The US public debt, the Debt Ceiling and the consequences of the current political contrasts

In January, the debt limit of $31.4 trillion was reached, which is the amount of debt the US government can hold. According to Treasury Secretary Janet Yellen, this means that US cash reserves could run out by June 1. If Republicans and Democrats fail to act, the US could default on its debt, causing detrimental effects on the financial system.

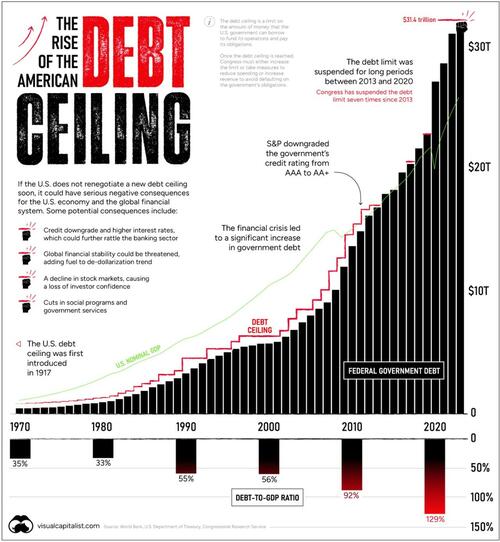

The chart below, created by Dorothy Neufeld and Nick Routley of Visual Capitalist, shows the sharp increase in the debt ceiling in recent years, drawing on data from various sources, including the World Bank, the US Department of the Treasury and the Congressional Research Service

A familiar territory

Raising the debt ceiling is nothing new. It has been raised 78 times since 1960.

In the 2023 version of the debate, House Republican Majority Leader Kevin McCarthy is calling for cuts in government spending. However, President Joe Biden argues that the debt ceiling should be raised without strings attached. Furthermore, the sharp hike in interest rates was a clear reminder that increasing debt can be precarious.

Consider that historically the interest payments on US debt have been about half the cost of defense. Recently, however, the cost of servicing debt has risen and is now nearly on par with the defense budget as a whole.

Highlights of recent discussions

Throughout history, raising the debt ceiling has often been a quick and standard process in the US Congress.

Unlike today, deals to raise the debt ceiling were often negotiated more quickly. The increase in political polarization in recent years has contributed to deadlocks with harmful consequences.

For example, in 2011 an agreement was reached within days of the deadline. As a result, S&P downgraded the US credit rating from AAA to AA+ for the first time in history. This delay cost the government an estimated $1.3 billion in additional costs that year.

Before that, the government had shut down twice between 1995 and 1996, during the head-to-head between President Bill Clinton and Republican House Speaker Newt Gingrich. In late November 195, more than a million state workers were furloughed for a week before the debt limit was raised.

What happens now?

Today, Republicans and Democrats have less than two weeks to reach an agreement.

If Congress doesn't strike a deal, the result would be that the government couldn't pay its bills by taking on new debt. Payments to federal workers would be suspended, some pension payments would be blocked, and interest payments on Treasuries would be delayed. Under these conditions, the United States would default.

Three potential consequences

Here are some of the potential knock-on effects if the debt ceiling is not raised by June 1, 2023:

1. Higher interest rates

Investors typically require higher interest payments as the risk of their debt increases.

If the US fails to pay the interest on its debt and gets a credit downgrade, interest payments would rise. This would have an impact on US government interest payments and the cost of borrowing for businesses and households.

High interest rates can slow economic growth by disincentivising spending and taking on new debt. The chart below shows how a darker economic picture has already been anticipated, showing the highest probability since 1983.

Historically, recessions increase US deficit spending, as tax revenues fall and there is less revenue to fund government activities. Further fiscal stimulus spending can also exacerbate any fiscal imbalance.

Finally, the increase in interest rates could lead to further problems for the banking sector, already in trouble after the failure of Silicon Valley Bank and Signature Bank.

A rise in interest rates would drive down the value of outstanding bonds, which banks hold as capital buffers. This makes hedging deposits even more difficult, which could further increase uncertainty in the banking sector.

2. Reduction of international credibility

As the world's reserve currency, a default of US Treasuries would rock global markets.

If its role as an ultra-safe asset is undermined, a chain reaction of negative consequences could spread throughout the global financial system. Treasuries are often held as collateral. If debt payments are not made to investors, prices would collapse, demand could collapse, and global investors could shift investments elsewhere.

Investors are factoring in the risk of the US not paying its bondholders.

As can be seen in the chart below, US one-year credit default swap (CDS) spreads are much higher than those of other countries. These spread-traded CDS instruments offer insurance against a US default. The wider the spread, the higher the expected risk that the bondholder will not get paid.

Furthermore, a default could fuel the perception of global de-dollarization. Since 2001, the USD has gone from 73% to 58% of global reserves.

Since the Russian invasion of Ukraine led to heavy financial sanctions, China has also entered into non-dollar-based deals with Brazil and Kazakhstan.

3. Financial sector turmoil

A debt default would damage investor confidence in the US economy. Coupled with already higher interest rates impacting costs, financial markets could experience further strain. Declining investor demand could depress stock prices.

Today, US public debt is 129% of GDP. The annual cost of debt service has increased by about 90% since 2011, due to the increase in debt and interest rates

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article The US public debt, the Debt Ceiling and the consequences of the current political conflicts comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/il-debito-pubblico-usa-il-tetto-le-debito-e-le-conseguenze-degli-attuali-contrasti-politici/ on Sat, 20 May 2023 06:00:55 +0000.