What happened to the famous Austrian centennial title?

In 2017, to enjoy extremely low interest rates, Austria issued a 100-year bond, maturing in 2117, which had a fixed yield of 2.1% – at that time it was a very high interest rate, and, with permanent negative ECB rates and near zero inflation, the stock's value has skyrocketed. Recall that even the Italian ten-year bonds yielded less than 2%, the Bunds even reached a negative yield in 2019. The centennial, despite its particular characteristics, had a boom in its value.

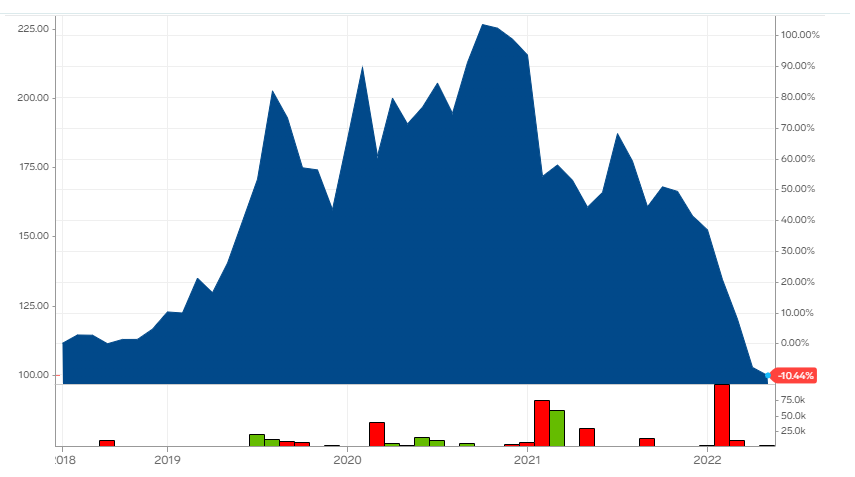

But things change, and so have the returns on the market. What happened to the famous Austrian centennial title? We see it in the following graph:

The starting value 100 to 100 is back, but after having reached a maximum in 2021, not long ago, a monstre value of 225 !!! Practically in one year the price has more than halved.

In 2021, for a period, the BTP yielded less than 0.5%. In the same period we were in the midst of negative rates and the PEPP, the European QE created to counter the COVID crisis. Inflation was minimal. Inflation in the euro area is now 7.5%, the PEPP is over, the other expansion programs will also close soon, while interest rates are likely to increase in July also in the euro area. At this point, in less than a year, everything seems to have changed and what was inflated with QE and negative rates is deflating very quickly. Too bad that among what is emerging from the boom there are also many of our investments and many pension funds …

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article What happened to the famous Austrian centennial title? comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/che-e-successo-al-famoso-titolo-centennale-austriaco/ on Thu, 12 May 2022 07:00:25 +0000.