USA: consumer debt at its peak, and with this also oppressive interest payments

Economics tells us that the economy grows primarily through increased retail consumption. The problem is that this continuous growth must be fueled by increasing personal incomes, otherwise something unpleasant happens to the consumer, especially to his wallet.

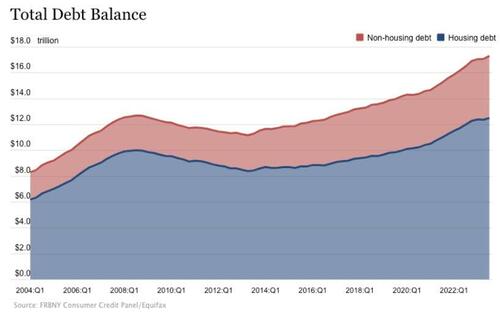

According to the latest data from the New York Federal Reserve , total household debt increased by $228 billion in the third quarter, setting a new record of $17.29 trillion.

Rising credit card balances led the way, rising 4.7% to a record $1.08 trillion. Year over year, credit card debt increased by $154 billion. This is the largest annual increase since 1999.

The biggest problem is the dual problem of rising debt and rising interest rates. Average credit card interest rates eclipsed the previous record of 17.87% months ago. The average annual rate (APR) is currently 20.72%.

According to the Consumer Financial Protection Bureau , Americans paid $130 billion in interest and fees on their credit cards over the past year. This was the largest amount ever recorded.

When prices skyrocketed last year, Americans burned through their savings to make ends meet. Aggregate savings peaked at $2.1 trillion in August 2021. In June, the San Francisco Fed estimated that aggregate savings had fallen to $190 billion.

In other words, Americans have devoured $1.9 trillion in savings in just two years.

Then they turned to credit cards.

“People have to deal with this somehow. After wasting their savings on buying essentials, they do what comes next: finding sources to borrow,” Villanova University finance professor John Sedunov told ABC News.

According to MarketWatch, “Americans appear to be relying more on debt to pay for their purchases. They are also using more “buy now, pay later” plans, i.e. very short-term consumer credit.

The New York Fed's economic research consultant, Donghoon Lee, also attributed the resilience of American consumers to Visa and Mastercard, i.e. the most expensive consumer loan that is sensitive to changes in rates. Credit card balances saw a strong jump in the third quarter, in line with strong consumer spending and real GDP growth.”

Debt.com president Howard Dvorkin told CNBC, “Consumers maintain and sustain their lifestyles using credit card debt.” In other words, the economic growth that President Biden and others continue to boast about is simply a function of borrowing.

This is not exactly indicative of a healthy economy and is not sustainable.

Consumer spending, which we all know is the basis of GDP, is actually supported by credit card debt and is perhaps not sustainable,” American University economics professor Mary Hansen told ABC News.

There are some signs that the debt-fueled spending spree is slowing. After rising more than 13% in August, growth in revolving credit (primarily credit card balances) slowed to 2.9% in September, according to the Federal Reserve's latest consumer credit data. This could signal a significant slowdown in spending. This would mean the end of the mythical “strong” economic growth.

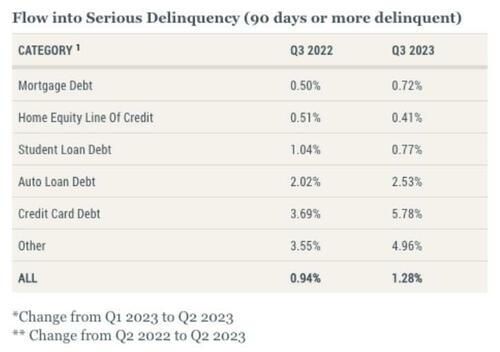

Not only that, the debt distress rate is also increasing rapidly, as can be seen from the following graph:

These bad debts will only weaken the position of banks and other financial institutions. If these are then financed with the securitization of these debts, we also risk repercussions throughout the financial system.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article USA: consumer debt at its peak, and with it also oppressive interest payments comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/usa-il-debito-dei-consumatori-al-massimo-e-con-questo-anche-gli-oppressivi-interessi-passivi/ on Sat, 11 Nov 2023 10:00:47 +0000.