportion to the risks assumed by each institution.

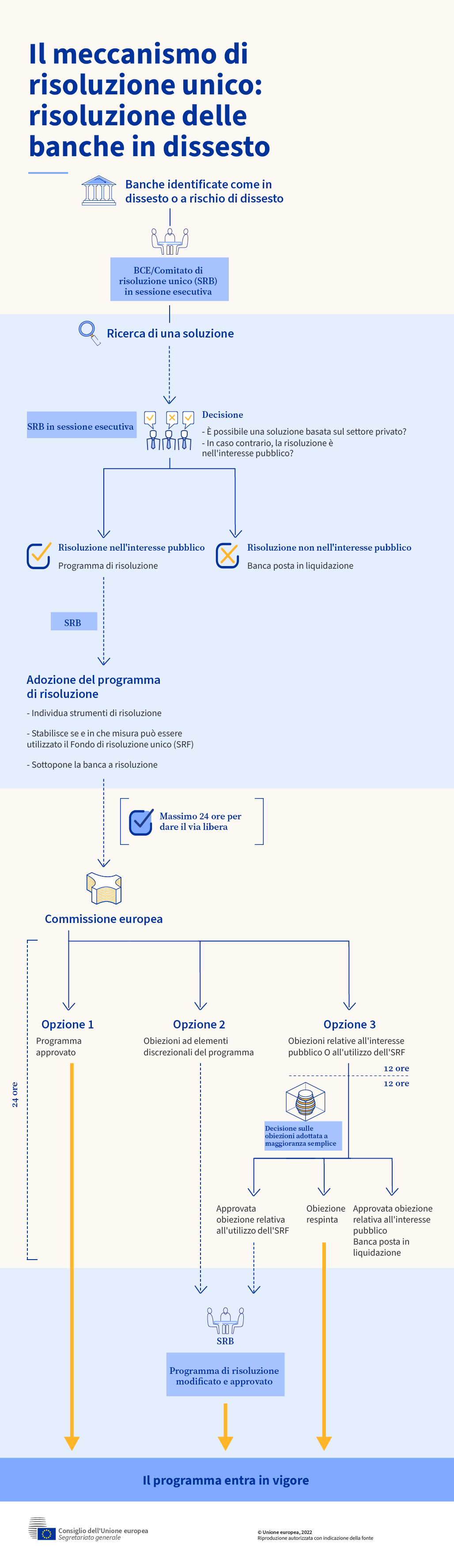

The use of the same is linked to an activity of the Commission through the Single Resolution System, of which it is the financial arm, and which acts as you can see below:

The system is not perfect: it intervenes when it is too late, while an earlier intervention than the SRF SRB would be more useful, i.e. when the first signs of crisis begin to appear. Furthermore, the preventive application of the Bail-in is excessively punitive for investors, but these defects were shared with the ESM which, in fact, made everything worse with an interference in the public debt on the one hand and the possibility of asking money, immediately, from the been on the other.

So it is not true that the EU does not have a system for protecting the credit system. This is there, it is capitalized and, although not perfect, it is operational. Don't believe what the newspapers say.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article The Single Resolution Fund: or the true protection of the European credit system comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/il-fondo-unico-di-risoluzione-ovvero-la-vera-tutela-del-sistema-creditizio-europeo/ on Fri, 22 Dec 2023 16:19:09 +0000.