Warren Buffet invests in Liquefied Natural Gas and its infrastructure

Berkshire Hathaway Energy has agreed to buy a 50% stake in the Cove Point liquefied natural gas plant for $3.3 billion in cash.

Warren Buffett's large energy and utilities division bought the stake from Dominion Energy

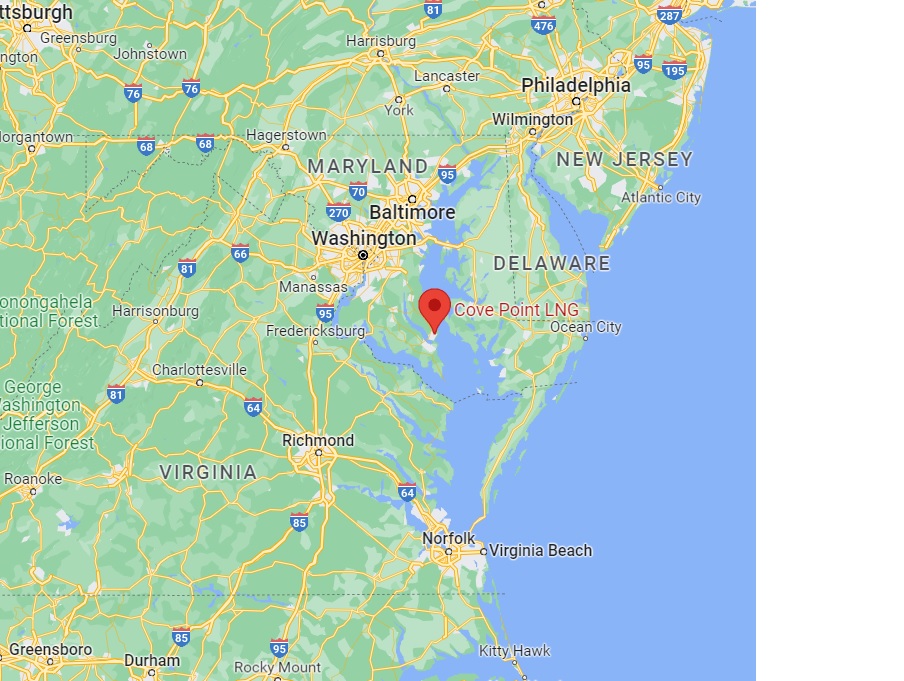

and will now own a 75% limited partnership interest in Cove Point LNG located in Lusby, Maryland. A subsidiary of Brookfield Infrastructure Partners owns the remaining 25%.

While the deal, announced Monday, isn't a large one for Berkshire, it builds on a growing bet on the conglomerate's energy infrastructure as it gains control of one of the few functional facilities in the United States capable of exporting LNG.

“It is based on the long-term theme of energy resources becoming more valuable and ownership by one of the few U.S. LNG exporters,” said Bill Stone, chief investment officer at Glenview Trust and a Berkshire shareholder.

The Cove Point LNG Terminal has a storage capacity of 413 million cubic meters and a daily shipping capacity of 50 million cubic metres. The firm has a long-term contract with Sumitomo Corp., a Japanese trading company in which Buffett is also invested. This shows a strong trend towards vertical integration of Warren Buffett, a very classic strategy for the US.

Berkshire Hathaway first bought a stake in Dominion's pipeline and storage assets for $4 billion in 2020. Greg Abel, president and former CEO of Berkshire Hathaway Energy, previously told CNBC that the deal in 2020 it ended thanks to a strong relationship he had with former Dominion CEO Tom Farrell.

Abel is now the vice president of non-insurance operations at Berkshire Hathaway and the successor to the 92-year-old "Oracle of Omaha." Buffett said Abel has assumed many of the conglomerate's responsibilities.

In 2022, Berkshire has proposed spending nearly $4 billion to help generate more wind and solar energy in Iowa. At the same time, the conglomerate has significantly increased its exposure to two traditional energy companies: Occidental Petroleum and Chevron.

“Buffett has liked pipelines for a long time, given their toll bridge-type revenues rather than sheer commodity exposure, and this is probably similar,” Stone said. “Natural gas prices are down a ton, but I think most of these exporters are working on long-term take or pay contracts.”

So Warren continues to dive into the energy. An attitude that, at least so far, has allowed him excellent economic results.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Warren Buffett invests in Liquefied Natural Gas and its infrastructure comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/warren-buffet-investe-nel-gas-naturale-liquefatto-e-nelle-sue-infrastrutture/ on Tue, 11 Jul 2023 19:51:31 +0000.