Red sinkhole: the debt situation of Les Bleus

(… for the analogue college I leave in the afternoon, tomorrow the extension of the runway at Pescara airport will be inaugurated – which we hope is not the premise of an invasion of locusts, but allows us to connect our industrial districts with the rest of the world – and today I am at home doing office work. However, I thought of a different way to tell you something that I have always told you, and I start the day from here, from my digital college …)

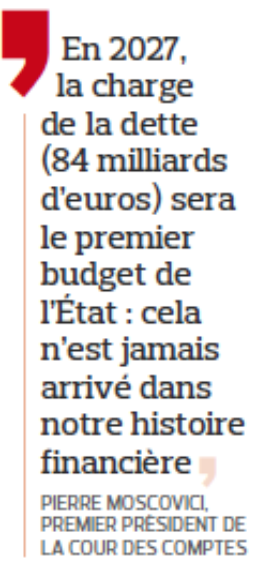

Every now and then I wonder if the most cited post on this blog (most cited by me, I mean), that is, the first, " The bailouts that won't save us ", has been read and understood by anyone. I hope so, against all evidence. A few days ago our friend Hardness of Living pointed out to us that awareness of the fragility of the situation is gaining ground in the French public debate:

and our friend GioMacone , wanting to be cultured, probably said the opposite of what he meant. In fact, exoteric is that which is addressed to the outside of the community, that which can be communicated to non-initiates, just as esoteric is that which is addressed to the inside, which is communicable or understandable only to the initiated. Pro bono pacis addressed to everyone an invitation not to be cultured, especially if you are left-wing (now that stuff is no longer in your DNA, forget it…), and reminded that the use of punctuation is the marker sovereign of familiarity with books without figures (or of the absence of such familiarity), I highlight that my intervention was clearly esoteric: it used our language, where the " words macedonia " and the journalistic pronunciation (erdebbitopubblico, said all in one breath ) are used as an expressive device to highlight bar clichés, and pointed the finger at a fact that those who have not followed "the route", the gradus ad Parnassum , cannot glimpse, but which at the end of this post you will not be able to ignore .

Even if I am tepidly convinced of the opportunity to make conversions and therefore to strive to speak exoterically (the truth is that the conversions will, as always, be the bombs: the writer Céline will prevail over the painter Luke 15.7, and a transition will be inevitable for Genesis 19.24), today it is not to others that I speak, but to us, because it seems more important to me to highlight the meaning of a path, the awareness of what we know or at least should know, the correctness of our intuitions. However, I hasten to warn you against a risk, the usual one: what you have understood, or think you have understood, use it first of all to save yourselves, then to try (in vain) to open some minds, but never as a blunt force , as "veritah" to be wielded like a club. It serves no purpose and disqualifies you and the message you believe you are carrying.

So, let's get back to the point.

Moscovici's utterances highlight a somewhat reassuring fact: thirteen years later, eyes are still autistically pointed in the wrong direction, that of "public debt". In short, everyone looks at this graph:

|

| Figure 1 |

(source: EUROSTAT ) and, for heaven's sake, the operation makes sense, if only because everyone does it! In financial markets, reputation plays an essential role, and we know that it is better for reputation to fail conventionally than to succeed unconventionally , from which it follows that it is certainly better, if you want to appear to be a reliable expert, to focus on indicators that tell just a piece of the story, if it's the piece everyone else is talking about. It is precisely the importance of reputation in the dynamics of financial markets that determines their intrinsic conformism, with the well-known consequences , and this alone should make us reflect on how intrinsically stupid it is to entrust our fate to an institution (the financial market) that works thus, on an institution which, while making risk diversification a (scientifically founded) mantra, tends endogenously towards the concentration of opinions, due to an inexorable sociological dynamic, with all that this entails in terms of financial fragility. But anyway, when the market fails, the bill leans on us (and we also have to thank it)!

Read in the metric of the debt/GDP ratio, and crushed by the order of magnitude of the latest upheavals, the story seems to be that of a failure of our country, of a success of Germany, and, indeed, of a "fragility" of France.

This story of ratios to GDP certainly makes sense.

The problem of public debt does not consist in the fact that future generations will have to "repay it", as the idiots say, but in the fact that present generations will have to renew it when it expires (this year we are going for 400 billion maturities ), and this The problem is very easily solvable if the issuing country is able to demonstrate that it will be able to honor the interest payments, i.e. "service" the debt. Debt servicing absorbs resources, of course. Said in French: sosòrdi. It follows that a country's ability to generate value, i.e. its growth, is the best guarantee for international creditors. The matter is naturally more complicated than that (we are neglecting that in a world of growth and full employment, work will try to pull the blanket of income distribution on its side, leaving financial income out in the cold, so despite the fact that growth is the best guarantee that capital has of being remunerated, capital tends to support recession to keep its antagonist under control), but let's keep it for now at this level of simplicity and repeat it in summary: the problem of debt is not to repay it but to serve it, and, as Domar said, the problem of debt servicing is essentially that of obtaining growth in national income, in GDP.

