Why is the public debt that exploded in the 1970s unstoppable today?

After years of terrorism, the public debt, as if by a miracle, with the covid emergency has ceased to be a taboo.

Until a year ago it was considered as absolute evil. A balanced budget, on the other hand, was considered the solution. But the ugly and bad curb on public spending turned out to be a boomerang, as we lost public health with the cuts.

Public debt, what they told us before was impossible

today it is considered necessary

We have often wondered why the public debt was not considered only an accounting factor necessary to make the economy work, even when instead of scarcity of beds in the recovery rooms or stocks of medicines and (real) experts capable of identifying the treatments more suited to the emergency, which had been trained by avant-garde universities, we saw wage deflation galloping, unemployment reaching unsustainable thresholds and the hydrogeological emergency and the weakness of road infrastructures claiming victims.

On the causes of public debt; that boulder that they told us would have crushed future generations (without taking any interest in current generations, crushed by the weight of scarcity), everything has been said.

The book of easy explained economics has revealed its many facets and has identified all the real perpetrators.

Despite this, in the collective imagination the culprits continue to be politicians of this and that party, of this or that Republic, but hardly anyone knows the real reasons.

On both sides of the fans, we do not make distinctions.

To the mythological causes such as that of waste (certainly true at least to a small extent), waved by the penalty takers, is added the science fiction one: because we have lived beyond our means.

Leaving aside the latter for obvious reasons of intellectual decency, there are those that are heralded from the opposite curve.

The debt caused by Mario Draghi's derivatives

One of these refers to the derivatives of which Mario Draghi is among those responsible .

What are derivatives?

Explained in the most understandable way, derivatives are bets that are based on the possibility that certain events may or may not take place.

In the 90s, when Mario Draghi was at the treasury ministry, Italy took out numerous derivatives on its debt. THE

data available to us indicate that up to 2015 Italy was exposed in derivatives on government securities for 163 billion.

Draghi's bet was that with Italy's entry into the euro we would have experienced an increase in inflation.

Since the exact opposite happened, Italy found itself having to pay… its gambling debt with the markets against which it had lost its bet.

To better understand how the mechanism works, let's look at this page taken from the easy explained economics book:

On those 163 billion in derivatives purchased by the state, the losses were 37 billion. About the amount of the MES without having to repay a cent of interest and with the possibility of spending it as we like.

Does public debt have anything to do with the transfer of monetary sovereignty?

The sovereign theory according to which every Italian economic and financial problem is due to the sale of monetary sovereignty is such a redundant issue that it will have lost credibility, because it seems to have become the only excuse for all Italy's misfortunes.

Perhaps also for this reason the fans of liberalism manage to diminish its validity. However, we are sure that not even the most observant have grasped its importance well.

