WHY DOES THE PRESIDENT THREATEN SAVINGS? ARE WE AT THE BALANCE SHEET?

Yesterday was Savings Day. A day in which once, before the euro, some qualities of Italians were celebrated that now seem of other times, such as the ability to work, to invest and to be voluntarily austere in order to achieve their personal and family results. Then it was all swept away by the euro, finance, taxes and imposed austerity.

Yesterday, however, we had the impression of having officially passed from the celebration of savings to the celebration of its destruction. I was truly speechless in front of the words of the President of the Republic, which we report as reported by ANSA:

“ This Day is held during a deep crisis, which requires urgent measures to safeguard the present and, above all, the future of our society. Savings, traditional patrimony of our country – whose protection is enshrined in the Constitution – can contribute to the restart " .

“ The serious economic situation and the concerns about the spread of infections – says the Head of State – have led to a significant increase in the savings rate of families and businesses. These resources, if properly used, can help support a rapid recovery in consumption and investment once the pandemic has been tamed and uncertainty about future prospects has been reduced. It is essential to create the conditions to restore a climate of trust “.

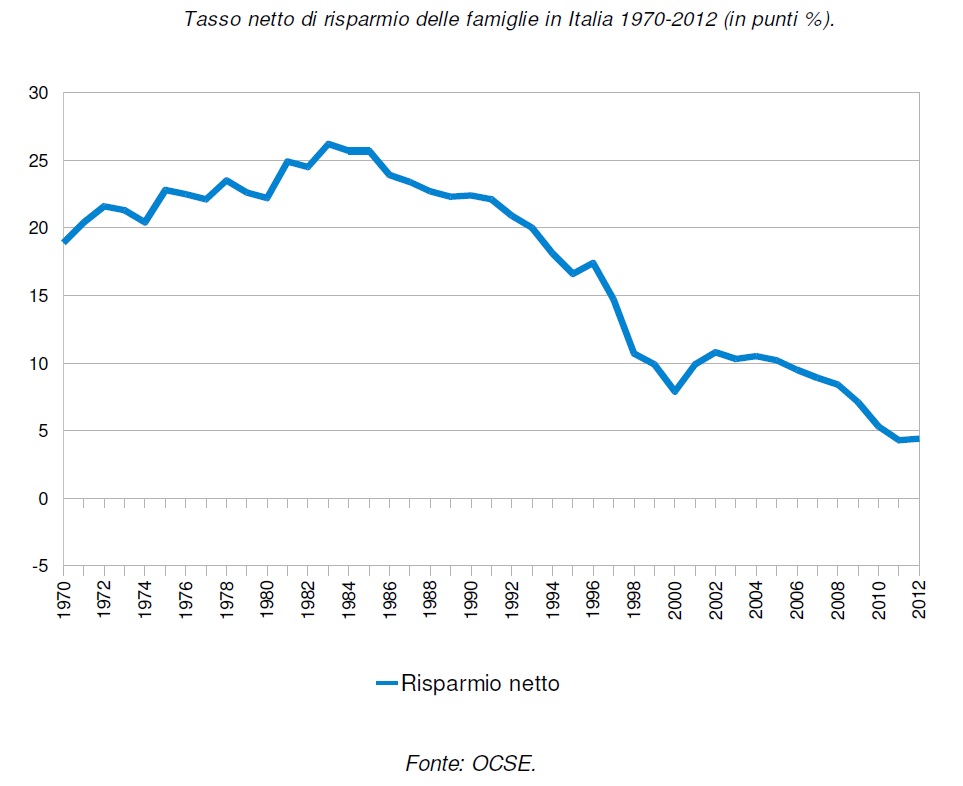

There is no doubt that saving is, at this stage, a negative element, because it leads to a further contraction of consumption and investments. But to be able to create savings you need to have an income, and an “Available” income, that is, not canceled by direct and indirect taxes. It is no coincidence that, during the 1980s, when the tax burden was at least ten points lower, especially on small businesses, savings were much higher:

