US bankruptcies are at their highest since 2010. The economy is reeling, for now

The crisis is starting its own competitive selection among US companies, and it is a very painful process for investors and employees, but we are only at the beginning, as Wolfstreet notes.

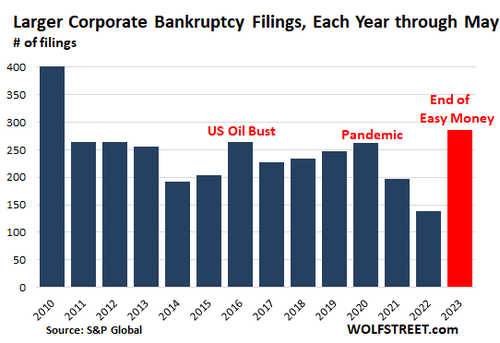

2023 is becoming a corporate bankruptcy fest, after years of easy money causing all kinds of excesses, fueled by investors chasing yields, in an environment where the Fed has been squeezing yields with all its might. These yield-seeking investors have ensured that even the most indebted zombies are supplied with more and more fresh money, but that era is over. Interest rates are much higher, investors are getting a little more cautious and the easy money is gone.

At the height of the Fed's crackdown on yields, in mid-2021, companies rated "BB" – hence rated "junk" – could borrow at about 3%, despite being companies that hardly had operating income capable of bear the financial costs. Now yields on these "BB" junk bonds have risen to almost 7%. This means that these companies, which have been having trouble producing enough cash flow to service their 3% or 5% debt, must either refinance their debt when it matures, or add new debt, at 7%. 7% may still be low, considering that inflation hovers around that percentage, but it puts a much greater strain on these companies.

So many overleveraged junk-rated companies will restructure their debts in bankruptcy court at the expense of shareholders, bondholders and the holders of their leveraged loans, no longer being able to finance themselves on the market. This is how the capitalist system wants, which in fact works like this, through selections. Too bad this means that someone loses their money and someone else their job.

S&P Global released May bankruptcy statistics for publicly traded companies with at least $2 million in assets or liabilities listed in their bankruptcy filings, and for private companies with publicly traded debt (such as bonds) with at least 10 million dollars

of assets or liabilities listed in their bankruptcy documents.

In May, 54 of these types of companies filed for bankruptcy, including, notably, the largest :

- Envision Healthcare

- Vice Holdings and its affiliate Vice Media (a group of creditors intends to acquire Vice Media out of bankruptcy

- Kiddie-Fernwal

- Monitoronics International

Filings in May brought the five-month total to 286 bankruptcies, the most since 2010, more than double the filings for the same period in 2022 (138). And it even surpassed the 262 filings for the same period in 2020, when some companies were faced with enormous stress.

In 2016, as the oil crisis took its toll and drilling companies collapsed one by one, S&P Global reported 265 filings, but concentrated in the oil and gas sector. To have more filings than in the first five months of 2023, you need to go back to 2010, when 402 companies filed for bankruptcy in the first five months.

Among the biggest busts included in this illustrious list so far this year and entering my pantheon of imploded stocks are:

- SVB Financial, the holding company of Silicon Valley Bank which collapsed in a big mess and was taken over by the FDIC;

- Avaya, the telecommunications, software and services company that issued $600 million in bonds just last year;

- the ridiculous Bed Bath & Beyond meme-stock, which is now being liquidated.

Today's problem isn't a price crash – like that of oil during the 2016 oil crisis, when WTI crude plunged below $20 a barrel, bankrupting scores of frackers; today WTI is at 72 dollars a barrel!

Today's problem is not a slump in demand like the one that hit some industries in 2020 or during the Great Recession. This economy is characterized by rising prices and resilient demand.

The problem now is that debt has gotten a lot more expensive, and investors thinking about buying this debt have gotten a little more cautious. The problem is the end of easy money. Once companies get hooked on the easy money thanks to piles of debt, it's hard to do without the easy money. The financial drug has been cut off too soon, too abruptly, and the drug addict is dying of too severe a withdrawal crisis.

On the other hand, the economy is normalizing with rates that were quite typical before the QE era. But companies that only got to this point thanks to easy money are now hanging on the nail.

Bankruptcies will reduce corporate debt overhangs. Many businesses will emerge from bankruptcy with less debt and will be more agile and able to thrive. Others will be sold off in bits and pieces, to make room for well-managed companies unencumbered by these problems. Paradoxically, this is a correct process that would not have occurred in such a painful way if there had not been, first, a flood of liquidity to the private sector.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article US bankruptcies are at their highest since 2010. The economy is faltering, for now it comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/le-bancarotte-usa-sono-al-massimo-dal-2010-leconomia-vacilla-per-ora/ on Fri, 09 Jun 2023 16:49:47 +0000.