USA: The collapse of the market is now evident

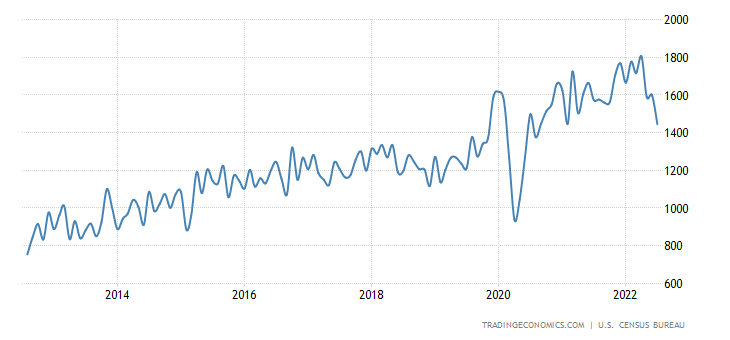

The data on the US real estate market are now clear: we are heading towards a crisis. New home yards in the U.S. plummeted 9.6% month-over-month, reaching an annualized rate of 1.446 million units in July 2022 , the lowest since February 2021 and well below market expectations of 1.54. millions. The real estate sector cooled due to the surge in material prices and rising mortgage rates. Single-family house start-ups fell 10.1% to 916k, the lowest level since June 2020, while unit start-ups in buildings with five or more units dropped 10% to 514k. Goodwill decreased in the Midwest (-33.8% to 139 thousand), in the South (-18.7% to 710 thousand) and in the West (-2.7% to 367 thousand), but increased in the North- East (65.5% to 230 thousand). The June data was revised slightly upwards, with a rate of 1.599 million units compared to the previous 1.559 million units.

As you can see, we returned to the new level of 2019, prior to the flare-up linked to the FED rate reduction of that period. If the US central bank wanted to destroy the excessive US real estate boom, it has succeeded.

These are not the only negative figures. As Wolfstreet points out, the Census Bureau reported that sales of new single-family homes plummeted 17% from a year ago and are just above the all-time low of April 2020. The National Association of Homebuilders reported that its index foot traffic from potential new home buyers plummeted in June and has now dropped to levels not seen since 2014, except during the March and April lockouts. Traffic is an indication of buyers' interest, and buyers have lost interest, at least at these prices.

Builders reacted by cutting prices: 13% of home builders cut home prices in June to boost sales "and / or limit cancellations," according to the National Association of Homebuilders. of new homes plummeted 12% in the two months of May and June as builders are trying to sell off the accumulating inventory. but this is not necessarily enough.

The fall in the real estate sector will lead to a decline in economic activity, but also to a reduction in inflationary pressure. The bet is that employment falls less than the decline in inflation. If this were not the case, it would be a sign that the economic policy of the Fed and the government have failed in their objective.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article USA: the collapse of the market is now evident comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/usa-il-crollo-del-mercato-e-ormai-evidente/ on Wed, 17 Aug 2022 06:00:56 +0000.