US banks: Moody’s downgrades NYCB to junk. Big risks from real estate loans

Ratings agency Moody's on Tuesday downgraded all of New York Community Bancorp's long-term and some short-term ratings to "junk" and warned of further downgrades.

The agency also downgraded all long-term and some short-term ratings and ratings of its main bank, Flagstar Bank. Moody's downgraded NYCB's rating from Baa3 to Ba2, which is considered a junk rating.

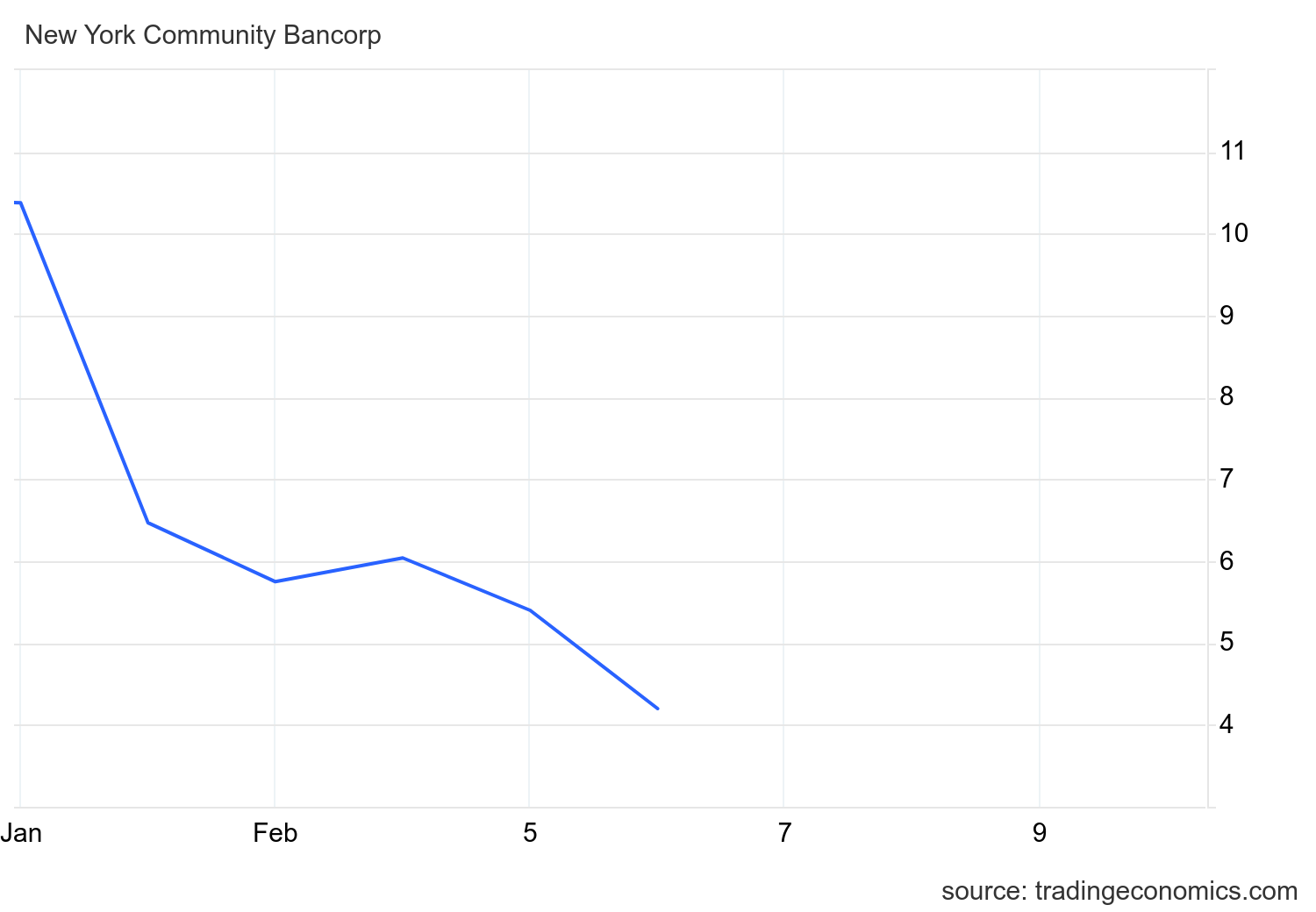

The downgrade reflects Moody's view that NYCB faces elevated governance risks as it transitions leadership of the second and third lines of defense – the bank's risk and audit functions – at a crucial time , the agency said. In short, the bank would not be able to manage its losses, and this has led to a dramatic drop in its prices in recent days :

Moody's said NYCB's historic lending in commercial real estate (CRE) and significant, unexpected losses on New York office and multifamily properties could create potential sensitivity to the trust. But how much do these losses amount to? At quite a bit of money. It's not just nervousness, there's a real problem.

NYCB is highly concentrated in rent-regulated multifamily properties, a segment that has historically performed well. However, this cycle could be different.

While vacancy rates are low for this CRE segment, properties may face different challenges this cycle due to higher interest expense when refinancing and already higher maintenance costs due to inflationary pressures.

These higher costs may prove more difficult to pass on to tenants through rent increases. So rental management could make a loss.

Beyond regulated rentals, the bank has a significant concentration of low-fixed-rate multifamily loans. This type of loan portfolio is at risk of refinancing.

Then there is the problem of evaluation in general. For example, offices in the city were once worth 3 trillion dollars, now, if all goes well, they are worth 1.8 billion. What if these losses ceased to be latent and became realized? How many banks would it support?

All of this is happening in an environment where, due to the Fed's delays in lowering rates, refinancing is much more expensive. NYCB isn't just a temporary fad.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article US Banks: Moody's downgrades NYCB to junk. Big risks from real estate loans comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/banche-usa-moodys-degrada-nycb-a-spazzatura-grossi-rischi-dai-crediti-immobiliari/ on Wed, 07 Feb 2024 08:30:46 +0000.