US Inflation: Small rebound that will fuel Fed hawks

The price trend in the USA slightly increased growth in July, but nothing outside expectations, above all due to the effects of energy materials, which decreased less than in June, and an increase in some goods and services. The FED will not let go of the bone.

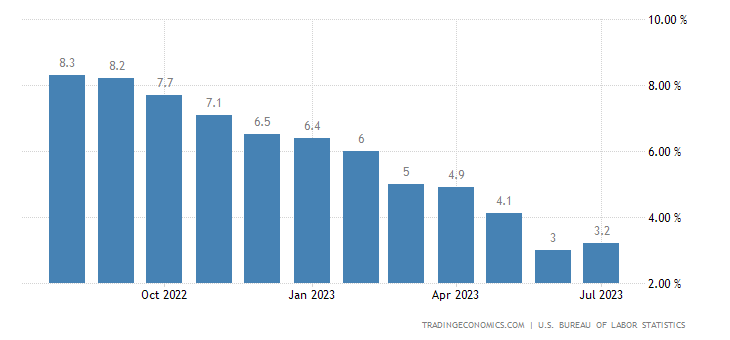

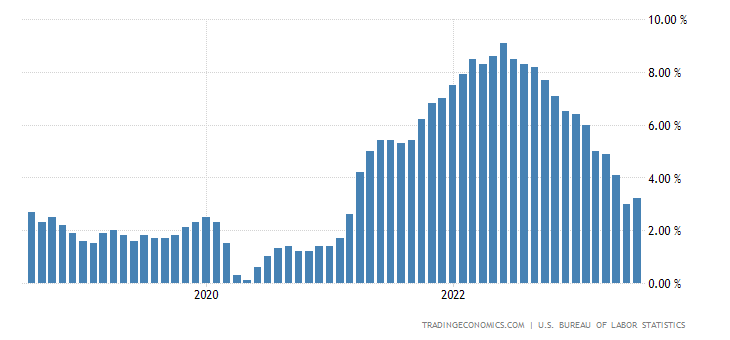

The US annual inflation rate accelerated to 3.2% in July 2023 from 3% in June, but below forecasts of 3.3%.

The reading marks a setback in a consecutive 12-month decline, due to base effects. A year earlier, inflation had started to ease off its peak of 9.1%.

In July 2023, the cost of energy fell by 12.5%, less than the 16.7% in June, with a more contained decrease in fuel oil prices (-26.5% vs. -36.6 %), gasoline (-19.9% vs. -26.5%) and public utility gas services (-13.7% vs. -18.6%). The costs of clothing (3.2% vs 3.1%) and transport services (9% vs 8.2%) also increased.

On the other hand, electricity prices rose 3%, from 5.4% in June, and inflation slowed for food (5.7% vs 4.9%), housing (7.7% vs 7.8%) and new vehicles (3.5% vs 4.1%).

The cost of medical services fell by 1.5% (against -0.8%) and the prices of used cars and trucks decreased by 5.6% (against -5.2%). Meanwhile, core inflation, which excludes food and energy, fell to 4.7% from 4.8% in June, below expectations of 4.8%.

Here are the graphs. Inflation soon:

Medium

A very important indicator for the Fed, the cost of consumer goods excluding housing costs, which has rebounded and is above 4%

In general these are the most dynamic product categories on a monthly basis

Increases:

- The cost of housing index rose by 0.4% in the month, the same increase recorded in June.

- The rental index rose 0.4% in July, while the owner-equivalent rent index rose 0.5% for the month.

- The night away from home index decreased by 0.3% in July, after falling by 2.0% in June.

- The housing index was the main driver of the monthly increase in the index of all goods, excluding food and energy.

- Other indices that rose in July included motor vehicle insurance, which rose 2.0% after rising 1.7% the previous month.

- The education and recreation indices also increased in July.

Decreases:

- The airfare index fell 8.1% over the month, the fourth consecutive monthly drop, although judging by the soaring airfare prices, that's just another seasonally adjusted gimmick.

- The used car and truck index fell 1.3% in July, following a 0.5% decline in June.

- The communications index fell by 0.1% in the month, as did the new vehicle index and the home furnishings and operations index.

- The medical care index fell 0.2% in July after remaining unchanged the previous month.

- The hospital services index fell by 0.4% over the month, while the medical services index increased by 0.2%.

- The prescription drug index was unchanged in July.

Inflation looks rather sticky, difficult to bring down, and this, together with the persistence of core inflation, will justify any further tightening on Fed interest rates, or at least staying at current rates. No relief coming for indebted US citizens.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article US Inflation: Minor Rebound That Will Fuel FED Hawks comes from Scenarios Economics .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/inflazione-usa-lieve-rimbalzo-che-alimentera-i-falchi-della-fed/ on Thu, 10 Aug 2023 15:58:44 +0000.