It's not just stuff from Keynesian archeology and it's not just the words of a nazixenohomophobic fasheesta provincial professor like me, obviously. For the benefit of the idiots, I would like to point out that this is exactly what Moscovici says, even if implicitly, where in his speech he becomes worried because:

(do I have to translate it for you?).

So yes, the ratio to GDP of "erdebbitopubblico" makes sense as an indicator of our ability to service the debt, which is exactly the reason why we should have avoided this disaster:

|

| Figure 2 |

(documented in the post on the sustainability of the pension system ). In this regard, I would like to point out to you that from 2000 to before our crisis, our debt/GDP was slightly decreasing and that of others was slightly increasing, and that the start of national debts on highly divergent trajectories was the result of the crisis, or rather its management, with austerity. This can be seen clearly at the end of Figure 1, where it is clear that by suspending the rules, Italy managed to very quickly bring its high debt/GDP ratio back under control.

The point, however, is always the same: we are talking about a relatively irrelevant variable, and we are talking about it in a relatively inappropriate way.

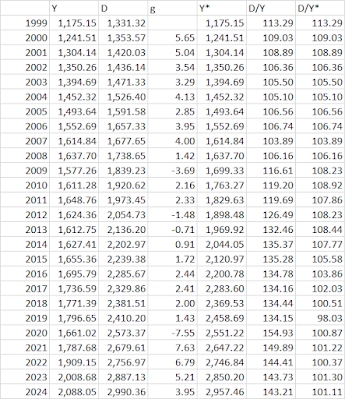

Let's start with the second observation: the inappropriateness comes from focusing exclusively on the numerator. It doesn't take long to make this clear, and I'll show you two different ways. Meanwhile, if we had not killed GDP with austerity, that is, if starting from 2008 nominal GDP had grown at the same average growth rate sustained during the euro period, the situation today would be this:

and the related calculations are here:

(source: IMF ), where Y is the historical nominal GDP, D the public debt, g the growth of the nominal GDP (average 2000-2008 equal to 3.76%), Y* the counterfactual nominal GDP (i.e. the one that grows from 2009 to 3.76%), D/Y the historical debt/GDP ratio and D/Y* the counterfactual debt/GDP ratio, i.e. constructed using Y*.

This graph is also not the birth of a Nazixen etc. provincial, but was presented under Chatham House rules by a very prestigious civil servant in an office behind enemy lines (which means that They, as Luciano would call them, are perfectly aware of the real problem, even if in public they cannot even make it suspect )!

To avoid any misunderstanding, of course, I know that the crisis was there for everyone, but in other countries the impact on nominal GDP was considerably different:

In France nominal growth has halved approximately, in Germany it has increased, in our country it has fallen to less than a quarter of what it was before the crisis, and it is sufficiently obvious that Monti-Letta's assassination of public investments -Renzi-Gentiloni was the magna pars of the problem:

With a denominator (GDP) so disturbed by exogenous events (austerity), perhaps the real dynamics of the numerator (debt) can be overlooked. I'm here to help you! It's this one:

Having made the debt 100 in 2000, the Italian one almost doubled, going to around 200 (204, to be precise), the German one as well (it went from 100 to 205), while the French one more than tripled, going from 100 to 339. Given the French anomaly in this way, which we have been insisting on for more than a decade ( do you remember QED 10 and all its subsequent confirmations ?), it is truly scary, and certainly our dear friend Moscovici:

It's a little tight…

You will say: but France started from a very advantageous position, so even if it has more than tripled its public debt, there is no problem, etc. I don't deny that our situation is more delicate, but have you ever seen the public debts of Italy, France and Germany? I am here:

and it doesn't seem to me that an absolute Italian anomaly emerges from this angle of observation, or am I wrong? The anomaly remains that of the GDP, the causes of which we know: the foolish policies of Monti, Letta, Renzi, Gentiloni.

And at this point, however, I would have liked at least one of you to have asked yourself a question, which certainly no one has asked: "Yes, that's fine, but why are we talking about this? Why do we insist on public debt when we, here, know , have you shown us that the real problem is the foreign one, and that the indicator to be monitored, consequently, is not the public balance, but the foreign one, as the Economist itself claimed in unsuspecting times ?"

Oh yeah, why?