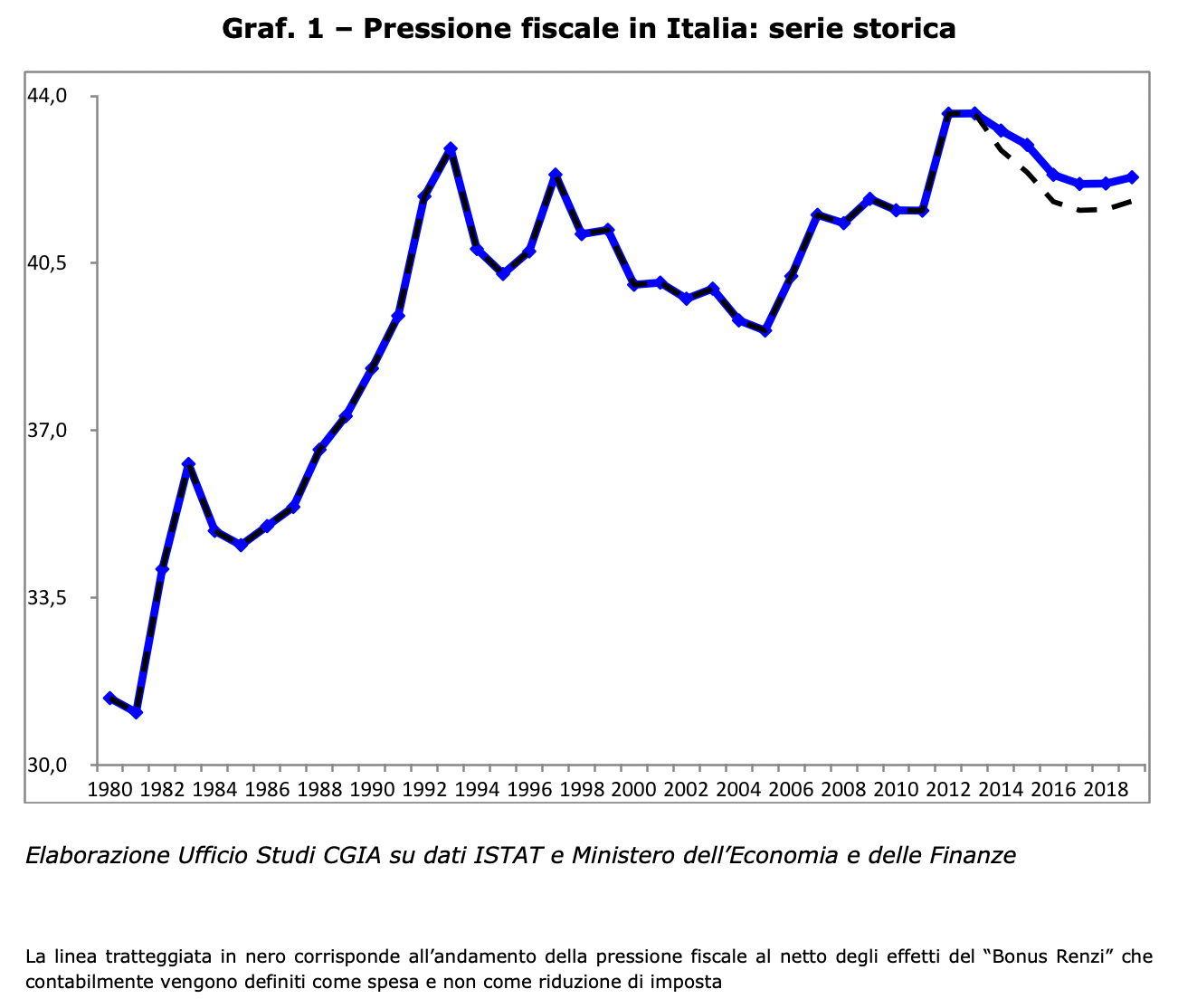

here the tax burden (but remember that it is an average value and does not reflect the pressure on small businesses and VAT numbers ..)

