US Stocks: Marginal Debt Indicates Storm Coming

The total amount of leverage in the stock market is unknown and takes many forms. The only module that is monitored and reported on a monthly basis is the “Margin debt” in English. This is a particular form of loan, used for speculative stock exchange transactions, in which the shares owned are left as collateral, "Collateral", for new loans intended to purchase shares. The forms of marginal debt are different, but the quantity is not known for all. Some forms, such as Securities Based Lending (SBL) and hedge funds with institutional leverage, do not know exactly how much. Not even the banks and brokers who finance this leverage know how much total leverage their client has from all brokers combined, which became clear when the Archegos family office imploded in March 2021 and wiped out billions of dollars of capital at first brokers who had provided leverage.

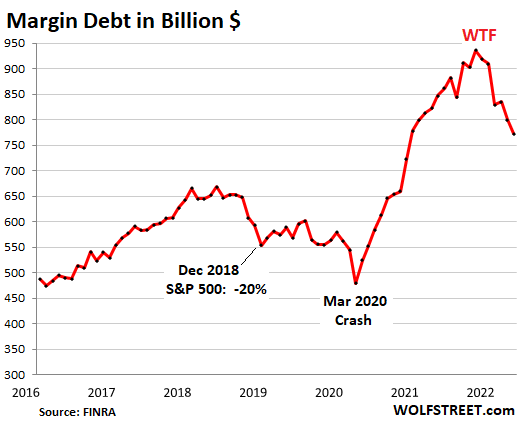

Loans to finance stock market operations are indicators of market performance. If no growth in stock market values is expected, no one is borrowing from "Margin" to buy the securities and speculate on them. As Wolfstreet points out, marginal debt – the tip of the indexberg and the directional indicator of overall stock market leverage – fell by $ 27 billion in April from March, to $ 773 billion, according to Finra, which gets this data. from its member brokers. Marginal debt peaked in October last year at $ 936 billion and started to decline in November. In those six months, it fell $ 163 billion, or 17%. But the leverage is still huge and relaxation still has a long way to go:

As can be seen from the historical trend every time the marginal debt has fallen sharply, the stock market has also seen a reduction in value. Marginal debt falls when it becomes too expensive, or rather its cost exceeds the prospective possibilities of growth in the value of the securities. That is, the money costs more than the possible stock market gain. This feels like one of those moments.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article US Stock Exchange: marginal debt indicates storm coming comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/borsa-usa-il-debito-marginale-indica-brutto-tempo/ on Tue, 17 May 2022 08:00:26 +0000.