Turkey: the lira sinks and the BC burns reserves …

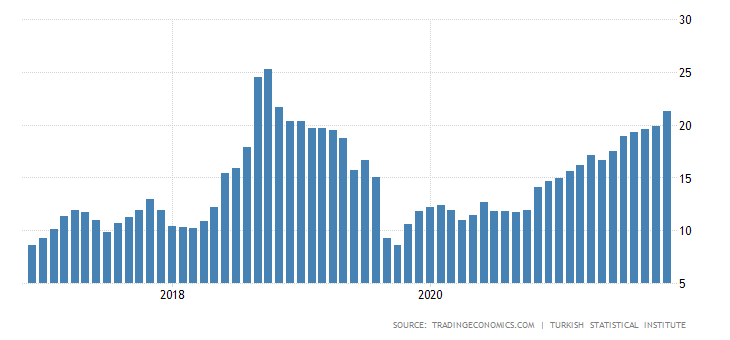

The Lira / Dollar exchange rate rose above 14 for the first time ever and then catapulted to 14.75, after the new Turkish Treasury and Finance Minister Nureddin Nebati told the Haberturk newspaper in a telephone interview that "no we will raise the interest rate. You will see that we will operate without without increasing rates ”. A downgrade by S&P of Turkey's sovereign credit rating outlook to negative did not help.

Responding to a question about continuing the rate cut policy, Nebati said "I don't know" but said the lira is not attacked from abroad – rejecting a popular narrative spread by its boss Recep Erdogan – adding that there are only "Few manipulative and speculative transactions within" the country. He also said that there are no problems regarding Turkey's macroeconomic indicators. After all, high inflation is enough to explain the current situation, combined with an expansionary monetary policy

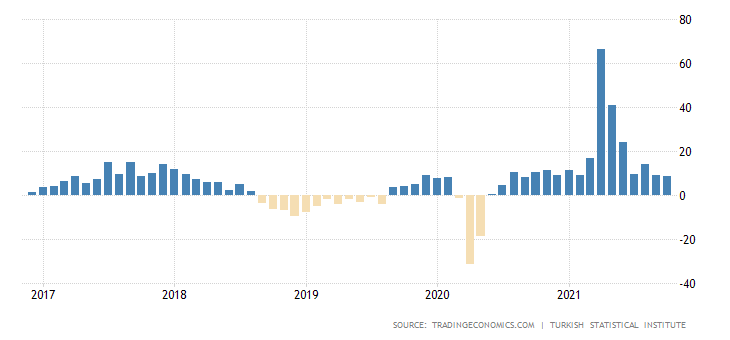

On the other hand, the devaluation is no longer able to relaunch the Turkish industry as it did a few months ago: the volatility of the exchange rate is excessive and companies obviously find it difficult to organize their production cycles. Then the external demand doesn't pull that much.

As Bloomberg's Netty Ismail writes, the unprecedented lira is unlikely to see a respite before what is likely to be Turkey's fourth consecutive interest rate cut. Policy makers are likely to cut the benchmark rate by 100 basis points on Thursday, despite the lira plummet and rising inflation. Surprisingly, Turkey's real rate is currently minus 631 basis points, the lowest in major emerging markets. This will widen further with the prospect of another rate cut and accelerating inflation even as it sends the remaining savings to the relative safety of the stock market (plus gold and cryptocurrencies).

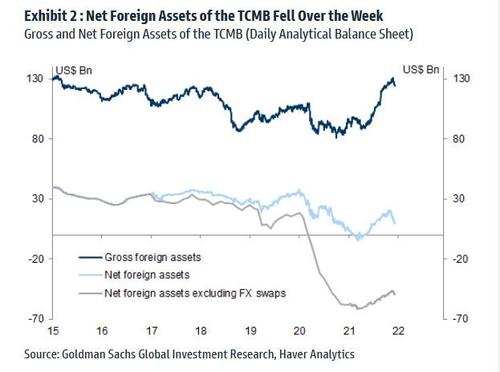

Meanwhile, options traders see a 56% chance that the lira will touch 15 / USD in one week; at this rate, that level could be removed as of today, despite yet another intervention by the Turkish central bank. As a reminder, the CBRT, Central Bank of the Republic of Turkey, Ankara's central bank, has spent over a billion dollars on its two previous interventions and continues to burn billions of foreign reserves every day as it tries to contain the collapse.

Naturally, such interventions are the quintessence of uselessness since in the absence of a rate hike, the lira will continue to slide; running out of foreign exchange reserves will only make things worse for the Turkish currency… and for the country. As Goldman calculated at the end of last week, as of December 8, the Turkish Central Bank's net foreign assets were $ 9.9 billion, down $ 0.5 billion from a week ago. Swaps, i.e. currency loans, and the stock of the FX deposit facility totaled $ 45.6 billion, up $ 1.4 billion from a week ago. The stock of the FX depository facility is now at US $ 7.0 billion and swaps are at US $ 38.6 billion. Most ominously, net reserves excluding swaps with banks and other central banks are, according to our estimates, minus $ 49.7 billion. The Turkish BC not only has no reserves, but has debts …

So the Turkish lira not only devalues, but has eaten up the reserves of the BC, which literally risks not being able to meet its commitments. A nice mess which, however, does not seem to affect Erdogan.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Turkey: the lira sinks and the BC burns its reserves… comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/turchia-la-lira-affonda-e-la-bc-brucia-le-riserve/ on Mon, 13 Dec 2021 18:30:23 +0000.