US government bonds are at their highest in 14 years. Real estate suffers

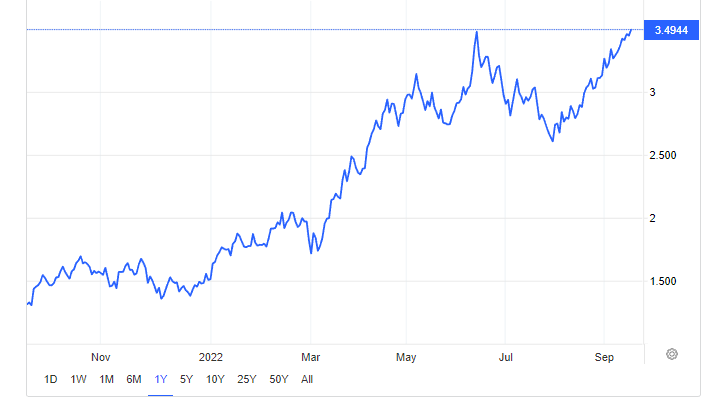

The 10-year US Treasury yield exceeded 3.5%, approaching levels not seen since April 2011, amid expectations that the Federal Reserve will further accelerate the pace of its monetary tightening in an attempt to control inflation that remains elevated. Last week, data showed that US consumer prices rose at an annual rate of 8.3% in August, slowing less than expected, as retail sales beat weekly forecasts and demand for unemployment fell to its lowest level since May, raising bets that the Fed could raise interest rates by as much as 100bps on Wednesday, and 100bps is a whopping one percent, a value that is very rarely seen in a Western country. . Increasingly optimistic expectations pushed Treasury yields up across the board, with the policy-sensitive 2-year bond yield hitting a 15-year high at 3.94%, reversing the yield curve between the 2 and 30 years at the steepest level of this century. Here is a graph showing the peak

What will the immediate effects be on the US economy?

- a drop in the demand for real estate, due to the much higher cost of mortgages which will discourage demand. For some time now there have been signs of fatigue in the real estate market, due precisely to the rate hike already underway, but these data and Wednesday's decisions could accelerate the negative trend.

- the bag will have to somehow suffer, even if for now it still seems to hold up. But it's only a matter of time. In the meantime, speculative assets such as gold and cryptocurrencies are deflating.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article US government bonds at their 14-year highs. The real estate suffering comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/i-titoli-di-stato-usa-ai-massimi-da-14-anni-limmobiliare-soffre/ on Tue, 20 Sep 2022 06:00:32 +0000.