We are approaching the “Minsky Moment”. Which market will jump first?

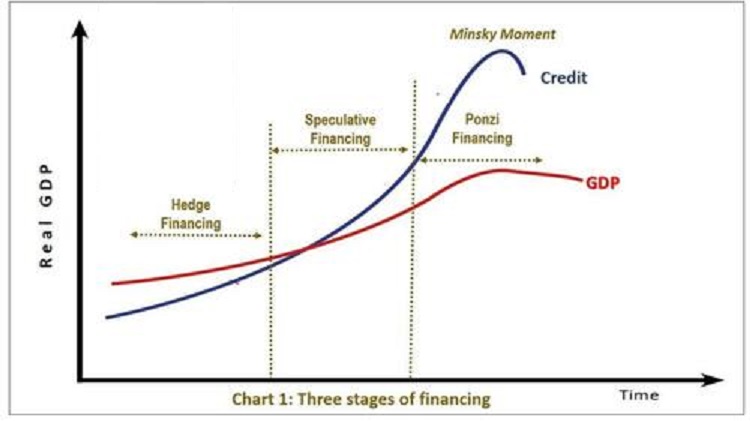

What is a “Minsky Moment”, the Minsky Moment? Minsky Moment refers to the onset of a market crash caused by reckless speculative activity which defines an unsustainable bull period. This is the "Redde rationame" when the crash begins, driven by speculative credit that has over-expanded relative to GDP and eventually implodes on itself.

Minsky Moment crises generally occur because investors, engaged in overly aggressive speculation, take on additional credit risk during bull markets.

Minsky Moment defines the tipping point at which speculative activity reaches an unsustainable extreme, leading to rapid price deflation and an unpreventable market collapse.

A Minsky Moment is based on the idea that periods of bullish speculation, if they last long enough, will eventually lead to crisis, and the longer the speculation goes on, the more severe the crisis, because the more speculation and exposure implemented by market operators. The term was invented for the financial collapse of Russia in 1998, but also applied to eastern markets and to the greatest "Minsky moment" in history, 2007 in the US housing market.

Have we arrived at our “Minsky Moment”? Let's think for a moment:

- Recent PMI and GDP data from China show that manufacturing remains under pressure and that the positive momentum associated with the end of the Covid-19 period and lockdowns is wearing off . Rabobank China expert Teeuwe Mevissen was clear and expects any stimulus effort to be much more modest than we have seen in the past, due to China's problems with a high local government-level debt load and a simmering real estate crisis that Xi Xinping has repeatedly failed to avert via a tightening of bank lending. It is expected that we could have aid aimed at certain sectors, but nothing in rain. Those who expect Xi Jinping to take the chestnuts out of the fire for everyone with a hyper-expansive policy risk disappointment.

- Commercial real estate valuations in the West face daunting challenges amid ever-higher interest rates, a creeping economic crisis, and declining disposable income for households. Gillian Tett notes in the Financial Times that $270 billion of commercial real estate debt is expected to be refinanced this year and up to $1.5 trillion over the next three years. Declining valuations were driven by lower demand for office space, which could mean commercial real estate has moved away from Minsky's definition of speculative financing (where cash flows on the asset are sufficient to satisfy financial liabilities, but not sufficient to repay the principal) to Ponzi financing, whereby the cash flows on the asset are no longer sufficient to repay the principal or interest charged at prevailing market rates, but only serve to buy time and delude the banking system . One foretaste came with the failure of US regional banks.

- The problems in the housing market appear particularly acute in the UK, where there is a growing chorus of requests for government assistance in paying off mortgages, now intolerable due to the combination of high interest, callable interest contracts and rising interest rates. Naturally, the very idea of "mortgage relief" is completely contrary to the policy prescriptions of the Bank of England which, however, has to choose between the ruin of families and businesses and inflation. So far we have tried to kick the can by extending the term of the mortgage, but when the life of the mortgage exceeds the life of the debtor, what's the point of all this? It would have been better to avoid excessive real estate values, but it's late now and Minsky is on his way. RightMove's latest real estate report shows prices down 0.2% in nominal terms in one month, while zero was expected, meaning the negative value point is getting closer and closer

The real estate markets are at this point in the hands of central banks which we can divide into three categories:

- those that place monetary stability in the background with respect to the well-being of citizens and economic growth, such as the RBNZ, the RBA (and in Australia there is not really the objective of financial stability, but that of the generic protection of citizens' assets ), the BoJ and the PBOC;

- those, like the ECB, which are ready to sacrifice firstborns for price stability, and which are doing so, given the European demographic crisis;

- those like FED and BoE which for now appear tough, except change their minds at breakneck speed as soon as the market shows a sticker of Mr. Minsky, even if by then it will be too late.

Happy Minsky moment everyone, also because this will vary from country to country.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article We are approaching the “Minsky Moment”. Which market will jump first? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/stiamo-avvicinandoci-al-momento-minsky-quale-mercato-saltera-per-primo/ on Tue, 18 Jul 2023 07:00:53 +0000.