USA: rising inflation…. and the Euro devalues. How come?

In the USA, inflation signals a rise, but this is accompanied by a weakening of the Euro. How come ?

Simple, it all depends on the central banks…

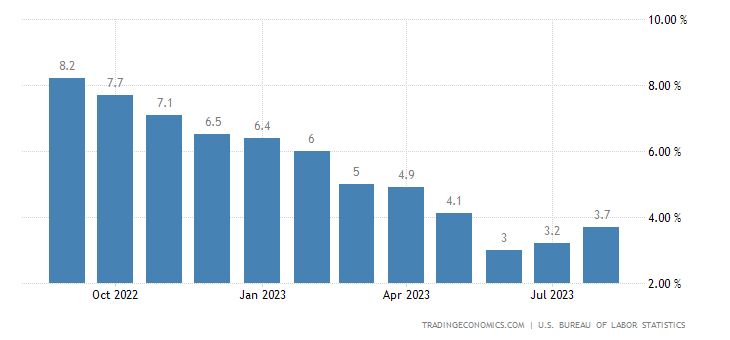

We are starting to see the situation in the United States: the annual inflation rate in the United States accelerated for the second consecutive month to 3.7% in August from 3.2% in July, above market forecasts of 3.6 %. Oil prices rose over the previous two months, which, combined with last year's base effects, pushed inflation higher.

In July 2023, the cost of energy fell 3.6%, much less than July's 12.5% decline, with prices falling at a slower pace for fuel oil (-14.8% vs. -26.5%) and petrol (-3.3% versus -19.9%).

The cost of transport services also increased more (10.3% vs 9%). On the other hand, inflation slowed down for electricity prices (2.1% against 3%), food products (4.3% against 4.9%), housing prices (7.3% against 7 .7%), new vehicles (2.9% versus 3.5%) and clothing (3.1% versus 3.2%).

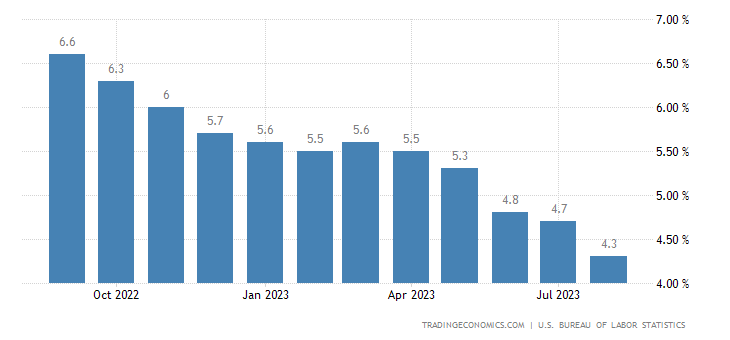

Furthermore, more significant decreases were recorded in the costs for gas services (-16.5% vs. -13.7%), medical services (-2.1% vs. -1.5%) and used cars and trucks. (-6.6% vs -5.6%). However, the core inflation rate, which excludes food and energy, slowed for a fifth month to 4.3%, in line with market expectations.

Here is the related inflation graph:

Now core inflation, which has fallen. So the wage dynamic is slowing down, despite the employment data (always revised ex post…) appearing positive. However, if salaries are falling it means that the economic slowdown is starting to impact employment

At this point, with inflation growing, albeit at much lower levels than 18 months ago, an intervention on FED rates remains much more likely.

The ECB, on the other hand, is thinking about it: inflation isn't falling even in the EU, but here the dynamics are external and the political opposition to further increases on the part of France, Italy and Spain is becoming increasingly heated. Therefore, a further increase in rates by the FED compared to the ECB is more likely, and the Euro then weakens against the dollar, as shown in the following graph

It is absolutely not impossible that this trend towards devaluation continues, also because in any case the European economy is increasingly weaker on a global level, its weight on trade is decreasing, and therefore its relative strength vis-à-vis both the dollar and the and other coins.

Europe is sicker than the USA and the Euro is the thermometer of this.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article USA: rising inflation…. and the Euro devalues. How come? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/usa-inflazione-in-rialzo-e-leuro-di-svaluta-come-mai/ on Thu, 14 Sep 2023 08:30:28 +0000.