USA and Europe: two stories of economic development and failure

If the Western world were governed with a minimum of logic, the Commission and all European governing bodies, and perhaps even several national governments, would have to be dissolved and then proceed with requests for huge personal damages to the individual perpetrators. Because the data from the PMI forecast indicators looks like the USA; despite everything, they float, while the EU is destined to sink economically like the Titanic towards the depths of recession.

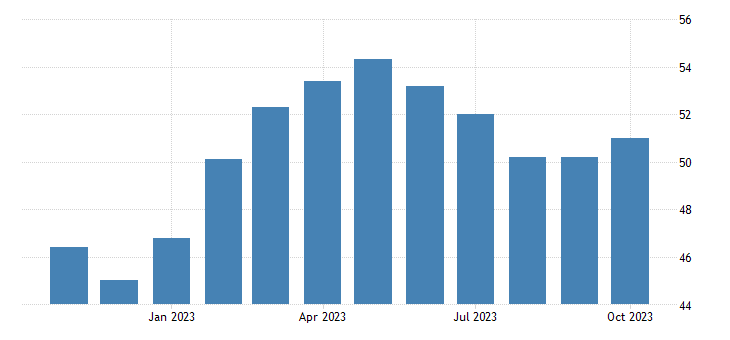

Let's start with the US: According to a preliminary estimate, the S&P Global US Composite PMI rose to 51.0 in October 2023, compared to 50.2 in September, signaling an acceleration in the pace of expansion of private sector output.

This is the fastest expansion since July, supported by a faster growth rate in both services and manufacturing. Demand conditions in the manufacturing sector improved for the first time since April, while new business in the services sector fell for the third consecutive month, due to high interest rates and difficult economic conditions.

Meanwhile, job creation was only marginal, with companies citing uncertainty over future demand conditions and their cost-saving efforts, while job backlogs fell for the sixth consecutive month. On the price front, operating expenses rose the least in three years and average selling price inflation fell to its lowest level since June 2020. Finally, business confidence rose to its highest level since May 2022 Here is the relevant graph

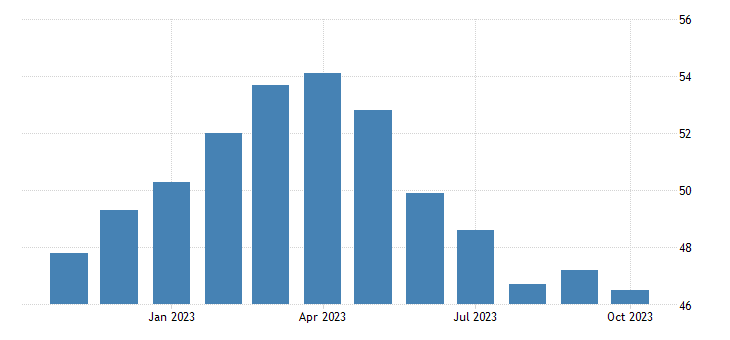

Washington laughs, while Brussels and Frankfurt cry. The HCOB Eurozone Composite PMI fell to 46.5 in October 2023, down from 47.2 in September and below the market consensus of 47.4 , according to a preliminary estimate.

The latest reading signaled the fifth consecutive month of decline in business activity and the steepest decline since November 2020, as both services and manufacturing activity continued to contract.

Excluding the pandemic months, the decline in activity was the strongest since March 2013, marking the return to the crisis condition when the Euro and the debt were trembling. Overall new orders saw the largest decline since May 2020 and, excluding the early months of the pandemic, since May 2009. Additionally, backlogs have cleared at a pace not seen since June 2020, and employment levels have dropped decreased for the first time since January 2021.

On the price front, the inflation rate of average prices charged fell to the lowest level since February 2021. Looking ahead, business confidence remained among the weakest in the past year. Here is the relevant graph

Previously we had already talked about how Germany felt this economic crisis situation particularly strongly. The "Locomotive" has become a brake, Brussels' anti-cyclical policies and monetary tightening are making their effect felt. In the end, the real estate growth seen in France, Germany and the Netherlands turned out to be a bubble that, fortunately, is not exploding, but is nevertheless deflating. The European growth boasted over the last 20 years, the famous “Resilience”, has turned out to be a simple illusion fueled by cheap gas. Half of Europe, the rich one, is gasping, while half, the Mediterranean and Eastern one, is at the limit of poverty.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article USA and Europe: two stories of development and economic failure comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/usa-ed-europa-due-storie-di-sviluppo-e-fallimento-economico/ on Tue, 24 Oct 2023 16:36:04 +0000.