If the money goes into taxes, which then go to pay foreign investors in our debt (see primary surpluses), it cannot go into savings….

Having made this premise, what the President means in his hint in which he says: " Savings ……… .. can contribute to the restart "?

How can the savings, obviously already accumulated, help the recovery?

- voluntarily, because savers-citizens find it convenient to invest, because the rates of return on investments are positive and sufficiently certain over time, or because consumption is particularly attractive. This would be the "Good" way, the one in which the tax system is reformed so as not to weigh excessively on the income from work and investment, for which it is the opposite of the patrimonial …), or economic incentives are offered such as to make particularly convenient consumption;

- voluntarily, but because the holding of savings has a zero or negative return, both as a form of liquidity and as a risk-free investment. This is the path chosen by the ECB: if savings are self-destructing, it is better to spend it voluntarily, even if the investment or consumption alternatives are not very attractive in terms of return and risk;

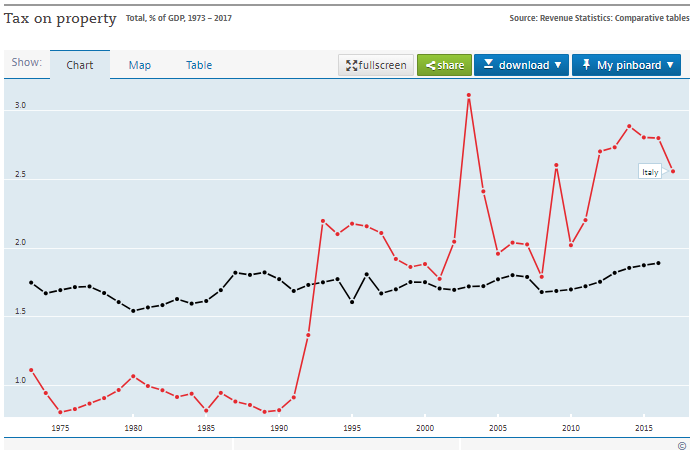

- involuntarily and coercively, with forms of direct and brutal taxation of assets (forced withdrawal on current accounts) or more subtle and hidden behind false social purposes (IMU; Bills tax, taxes on securities and real estate transactions, etc.) . Because property taxes, in spite of the Constitution that would prohibit them, already exist, and weigh significantly on wealth, as can be seen in the graph below:

The graph shows the tax burden on property as a percentage of GDP, with the Italian case in red and the OECD average in black. In spite of what the Commission says, our tax burden on property has been above the OECD average, and for some time.

Now if the President desires a mobilization of savings according to point 1) then his measure is deserving, but on the one hand it requires a commitment by the government in a profound reform of the serious tax system, which translates into a reduction in the tax burden on labor. and investment 8 therefore also assets …), but of which there is frankly no trace. moreover, such a move would require a Keynesian flexibility in the management of the economy that would certainly put us in contrast with the various limits of Europeans, now obsolete, unsuitable, old, but almost fetishistic objects of worship. If the President who rejected Paolo Savona, the MEF were able to make such an evolution, it would give a sign of intelligence and flexibility. If, on the other hand, the idea is that of point 3) that the President takes direct responsibility, in front of the Italians, to indicate a mass Patrimonial Tax, which would be far less destructive and distorting than the various succession tax – IMU prima casa – Transactions financial issues that we are now talking about. Take direct political responsibility for this choice and its dire consequences. Because an increase in the IMU would not mobilize savings, but would simply destroy it, causing property values to fall. In the same way, the other forms of patrimonial taxation would have no other effect than to decrease the value of the related investment assets, thus destroying the accumulated savings. If this is Mattarella's choice, please say it clearly, together with your pupil Conte, and take full responsibility for it.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article WHY DOES THE PRESIDENT THREATEN SAVINGS? ARE WE AT THE BALANCE SHEET? comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/perche-il-presidente-minaccia-il-risparmio-siamo-alla-patrimoniale/ on Sat, 31 Oct 2020 09:42:45 +0000.