But I told you why above: because when you are stuck in a communication frame that you don't have the strength to subvert, sometimes it can be useful to abandon yourself to the flow! Let's pretend that the problem is public debt, and not private debt contracted with foreign creditors: in any case, the analysis I have proposed dispels some clichés, and helps to focus on the real anomaly (that of GDP).

But we know here that the real problem is private foreign debt, and in general foreign debt (public or private). The reason was known before and is evident now: in the event of a crisis, the Central Bank intervenes on public debt, perhaps obtortocollo , because otherwise everything will fail, while it is a bit difficult to imagine a Central Bank refinancing companies! That's what banks are for, and the problem that a central bank must ask itself is how not to let them fail. Do you remember the ui are not ier to cloze spredz ?

And do you remember how it ended ?

With all due respect to Inspector Clouseau's perspicacity, it couldn't have ended any other way. But we have instead seen the fact that those who have a large foreign debt then go belly up happen a thousand and one times and it was also sanctioned by the good ones in their personal September 8th, which was a September 7th:

The crisis erupts when there is a sudden stop , a sudden stop in the refinancing of foreign debt positions ( the phenomenon of sudden stop in the economy concerns foreign debt ), as we understood here immediately by observing that:

So, if we put it in terms of the truly dangerous debt, the foreign debt, how is France doing?

It goes like this:

|

| Figure 3 |

It's not big news: this graph summarizes all the things you know or should know: the correction, thanks to austerity, of our net foreign position ( we talked about it here ):

the inability of France to get out of the trap of the twin deficits, to recover competitiveness, since a one-horse cure like the one inflicted on us is socially unsustainable at home, and the parasitism of Germany, which after having recovered competitiveness with a reform of the financed in deficit in 2003 ( as explained here ) benefited in a parasitic way from its reputation as a " safe haven " and from the policies of the ECB (which supported its debt – which did not need it – as much as that of the countries in crisis), obtaining a double and connected advantage: that of the devaluation of the euro, which allowed it to accumulate foreign surpluses of up to over 2000 billion euros, and that of negative rates, which allowed it to reduce its debt.

But what I never showed you, and consequently I hadn't seen either, is the inexorable and disturbing red sinking of the Bleus:

I don't know if our old friend Pierre (Moscovici) understood it or not, but he should worry about that stuff. Of course, France is not just any Irish or Spain, I am absolutely aware of this: the market attacks also have a geopolitical dimension and in this respect France certainly has some guarantees. The economic fact remains: France is a large country with an enormous competitiveness problem that it does not know how to solve and is not solving, while we have solved our foreign debt problem, even if at the cost of worsening the public debt problem killing the GDP (but surviving its death).

Of the French situation we had mainly observed the flow data (the persistence of France's negative foreign balance, last seen here ):

but observing the stock data, i.e. the accumulation of these negative balances in a gigantic net foreign debt, of a size never reached in our country, is quite frightening , as a good person would say. It's no coincidence that no one talks to you about these numbers: the markets are correct, they don't like to ruin surprises! I, on the other hand, who am mischievous, love doing it, as you well know…

I am about to conclude (cit.).

I just have to tell you why it's reassuring that everyone is looking in the wrong direction, and what's more with distorting lenses! But it's simple: because this guarantees us that the (financial) asteroid will arrive and do its job. Which? Well, reputation asteroids tend to not give a damn: their reputation is not given by what they say (they don't talk!), but by their mass, which judging from the graphs above is quite huge. We can therefore imagine that their impact will unfortunately (sorry) be more serious for the fragile, rather than for those who those who want to maintain their reputation as financial analysts must define as fragile. It's happened before, remember? When the last asteroid arrived, around 2010, the first to suffer were Ireland and Spain, the two countries with the lowest public debt and the highest foreign debt (i.e. the highest negative net position).

Obviously we are for the peaceful settlement of conflicts, for the prevalence of economic rationality, and for a new Bretton Woods, as are many others, who however forget what compelling forces pushed everyone to sit around a table in 1944, while the Soviets they entered Vilnius and the marines landed in Guam (where today, for various reasons, mostly Japanese land).

Well understood pauca .

(… ah, in case it was ever unclear, Figure 3, i.e. the red sink of the French foreign debt, explains why Inspector Clouseau, after having said that she was not there to cloze spredz, had to run to cloze spredz , otherwise the French banks would explode like popcorn. Factually speaking: I'm not interested in controversies …)

This is a machine translation of a post (in Italian) written by Alberto Bagnai and published on Goofynomics at the URL https://goofynomics.blogspot.com/2024/02/sprofondo-rosso-la-situazione-debitoria.html on Sun, 04 Feb 2024 12:29:00 +0000. Some rights reserved under CC BY-NC-ND 3.0 license.