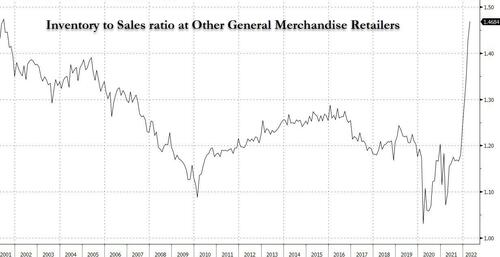

The “whiplash effect” that can blow up the Fed’s plans and bring down rates.

What is "The Whip Effect"? When an excessive drop in demand, read recession, following a period of supply shortages, leaves the warehouses of importers and traders incredibly full, thus launching a deflationary shock following an inflationary one. To explain in a simple way:

- logistical problems lower the reserves in the warehouses

- more orders are made, but for the logistic packages they do not arrive

- scarcity of goods causes inflation

- inflation causes the central bank to react which raises rates and slows down the economy

- in the meantime the ordered goods arrive and fill the warehouses

- the economic slowdown causes sales to drop and warehouses to remain increasingly full

- deflationary storm

But be aware that this concerns the USA, not Europe of imported inflation, or stagflation. Here is the "Whiplash" or "Bullwhip" that we see in the following chart showing the inventory / sales ratio

… Ensuring the liquidation of inventories across the retail sector, resulting in a “ deflationary tsunami ” and “falling prices,” which will force the Fed to change its upside plans and even start easing again.

Of course, not everything is destined for a deflationary slump: don't expect luxury items to suffer price cuts, and if anything, the prices of luxury items like bags and shoes are set to continue to rise.

We will therefore see a collapse in the prices of inflationary basket products very soon. The risk is that this decline is such as to lead to true deflation, and therefore to a reversal of the Fed's direction.

Today, none other than the "Big Short" Michael Burry, founder of Scion Asset Management, picked up on this news and tweeted that the "Bullwhip Effect" taking place in the retail sector will lead the Federal Reserve to reverse the price increases. rates and its Quantitative Tightening policy.

It's not the first time in recent months that Burry has raised concerns about the economy. In May, he tweeted that current market conditions are "like watching a plane crash."

Now if the deflationary storm were too strong the effect would be a drop in US rates by the end of the year. We just have to wait to see the results.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article The "whiplash effect" that can blow up the Fed's plans and bring down rates. comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/leffetto-frusta-che-puo-far-saltare-i-piani-della-fed-e-far-cadere-i-tassi/ on Mon, 27 Jun 2022 20:32:43 +0000.