Who is guilty of the speculative attacks against Italy? The ECB with the ICC

Last week the Financial Times sent us the usual pre-electoral horsehead: attention, international speculation has already loaded the weapons to attack the Italian public debt by betting on a decrease in the price of the BTP and on an increase in yields. An attack that would see 39 billion euros mobilized, probably through short selling, which would be the highest figure since 2008 against our debt

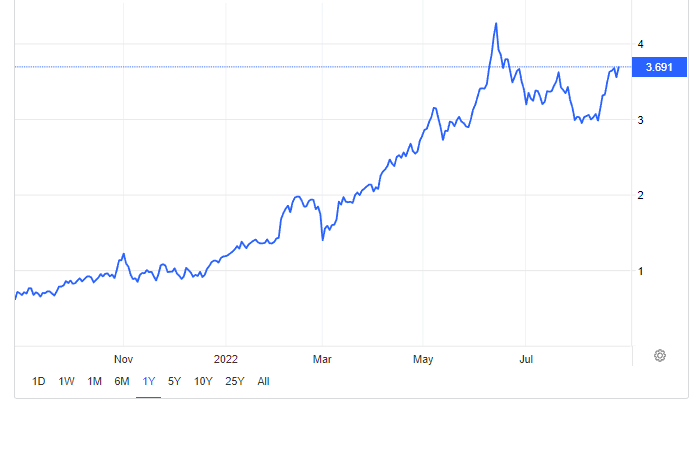

What are the causes of this attack? We have the superficial explanations of the politicians: Italy, after Germany, was the country most dependent on Russian gas, then there are the elections and the end of Mario Draghi's mandate (not that he did anything in particular) and the probable victory of the center-right, with a less servile position towards Germany and Brussels. Speculation could also have an easy game, given that, with the restrictive policy of the ECB, the yields of 10-year BTPs have already grown considerably, as can be seen from the following chart:

But the real cause of this speculation is not the economic conditions, common to most of the countries of the Western bloc. The real cause that favors these speculative positions is the uncertain attitude of the ECB and the ambiguities inherent in the new instrument for stabilization of securities, the TPI.

Speculation has attacked, and by other means, Japan, trying to bring down the ten-year title of that country. We have dealt with the matter in several articles , recalling how, in the defense of the government bond, the Bank of Japan has come to own 50% of the national ten-year debt , but the bond yield did not exceed the 0.25% target. highest place of the BoJ, for which speculation has failed:

Speculation has failed because no speculation can win against a central bank in its own currency. Among other things, Japan controls its inflation with much better economic and industrial policies than the ECB and the EU know how to do.

Speculation can win against Italian debt only because it is not clear what the ECB will do and if its mandate is to defend bonds without limits and, above all, without any political preference. Because the ECB is not independent, on the contrary it has already shown in the past (see Italy 2011 and Greece cases) its strong political inclination. Faced with a Central Bank that may not intervene, and an instrument against the "Splitting" the ICC, which has many contraindications, such as the supervision of the ESM, speculators have an easy game against the Italian debt, contrary to what happened with the much more indebted Japan.

The cure? A different governance of the ECB or a different central bank. There is no other tool that can work.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Who is guilty of the speculative attacks against Italy? The ECB with the ICC comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/chi-e-colpevole-degli-attacchi-speculativi-contro-litalia-la-bce-con-il-tpi/ on Sat, 27 Aug 2022 10:01:52 +0000.