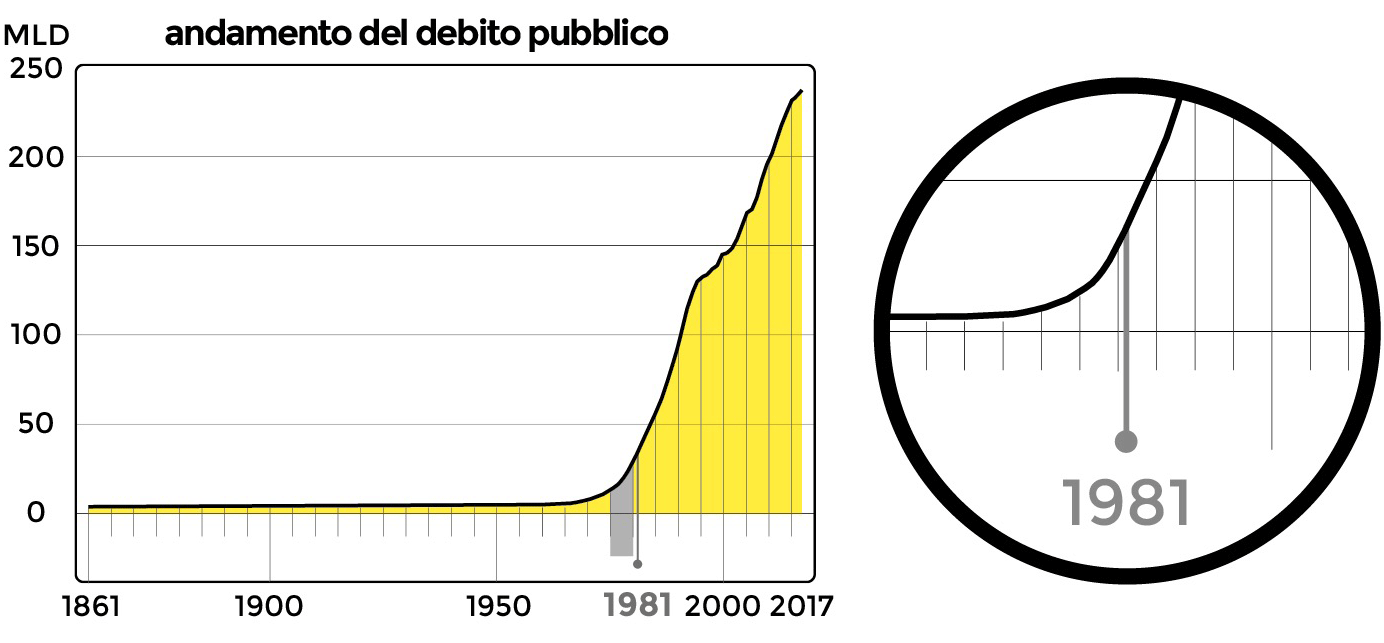

Among the main causes of public debt is the famous transfer of monetary sovereignty which took place with the decision to make the fateful "divorce" between the Treasury and the Bank of Italy at the end of 1981.

Even in the book of easy explained economics we explain in great detail who and why he decided to cede a large part of monetary sovereignty to the markets, returning to this point is necessary to also understand how this decision fits in with the historical events of the time and lay the foundations. for the current debt.

The vintage charts do not betray uncertainties, we know it very well, here is a representation taken from the book of economics explained easily :

Where does the problem of the explosion of public debt begin?

So far nothing so new, but a simple datum is not enough to give us all the answers.

Before issuing judgments it is necessary to understand why the debt curve, after the 1970s, continues to rise only in Italy, while in the rest of the world it will return to "normality".

In fact, there is a cause, which precedes and is linked to "divorce", of which there is rarely a trace in the reports and economic analyzes of today.

The spring that triggers the debt trap that in the following years will escape the control of economic ministries, economists and politicians is due to a strategic and forecasting error of the mid-late seventies political class.

Whether it was done in bad faith or not, out of myopia or to submit to obscure conspiratorial plots, it is not in the interest of the writer to do conspiracy or conspiracy. Everyone has his opinion.

What interests us is to report the facts, to relate them to subsequent events according to the principle of cause / effect, and to leave his opinions to the reader, as long as they are supported by objective elements.

What many cite is the infamous double-digit inflation that characterized the 1980s. As for the Germans it is the myth of Weimar, (see the sources at the end of the article) so it is for the Italians that period.

The only difference is that in the collective conviction, the "sin" of the surge in inflation is carried over to the next decade and often contributes to confusing Italians with the boom in public spending.

UNDERSTANDING THE ECONOMY IS YOUR INTEREST

AND TODAY IT'S EASIER THAN EVER

![]()

LOOK AT THE BOOK

The myth of foreign investment and the boom in inflation. Here is the first cause of the current Italian public debt.

In truth, the fuse of public debt and double-digit inflation is lit when the effects of the oil crisis of those years begin to subside in the rest of the world.

Inflation had in fact exploded all over the world due to the oil crisis. In October 1973, the Arab-Israeli war of Yom Kippur (6-25 October) led to the embargo decreed by OPEC.

This caused an obvious drop in supplies and a corresponding boom in prices for fuels for mobility, production and energy in general, as well as for raw materials related to oil.

Hence the explosion of prices, or inflation.

This is the year of the first Sundays on foot, designed not to raise public awareness on climate issues, but to sip national consumption.

But if at the end of the tensions in the rest of the world, inflation was appeased by the resumption of exports by OPEC, so it was not for Italy.

