Will the FED lower rates? The impact of the latest data on employment

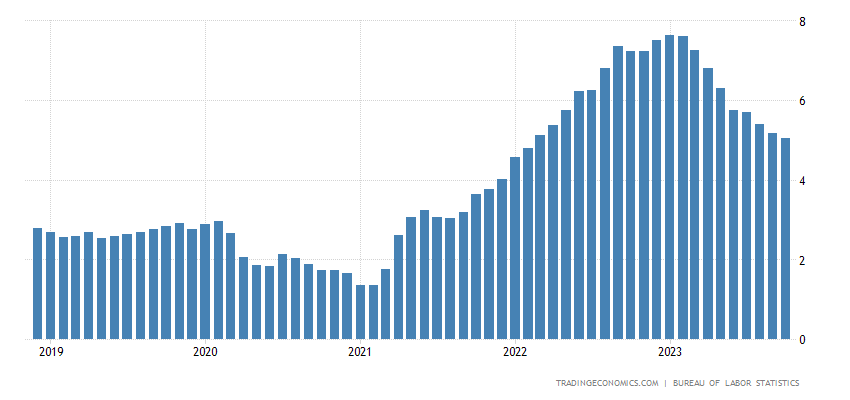

The question of the moment is: why should the Fed change course towards multiple rate cuts starting from the 1st quarter, with such a strong labor market, with reaccelerating wage growth and with inflation in services – where the two-thirds of consumer spending – at 4.6% according to the PCE price index (the personal consumption price index) and 5.5% according to the CPI?

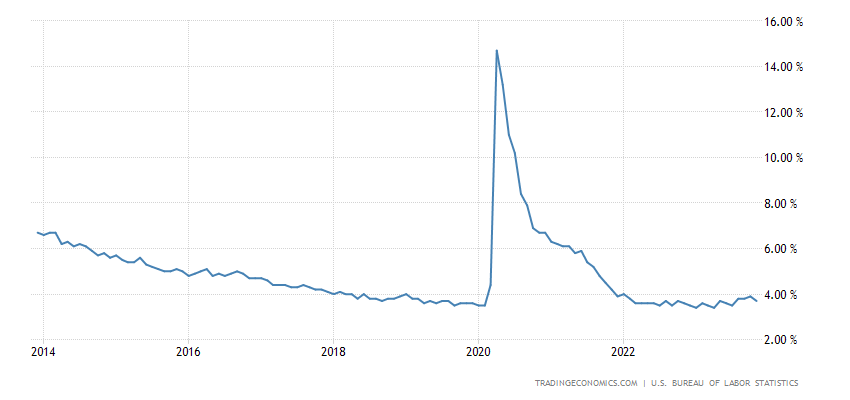

Inflation imported from energy and durable goods has fallen significantly, but these are external data, for which the FED should not even have intervened. The FED, on the other hand, should operate when the wage dynamics are too strong and high. Let's see how unemployment is moving in the United States:

The job market is strong: Companies added 199,000 workers to their payrolls in November, according to the survey conducted today by the Bureau of Labor Statistics.

Strikes in the manufacturing sector had caused a drop in employment by 35,000 units in October, but now many of these workers have returned to work, as we said a month ago, and also in this case. In November, therefore, employment in the manufacturing sector increased by 28,000 units.

US jobs data is the kind you'd expect from an economy that's doing well, growing at a solid pace as the woes of the pandemic settle.

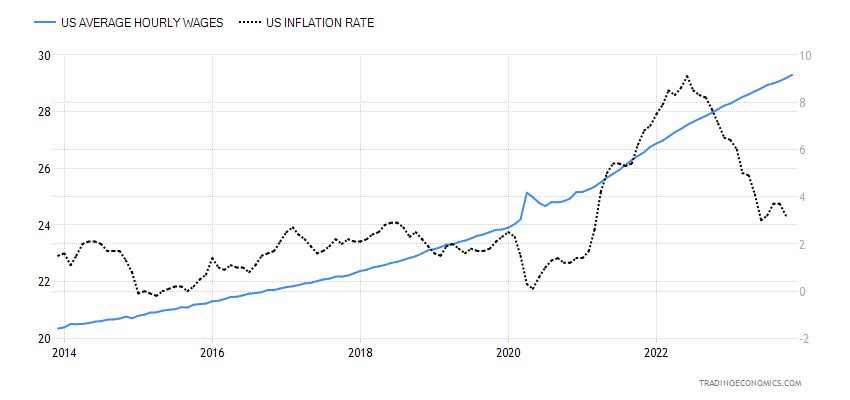

Indeed, there's even a problem: average hourly wages jumped, with growth accelerating for the third consecutive month, increasing in November at an annualized rate of 5.0%, at the high end of the range of the last 12 months.

Even more worrying is the trend in hourly wages in correlation with the inflation rate.

At this moment the trend in hourly wages has been such, in relation to inflation, that it does not justify a rate cut at this moment. Even if wages adjust to inflation with a temporal lag, this boost should be exhausted by now. The fact that they are growing continuously means that we are still faced with an economy that is still running too fast and risks maintaining an inflation rate that is still too high, as is happening in the services sector.

Therefore, in these conditions, the expectations of a reduction in interest rates by the FED risk being disappointed: why should the FED cut rates if the labor market is strong and internal inflation has not yet been completely eradicated ? Unfortunately, the ECB, which as always has confused ideas, risks following the FED's example, even if the situation in Europe is very different from that of the USA, and this would be a huge social and political problem.

Thanks to our Telegram channel you can stay updated on the publication of new Economic Scenarios articles.

The article Will the FED lower rates? The impact of the latest employment data comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-fed-abbassera-i-tassi-limpatto-degli-ultimi-dati-sulloccupazione/ on Mon, 11 Dec 2023 10:00:47 +0000.