Where does the GDP boom the newspapers talk about?

GDP is booming in the newspapers, but who is telling the truth between the increase in fixed costs and the bottles of champagne uncorked in the media? Maybe both, but "the information" hides something from us.

Perhaps we have all been infected by this great euphoria of the Italian GDP boom which, depending on the newspaper, jump from + 6% to (hear, hear) + 17%.

So how can you not get infected by optimism?

First of all, the fact that the estimates go from a tot to triple, should make us doubt that they are making fun of us.

But then no one – and I repeat, no one – explains to us that these estimates are linked to short periods of surveys and, above all, no one points out that compared to -9% of a whole year, they are a rebound.

But apart from all these speeches, the gist is another, that is: these data, as well as being shot as headlines, what are they hiding?

Are these data positive or should we be careful?

In newspapers, GDP is booming year on year and we are all happy

Real data and official GDP forecasts

The data inform us that the GDP loss in 2020 was 9% .

The most updated forecasts for the end of 2021 speak of a 5.9% rebound. Source OECD .

How do you calculate the recovery compared to 2019?

What everyone tends to forget, especially those who want to paint a more rosy situation than the real one, is that the accounts should be done with the latest pre-covid data and not with last year, when the economy was stuck on the ground.

So, to simplify, done 100 in 2019, the calculation to do should be:

So compared to the end of 2019 it is expected that Italy will record a net loss of 4.54% in two years.

It's a lot? Is it little? To establish this, let's compare it with the other G7 states:

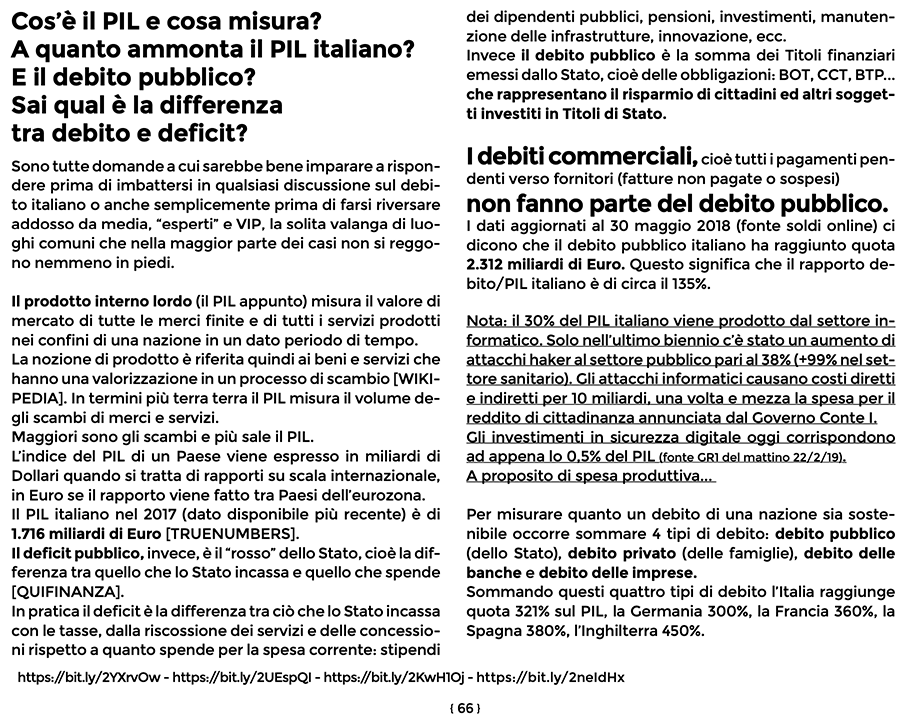

What is GDP

From the book of Economia Spiegata Facile : "the gross domestic product (GDP in fact) measures the market value of all finished goods and all services produced within the borders of a nation in a given period of time".

What is inflation

In this blog and on our YouTube channel over and over we have talked about inflation based on elementary and basic notions.

