The Yen hits lows not seen for almost 40 years. What will happen now?

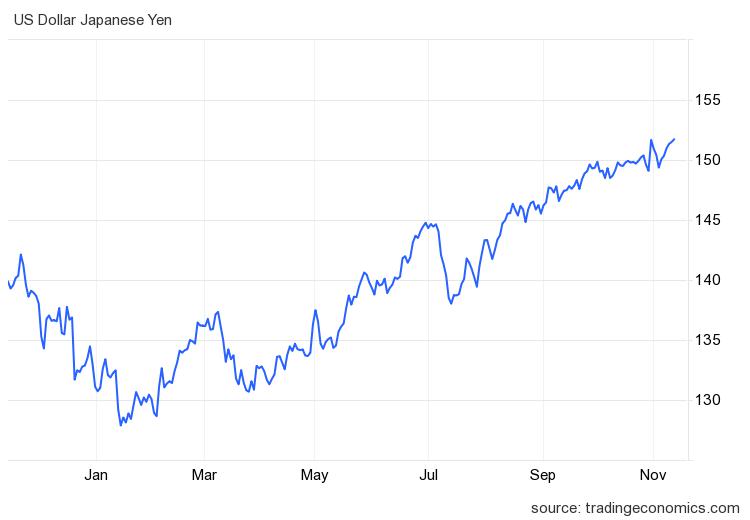

The Japanese yen depreciated toward 152 per dollar, hitting a fresh one-year low but beyond, as investors braced for U.S. inflation data and further comments from Federal Reserve officials this week.

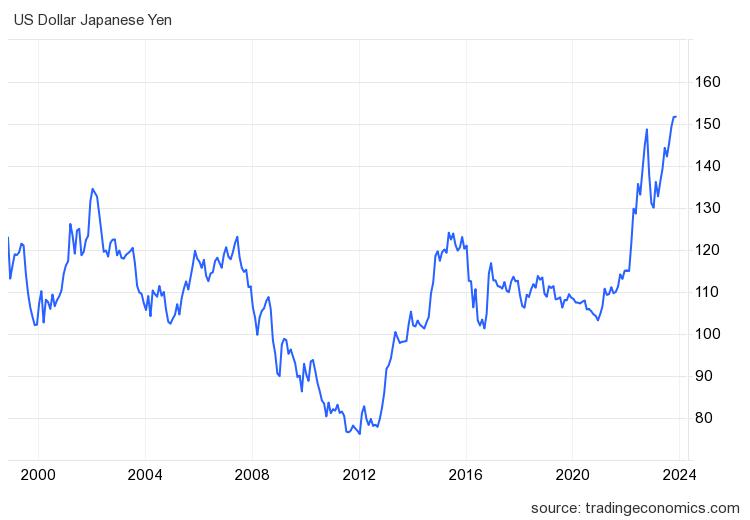

In truth, as can be seen from the charts, the Yen has not been this weak against the USD in practically 39 years. Let's go back to the roaring eighties to see such a strong Dollar

To USD YEN one year

USD Yen at 25 years

And here we see how these levels had not been reached since April 1984

Aggressive monetary messages from US policymakers weighed on markets last week, with Fed Chair Jerome Powell saying the central bank is "not confident" it has done enough to reduce the inflation, and therefore not excluding further increases.

This is in stark contrast to the Bank of Japan, which has pledged to patiently maintain an accommodative monetary framework. Meanwhile, BOJ governor Kazuo Ueda said the central bank needs to tread carefully as uncertainties abound. A rather prudent vision, which shows the quality of the preparation, including academic, of Japanese officials.

He also acknowledged that growing policy divergence has led to currency weakness, but made no direct statements in support of the yen. Earlier this month, the BOJ redefined 1% as an “upper limit” rather than a hard limit for 10-year JGBs and removed a commitment to defend the level with unlimited bond tender offers. This means we could see Japanese 10-year bonds break above 1% yield for brief moments.

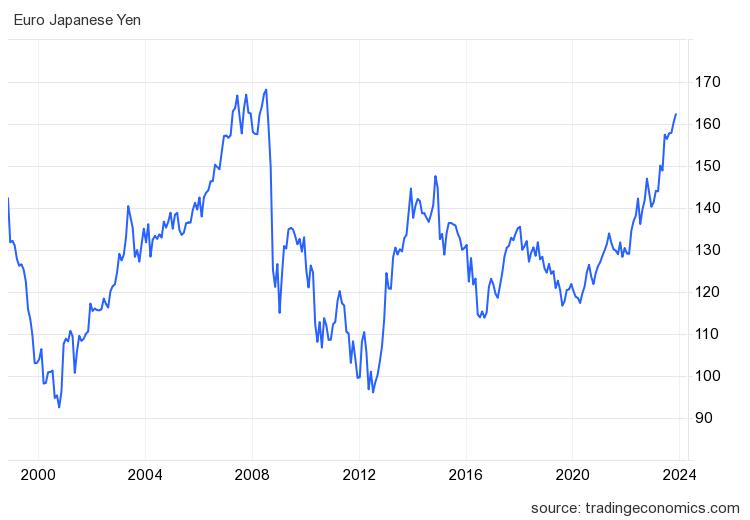

The Yen has also weakened against the Euro, although the record against the European currency is less evident, as you can see in the following graph:

What does this mean for the Japanese economy? First of all, there is a risk of an increase in inflation for two reasons:

- the effect of imported inflation due to raw materials and energy, of which Japan is a large importer, and which could influence domestic prices. Oil, natural gas, iron, copper are all commodities quoted in dollars;

- the devaluation against the Dollar and Euro makes Japanese products more competitive compared to their competitors, and here we are talking about sophisticated products, the result of an advanced economy. This will lead to an increase in demand for industrial goods, an overheating of the economy and an increase in inflation.

We await the next data.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article The Yen hits lows not seen for almost 40 years. What will happen now? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/lo-yen-tocca-i-minimi-mai-visti-da-quasi-40-anni-cosa-succedera-ora/ on Mon, 13 Nov 2023 13:00:16 +0000.