Why?

Because in conjunction with the high interest rates that coincided with inflation and vice versa.

When there is high inflation, it is worthwhile to go into debt, since since inflation "eats up" some of the value of the loan, those who get into debt have greater ease in repaying it.

Thus it was that the Italian Treasury in those years found it smart to attract foreign capital (mainly American) by offering high yields on public securities.

Italian BTPs were purchased in large quantities by American investment funds, which invested large shares of pension funds, knowing that, at the maturity of the bonds, the high yields would guarantee excellent earnings for investment funds and lavish checks for American retirees.

The surge in the public debt curve and how it has become unstoppable even today

In fact, as reported by the book of economics explained easily, the American pension funds absorbed our government bonds which yielded more than 7% adjusted for the inflation rate.

When they talk to you about attracting foreign investment, you imagine industrialists coming here to open factories, to build our future, but in reality they tell you about this stuff here.

Not only; since 1982, with the boom of interests (ie of rents) on securities, there has been a flight of capital from production towards speculation even by large Italian companies.

When the Italian state begins to finance itself on the capital market, the annuity boom occurs and the industrial system changes investment policies.

FIAT in 1986 made 55% of its profits by purchasing bonds. The Olivetti even 67%. It becomes common practice in the Italian industrial system to take large loans (from which interest was also deducted from taxes) to be used for the purchase of Italian securities instead of investing in companies.

The public debt, instead of being used to make investments in the country system, becomes a source of profit for its own sake.

The sale of monetary sovereignty shifted the axis on which the spending power of the state was based

With the transfer of monetary sovereignty to the markets and policies on government bonds, the debt curve takes precedence over Italian economic and industrial plans and escapes the control of public accounts.

And considering that this status will become the model of the following decades, the mercantilistic one in which the effects of globalization will be added to the dominance of finance, it is quite easy to understand how even the subsequent privatizations were useless in pursuing the announced objectives of fiscal consolidation.

Evidence that to some observers of the time had already seemed self-evident at the time.

In fact, this minority had predicted that with the divorce between the Bank of Italy and the Treasury, Italy would face deindustrialization.

The privatizations, which began with the banking sector and continued with the sale of the assets on which the preservation of Italy's competitiveness should have been based (Telecom and IRI just to name the main ones), turned out to be sales and a transfer of monopolies of Been in the hands of private monopolies.

That is why the arrest of the debt curve is unstoppable, whatever the miraculous recipe they announce to you.

Who has the power to determine who will have to repay the public debt?

Because power has passed from the hands of the state to those of private individuals who have the mission of making a profit, leaving it to the state to make ends meet.

The cuts to health care, which we all noticed with the Chinese virus, that is, when it was too late, should remind us of this every time the savior of the homeland appears with his magic wand on the threshold of the political landscape.

It seems clear that if on the one hand the public debt was not invented in order to be repaid, but to support both investments and to protect the weakest, on the other, austerity is certainly not the way to solve the problem.

Debt monetization, which we have described several times and which we have explained in great detail in our book, is now recognized by almost everyone as the only way out of this age-old dilemma: is public debt a good or a bad thing?

Are there answers to your debt questions?

In this article, we have summarized some lesser known, but essential to know, aspects of the public debt issue.

- Is it difficult to fully understand the phenomenon of public debt?

- When is public debt a problem and when is it not?

- Will Italy be able to repay the public debt?

- Is it necessary to do it?

- Is it true that the public debt is a burden that is placed on the new generations?

- Who owns the public debt?

Reading the easy explained economics book will give you all these and many other extremely simple and understandable answers to everyone.

INVEST IN YOURSELF AND YOUR FUTURE:

READ THE BOOK OF ECONOMICS EXPLAINED EASY

Comfortably in your home with SAFE PURCHASE

ORDER NOW!

ORDER NOW!

Sources:

The Weimar Republic did not fall due to inflation but due to the same austerity we suffer today .

The derivatives with which Mario Draghi has borrowed Italy .

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Why is the public debt that exploded in the 1970s unstoppable today? comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/perche-il-debito-pubblico-e-inarrestabile/ on Tue, 23 Mar 2021 08:30:53 +0000.