The main one is the following:

"Inflation means a generalized increase in prices"

"By deflation we mean a generalized decrease in prices"

Each time I have warned you against always treating inflation as a bad thing and deflation as a godsend.

This is because if deflation is linked to falling wages and rising unemployment, there is little to be happy about.

Conversely, moderate inflation is a good sign when the increases are generalized, that is, they affect all or almost all sectors in all their supply chains.

In such a case, rising inflation is a positive sign. It means that the economy is healthy, because if the economy is good, more workers are hired, wages go up; it is true that prices will also increase – because there will be greater circulation of money – but all this will benefit the community.

Again from the book of Economia Spiegata Facile, here is explained the trap of deflation:

“Now, this sounds like a nice thing: prices go down, money is“ worth more ”.

Well that's not quite the case and to understand why you need to know where inflation comes from.

Moderate inflation is a sign of a buoyant economy, while deflation is a sign of stagnation.

We see the drop in prices, linked to deflation, in daily life when the shops are empty and the shelves remain full, because consumers have no money to spend ”.

Among the main effects of deflation we point out the search to reduce production costs. This has a ripple effect and can reflect on the quality of the products, in the cut in investments in research and development, up to the cutting of wages, precariousness, unemployment and the closure of companies or their relocation to countries where the production costs less.

To make these basic concepts clearer, we made a lot of doodles, graphics and cartoons using trees and apples as examples; the game of monopoly and the unexpected cards.

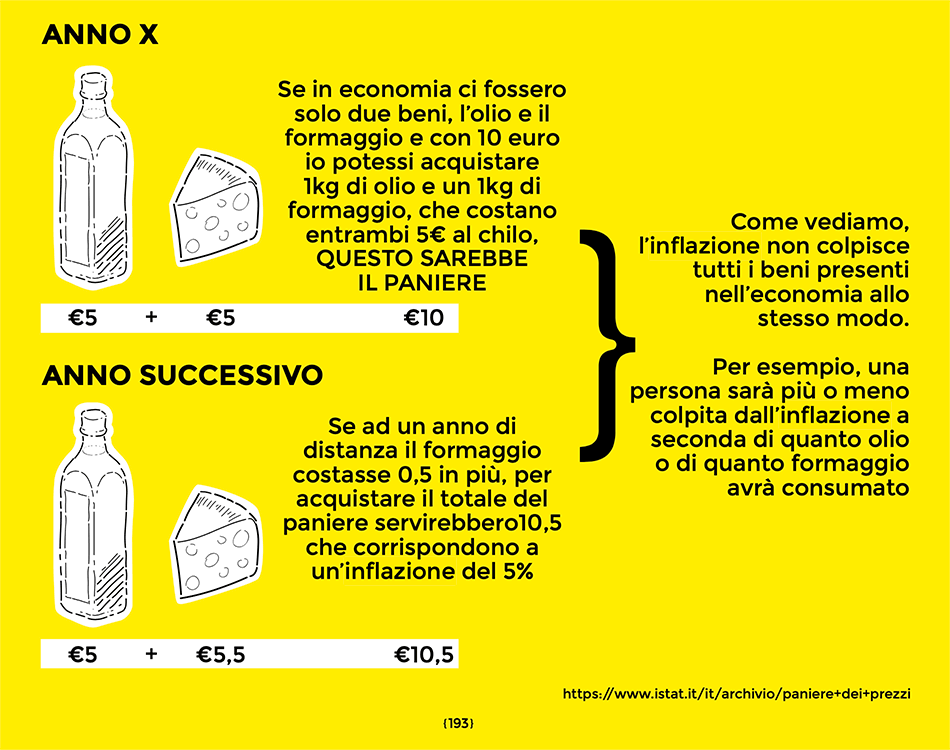

The ISTAT basket to control inflation

With this scheme that I wanted to introduce in the book of Easy Explained Economics I tried to better explain inflation by simplifying the functioning of the so-called ISTAT basket through which statisticians inform us if inflation has increased or not:

Whether one or more products increase in price can depend on a number of factors, which is not the purpose of this article to describe.

