Tin: Low demand causes price to fall, but watch out for problems in Myanmar

Tin prices have fallen recently, with the LME cash price falling by more than $2,000/t since Monday 25 September. Looking back to just the end of July, when prices were above $28,600/t, the decline appears even more dramatic. It wasn't long ago that tin prices witnessed a multi-year bull run, starting at the onset of the Covid pandemic and lasting until March 2022. The recent price declines follow a period of rising prices during the second quarter of this year, so in this In this week's article we will look at some of the main reasons behind the recent price decline.

The economic slowdown is affecting demand

When looking at the decline in tin prices , it is important to note that the long bull run that occurred during the pandemic created a unique environment for tin demand. With lockdowns imposed around the world, the demand for electronic devices to support working from home has increased, which has also increased the demand for semiconductors. Semiconductor manufacturing is a key source of demand for tin, and therefore, once the pandemic eased and demand for electronic devices began to decline, demand for tin also began to decline.

More recently, the continued lack of global economic growth has reduced the possibility of tin prices reaching pandemic levels. The price decline that occurred in early August, which was reflected across the industrial metals complex, followed a series of worse-than-expected economic indexes for the first half of 2022 released in China. Manufacturing PMI data for China has been inconsistent and has moved above and below the 50 point mark, which indicates neutral growth, while in Japan the PMI reading has been below 50 from June onwards. The slowdown in production in these two nations in particular has weakened demand for tin, as China and Japan are responsible for more than 45% of global semiconductor exports.

Tin stocks

Stocks rising and investments falling

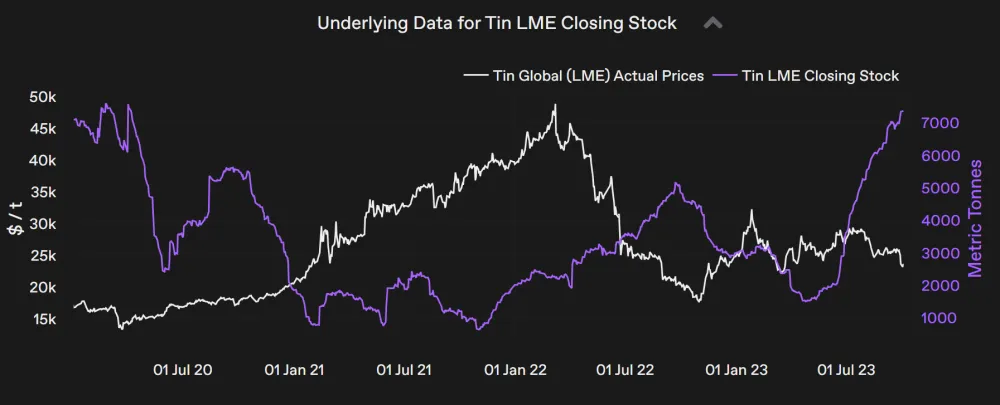

Another reason for the decline in LME tin prices is the increase in inventories recorded in warehouses. As the chart above from ChAI Insight shows, closing shares have risen significantly since May 2023, and in doing so, rose to the highest level since April 2020. With such a rise in visible inventories of the metal, there has also been a shift in investors' position on the pond.

Examining the change in investment fund positions in CoT reports is indicative of the current weakness in tin demand. In the week ending Friday, July 28, investment funds held 1,983 long positions to 475 short positions. However, by the end of the first week of September, this ration had moved from 1,039 long positions to 614 short positions, showing the extent to which bullish sentiment towards tin was waning. In last week's report, the ratio is even closer; Investment funds hold 875 long positions compared to 786 short positions. Since the end of July, therefore, the number of long positions has more than halved while the number of short positions has almost doubled.

Supply-side risks remain

As noted by Andy Home for Reuters , the drop in tin prices comes at a time when supply is at considerable risk. In early August, all tin mining activities were suspended pending a review in the semi-autonomous state of Wa. The region is located within Myanmar, the third largest tin producing country in the world.

This has led to a decline in activity in the foundries of neighboring China and therefore to a decline in global supply, of which China is one of the main customers.

Going forward, semiconductor production will be a key indicator for the next bull run in tin prices . Current ChAI price forecasts suggest that prices will rise again in the second half of 2024, and if demand recovers before the supply situation in Myanmar is resolved, tin could be set to see a rapid rise.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Tin: low demand causes the price to fall, but beware of the problems in Myanmar comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/stagno-la-scarsa-domanda-fa-cadere-il-prezzo-ma-attenti-ai-problemi-in-myanmar/ on Tue, 10 Oct 2023 06:00:05 +0000.