Will China have to use “Helicopter money” to boost the economy?

Even today bad news for the Chinese economy: after a brief rebound the price of real estate has started to fall again and this will lead to a further reduction in the overall wealth of the Chinese, as well as other problems for the already battered real estate sector

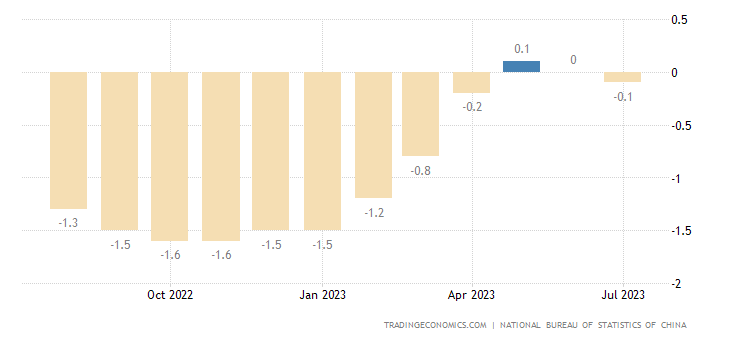

Average new home prices in China's 70 major cities fell 0.1% year on year in July 2023 after rising 0.1% in the previous month, indicating the fifth time of decline this year due to a prolonged real estate crisis and the stalling of the economic recovery. Among major Chinese cities, prices were lower in both Shenzhen (-2.8% vs -2.4%) and Guangzhou (-1.3% vs -0.8%). Conversely, prices continued to rise in Beijing (3.5% vs 3.5%), Chongqing (0.5% vs 0.6%), Shanghai (4.5% vs 4.8%) and Tianjin (0.5% vs 0.2%).

The situation is very complex

The situation is very complex and difficult to resolve. In the Chinese economic newspaper Economic Observer, close to the authorities, an extremely lucid piece of analysis of the situation has come out and presents an almost dead-end situation:

The dilemma

Despite the pressure on spending, the policy to raise tax revenues had yet to get underway; for example, there was still no news of when the long-delayed resource tax would be implemented.

On the contrary, the tax reduction measures had continued to enter into force. For example, the new corporate income tax law would actually result in a loss of about 90 billion yuan in revenue due to new pre-tax exemptions and other amendments.

In addition, the stamp duty cut that took effect in April would cause another 50 billion yuan in losses to the state coffers next year when calculated based on last year's trading volume.

In addition to all this, the central government had also lowered or revoked some taxes in the earthquake-affected areas, including value-added tax, personal income tax and sales tax.

Some industry associations said the government should consider giving more preferential tax policies to businesses currently under pressure from tight domestic credit scrutiny and slowing exports due to global economic uncertainties.

However, financial authorities also faced a dilemma, an official said: "Currently, we are facing severe spending pressure and are busy optimizing the financial budget." Another expert said: “More tax cuts? What if our tax revenues can't cover next year's expenses? “

China is therefore starting to see problems in applying its fiscal policies. Meanwhile half the economy is in crisis:

- Country Garden just defaulted;

- Zhongzhi Enterprise Group missed payments on high-yield investment products;

- recent bank lending data was dire;

- industrial production growing only 3.7% year-on-year (4.3% expected)

- retail sales grow only 2.5% year-on-year (up from 4.0%),

- Home Sales -8.5% YoY YTD (vs. -8.1%),

As Bloomberg writes (“ PBOC Adviser Says China Urgently Needs to Boost Consumption” ) Cai Fang, a member of the monetary policy committee of the PBoC, i.e. one of China's top central bankers, warned that the top priority for politicians is to stimulate consumption of families:

Cai added in the article published on Monday on a social media account of the China Finance 40 Forum, one of the nation's leading economic think tanks, that continuing unemployment in the wake of the pandemic is reducing household spending and consumer confidence it should weaken without new policies.

"The most urgent goal now is to stimulate household consumption, and all reasonable, legally compliant and cost-effective channels must be used to put money into the pockets of residents," said Cai, 66, one of the best-known economists in the China focus on demographics and labor economy.

Said by an important member of the PBoC, such a phrase has a clear meaning: "Helicopter money", i.e. direct financial transfers from the central bank to citizens, using some form of instrument (long-term loans, one-off contributions, etc.), to allow families to resume consumption and investment with confidence. Maybe it could be an opportunity to give a boost from the Digital Yuan, which hasn't had much success so far.

Obviously such a move could reignite inflation, but at this stage this appears to be the lesser evil for China. Growth and widespread well-being are much more important.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Will China have to use "Helicopter money" to boost the economy? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-cina-dovra-utilizzare-lhelicopter-money-per-rilanciare-leconomia/ on Wed, 16 Aug 2023 10:00:09 +0000.