USA: consumers are starting to use revolving credit cards less. Another ominous sign

There is a point at which the high-interest-based credit crunch begins to take its toll on consumption, starting with less use of interest-bearing credit cards. Last month the shock was in the non-revolving segment, which contains auto and student loans which had recorded the first negative figure since April 2020.

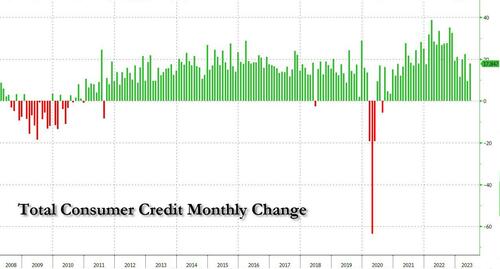

Now things are moving forward, and not in a good way for credit. Signs show that high rates are finally hitting consumption. Here is non-revolving credit cards which grew by an interesting USD 18.5 billion

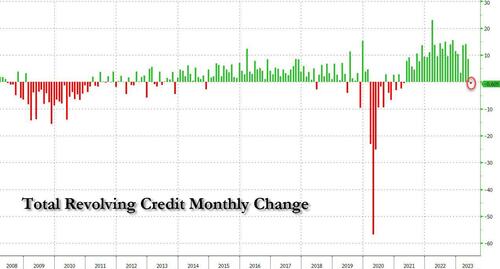

But this month the bad news comes from revolving credit, the one that's being split across the most jaw-dropping me this month, because after several months of solid increases, including a near-record $14.8 billion in April, June the credit card debt fell $0.6 billion – the first negative number since April 2021, when US consumers were still in shock from post-covid realities and were saving aggressively, money that has now been long spent – as Americans have been actively reducing their debt, which they only do when a recession is looming. Here is the related graph

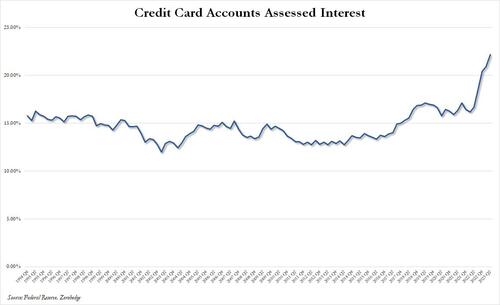

Needless to say, the decline in revolving credit is surprising because, outside of a sharp and unexpected crisis like covid, it is usually indicative of a late-business-cycle recession, when US consumers – traditionally responsible for the 70% of US GDP with their debt fueled purchases – they go dormant and start paying back their inflated credit card bills, which are currently accruing an astounding 22% average interest, as you can see in the next chart .

Obviously, with these levels of interest there isn't much revolving credit to do, if you don't want to start the

Adding these two categories together, total consumer credit in June was +17.85 billion dollars which, as noted above, was entirely due to the 18.5 billion dollar increase in non-revolving credit which includes loans cars and students.

The real crisis will begin when non-revolving credit starts to contract. In this sector, it is above all the car loan bubble that keeps credit levels high, but they cannot grow forever. Another brick is added to the wall of the next crisis.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The USA article: consumers are starting to use revolving credit cards less. Another disturbing sign comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/usa-i-consumatori-iniziano-a-usare-meno-le-carte-di-credito-revolving-un-altro-segno-inquietante/ on Tue, 08 Aug 2023 07:00:49 +0000.