Inflations

They say that history repeats itself, and to us who have seen and understood the euro tragedy it is physiological that its repetitions appear farce. Without prejudice to the right of those who were not there, and if they were there, were asleep, to attribute the noble rank of tragedy to a drama whose protagonists are virostars or similar scientists, it seems important to me that repetitions of the same narrative scheme (tragic or whether they are farcical, or whether you want to consider them) are correctly identified as such. The only vaccine against narratives is to recognize them. Only this can defuse its rhetorical, i.e. persuasive, potential and allow us to maintain, at the price of a minimal input of analogical reasoning, a decent emotional and mental balance, a minimal capacity for rational analysis of the facts and their interpretations.

To give a trivial example, in today's live broadcast:

I pointed out that in offering us the Euro "vaccine", the "virologists" of the time (Prodi & friends) neglected to draw our attention to the possible side effects of such a drug. Moreover, the same also happens in the proposal (or imposition) of the green "vaccine": it seems that lithium can be found at a low price on supermarket shelves, it seems that wind turbines at the end of their life can simply be folded up and put in your pocket, etc. The narratives wander in the enchanted land of free lunches , where everything is possible, and above all ghrhaduidamenhe is (remember anything?)!

But the world doesn't work like that.

The contraindications of the Euro "vaccine" arose, look at it, from the fact that it was proposed, that is, we can also say, surreptitiously imposed, on a very diverse group of patients: young patients, in the developmental age, and old, patients obese with debt or financially lean, more or less feverish patients of inflation, etc. In short, it is the famous theme of one-size-fits-all policies. Can a single interest (or exchange) rate be good for different economies or at different stages of their existence? Because even with the same age, weight and conformation, a convalescent is one thing and a patient in full health is another. The answer is obviously no, and science, which, despite the valid efforts of scientists, ultimately, in the long term, tends to annoyingly present itself as a formally correct and validated version of common sense, gave precisely this answer.

As in the case of other "vaccines", also in the case of the euro the side effects were not only there, but had also been correctly identified ab initio by science (which is not its whore cousin, i.e. Science, as I explained to you here when medicine didn't interest you, but she was already interested in you). Not only! They were also correctly specified in the "leaflets" of the institutions, which belong, like pharmaceutical companies, to the group of entities that cannot afford not to say the right thing while doing the wrong thing! Reputescion is everything, and since paper sings and villan sleeps (but it shouldn't!), here for example in 1999 mother BCE thoughtfully informed us of the fact that :

"Everything is going well, prices are converging, in any case it is going better than elsewhere, but if prices were to diverge then structural reforms would be necessary."

In short, what you know because we talked about it here from the beginning :

It is not public debt that makes structural reforms necessary, but the lack of competitiveness, i.e. the increase in the prices of national products, to respond to which it is necessary to cause unemployment, in order to crumble the bargaining power of workers, reduce their wages, and recover lost competitiveness in this dark forest. This was the unconfessed purpose of the labor market reform , which we described in 2012, and which today anyone can read in the data.

Read about the almost doubling of unemployment here :

while below you can see the consequences, i.e. the reversal of the inflation differential (with inflation becoming stronger in the North):

hence the appreciation of the North's real exchange rate (the price of Northern goods in terms of Southern goods):

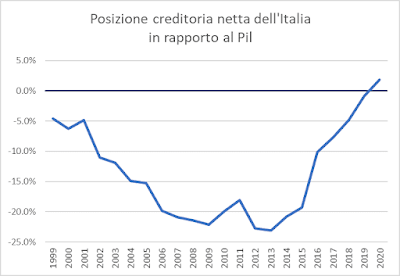

which corresponds to a recomposition of external imbalances (the balance of payments which becomes positive again in the South) and of the net foreign financial position, as we have seen here :

Put another way, the unpleasant side effect of the single currency was that it implies a single exchange rate (the one set by the ECB), but not a single inflation rate. There may be significant inflation differentials between the various countries, and these differentials can lead to imbalances which however must be cured with structural reforms (read: unemployment) because a single interest rate cannot be used to mitigate different inflation rates!

Is the point clear?

If Ruritania has inflation at 6% and Krakow at 1%, and the two countries are member states of a monetary union with an inflation target of 2%, there are two cases:

1) if Ruritania is in charge, the Single Central Bank will raise the interest rate until Ruritania inflation drops to 2%. In the meantime, in Krakow the high cost of money will cause a collapse in credit and therefore in investments (i.e. spending on machinery and equipment, which businesses normally finance with bank credit) and also in consumption spending (to the extent that families will no longer have money to spend after paying the mortgage). Moral of the story, in the end Ruritania will have prices under control and Krakow will be in recession.