Some may be cost increases including wage increases or new hires in a particular department or cost increases out of pocket.

Another factor may be that production has suffered declines due to an unfavorable season from a climatic point of view, which has reduced the production of olive oil or a disease that has decimated the cows destined for the production of the milk with which it is made cheese, etc.

So, if this principle has been well understood then it will not be difficult for anyone to understand what is happening in this period and we will go to see together in the 6 key points that follow.

YOU WANT TO BE AUTONOMOUS IN UNDERSTANDING THESE TOPICS

BUT YOU DON'T KNOW HOW TO DO IT?

TODAY IT'S SIMPLE AND CHEAP, CLICK ON THE BUTTON AT THE BOTTOM …

I WILL EXPLAIN IT EASILY

![]()

WITH SECURE AND ENCRYPTED PAYMENT

Covid-19 has brought about a paradigm shift, indeed not

Another thing that perhaps this blog wrote first of all is that the Chinese virus would not have changed the paradigm (if not in our heads) but would have accelerated the tilting process of the plan that globalization and the euro had begun to tilt in an already irreversible way.

But what happens if wages remain steady and the increases concern the tariffs of commercial transport with peaks of 600% in the nautical sector; whether the leading technology producer has taken over the monopoly and thus affects world markets; or if there are increased fixed costs in the bill?

source: shipping courier

1) The rise in commodity prices is "helping" the boom in GDP

According to the ISPI Institute, the increases in raw materials globally are 40% compared to the pre-pandemic .

Now it goes without saying that if inflation is a sign of a recovery in consumption, of new mass hires and the circulation of new money in the economy, the result we will get is a boom in GDP in favor of all.

But if the so-called GDP boom is linked only to the increase in the costs of services due to trade wars and taxes, it means that few are making money and all others are losing.

Let's see some other examples of increased costs and added taxes …

2) The geopolitical war of the sea straits

A component that became essential in the new cost increase occurred starting from the now famous blockade of the Suez Canal.

Following this incident. .. international … there was a race for alternative roads which thus produced a globalized increase in tolls.

3) Containers: the increase in prices and rentals contributes to the increase in GDP

On average, the price of the container, including the various related services, grew by 300%.

… And so on…

Linked to the increase in transport are the problems of imports from China that some define as blackmail …

There is not only a crisis in the semiconductor market: the entire logistics by sea has suffered a surge in costs since the blockade of the Suez Canal. Transport prices have increased tenfold, and many goods made by Western companies are blocked.

After all, we had already talked about the increase in the prices of made in China in the previous article: China, this is how it took the lead in the world in 9 moves.

Some of the most attentive readers will have to rub their hands: if it is no longer convenient to produce in China, finally the companies that have relocated will return to produce in Italy.

Yes, it's easy to say.

But the problem is that by now with the salaries that are found today, Italians could buy very few of the Made in Italy goods.

4) The increase in the prices of green semiconductors and semi-finished products made in China

We have already talked about this in the previous article and therefore we will not repeat it. But if on the one hand China (and Taiwan, monopolist of the semiconductor sector) increases prices, on the other the EU has decided to tie hands and feet to this fate. Congratulations ( read ).

"… starting from the second quarter of 2021, several chipmakers have applied increases in the price of semiconductors that vary from 10 to 30% more than those of Q1 2021."

" Over 30 companies specialized in the production of semiconductors , which would have increased the prices of their products to the extent indicated above, however it seems that some specific categories of integrated circuits have seen their price skyrocket, with quantifiable increases on the order of dozens of times. "

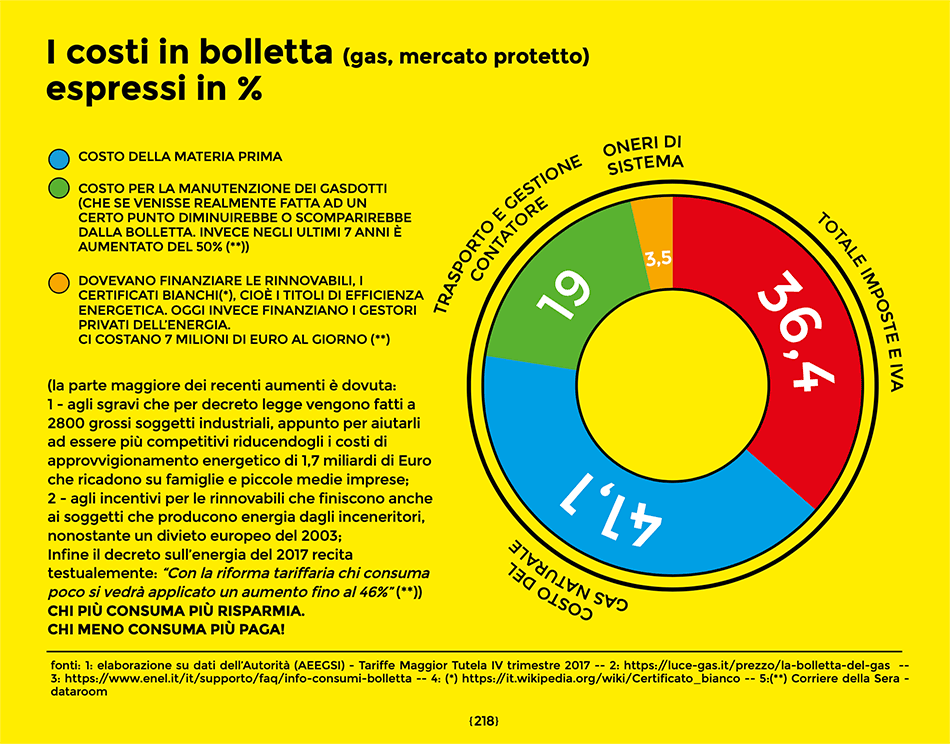

5) Even the stings in the bill make the GDP boom …

So I'm GDP going up; does he deserve to uncork a bottle or should he advise us to save that two bucks for what's to come?

In other words, what is the rising GDP made up of? From the well-being of the citizens who return to spend or from the poor citizens who are increasingly squeezed to make the accounts go back to the state (and to whom has the best cards in hand at the monopoly table)?

Even the stings in the bill increase the GDP …

And this, my gentlemen, is called hidden inflation, as we defined it in the book of Easy Explained Economics.

Do you want more examples?

The 350 euros to upgrade the coffers of each shopkeeper in order to go against the

ticket lottery flop helped bring about the GDP boom

Try to do a survey among the shopkeepers around you.

Just go sample. Give it a try.

I did it …

Even a small sandwich shop with a few dozen receipts a day had to pay 350 euros to comply.

When asked: "How many have asked you to do the lottery?" the answer was: “very few; almost no one".

And in the meantime, instead of encouraging work, the state has encouraged everything else …

6) the 110% super bonus

Do we have virtuous examples?

Fortunately, yes. If the Conte bis government has done a good thing, it is the super bonus of 110% for the renovation of old buildings.

It is bearing fruit the moment it is in operation.

The construction industry hadn't seen so much work in years.

In short, when incentives are given to create jobs rather than to enrich foreign factories, the multiplier effect bears fruit.

The Keynesian multiplier is explained in great detail in our book. For those who do not have time to go into details, here is a hint from L'Economia Spiegata Facile :

UNDERSTANDING THE ECONOMY HAS NEVER BEEN SO EASY …

![]()

WITH SECURE AND ENCRYPTED PAYMENT

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Where does the GDP boom the newspapers talk about? comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/da-cosa-deriva-il-boom-del-pil-di-cui-parlano-i-giornali/ on Thu, 09 Sep 2021 07:00:51 +0000.