2) if Cracozia is in charge, interest rates will be kept low, to revive the economy and the inflation process in Cracotia, and Ruritania will see its inflation rate rise further or at least not converge rapidly to 2%, but so by doing so it will lose competitiveness and will run a trade deficit with Krakow, accumulating foreign debt and opening the doors to a financial crisis.

As you know, we are Krakow, Germany is Ruritania, and Ruritania rules, which is why rates are high and we grow less than we could, having a trend inflation which is now below 1%.

Why has this phenomenon, which all textbooks describe, been little (or at least less) evident for so long?

Simply because in an environment where inflation was low on average, the differences between inflation rates were small on average . If we exclude the hypothesis of drastic deflations (i.e. negative and strong inflation rates in absolute value), then you immediately understand that we will have an average inflation of 2% in contexts in which individual rates range from 1% to 3%. (in spans). It is difficult to imagine a context in which an average of 2% results from rates ranging from -6% to 10%! Anything could be, but…

Conversely, when average inflation is around 10% (let's say), then it is easy for there to be high gaps, for this 10% to be the average between (let's say) 15% in one country and 5% in another. In short, without going into too technical things like this :

it is clear that some relationship exists between the level of inflation and its dispersion (uncertainty).

The periods of low inflation, which brought about so many evils, including the various ZIRPs , did however have one good thing, and that was to guarantee an overall sustainable dispersion between inflation rates, i.e. to mitigate the need for monetary policies, of interest rate levels, diversified by country.

But now things aren't exactly like that…

I show it to you (as promised) with a graph that depicts the average level and dispersion of inflation, the latter calculated with the simplest indicator, the range , i.e. the difference between the maximum and minimum inflation rates recorded in the MS (Member States) of the Eurozone:

It is clear that the situation through which we have recently passed and from which we have not yet completely emerged represented and represents a unique moment of stress in the history of the Monetary Union, with inflation differentials that approached 20 percentage points in the middle 2022:

Now things are a little better, but we are far from a sustainable situation:

(the data, trend changes on monthly surveys, are from Eurostat).

With a 6 point difference between the country with the highest inflation and the one with the lowest inflation, which is us, it won't last for very long. But raising rates in the hope that Germany will move quickly enough from 3.8 to 2 (because who cares about Slovakia, I think they are thinking of Frankfurt!) when we are at 0.5 obviously means that we will suffer a lot here. Real interest rates in Germany are still sustainable: here much less so, with a series of consequences, for example on the accumulation of public debt.

And be careful! Part of this heterogeneity is due to the link between volatility and the level of inflation, so we can think of treating it by acting as if it were on the level (trivially, if we bombed the entire Eurozone with a sufficient number of nuclear warheads, inflation would converge everywhere at zero, like everything else: the Lagarde fortunately has no warheads but only rates, and therefore can cause less damage, but the point remains that you always have to move on from causing damage). Another piece however is simply heterogeneity! Pay attention: the most unlucky countries in terms of inflation, in the two examples I have given you, are two recently entered countries: Estonia and Slovakia. In fact, in the previous graph I considered those countries (like all the others) only from the date of their entry, but if we redid the graph as if the current "twenty" Eurozone had been created with twenty, that is, as if Croatia, Estonia, etc., had entered in 1999, the result would have been this:

In other words, the current episode of very high gaps between maximum and minimum inflation would no longer appear to be an exceptional and isolated case, but the third in a series.

Nothing can be done against these banal data of historical and economic experience. Even babbling about "federal public budget" or similar makes little sense. It is not with budgetary policy that you can quickly reabsorb such nominal imbalances and such rapid losses in competitiveness. And in any case, what use do you need the single European budget if the problem is "fine tuning" at a national level? To no avail, because to use a huge mass of resources available at a supranational level in a differentiated way at a national level would require levels of solidarity that are unthinkable now and always irrational!

So, my dear friends, what are we talking about?

It takes a lot of patience, and to induce you to have it I will remind you that the facts have a hard head, and that, fortunately for us, we are not the ones who are hitting them head on!

This is a machine translation of a post (in Italian) written by Alberto Bagnai and published on Goofynomics at the URL https://goofynomics.blogspot.com/2024/02/inflazioni.html on Thu, 15 Feb 2024 17:27:00 +0000. Some rights reserved under CC BY-NC-ND 3.0 license.