All cuts in Santander Consumer Bank

Agreement signed between unions and Santander Consumer Bank. Appeal to the redundancy fund and voluntary resignation plan. All the details

Cuts at Santander in Italy.

An agreement has been reached between unions and Santander Consumer Bank to manage the repercussions on staff resulting from the reorganization desired by the company. This involves the closure of branches in the area and a strong push towards digitalisation.

Between Scb, part of the banking group born in Spain and present throughout Europe, specialized in Italy in consumer credit, Fisac Cgil and Fabi, the agreement provides for the use of the sector's solidarity fund, together with an incentivized voluntary resignation plan , and which will now be examined by Santander workers in the assembly.

To resolve the employment issue, the use of the solidarity redundancy fund for professional reconversion and retraining was promoted, which has always resolved the problems of the credit sector internally, without burdening the state budget, allowing the voluntary exodus of employees and rejecting the sender's attempt to proceed with indiscriminate dismissals", underline the unions.

THE FULL STATEMENT

Agreement reached in Santander Consumer Bank Spa Procedure pursuant to art. 22 ABI CCNL

Today, a hypothetical agreement was reached which will be submitted to colleagues at the meeting. Assembly to be held on November 8th from 10.30 am to 1.00 pm in mixed mode, i.e. in presence for the Turin office and connected simultaneously with the network and the Bologna office.

The trade unions met to define the commitments reported below on 14,20,26 September and 2,10,11,23,24,25,26, 31 October; 4 and 5 November. From the outset we said we were against the declaration of redundancies on the corporate side and the need to face the challenge of digitalisation and the related transformations of the sector through the elimination of the branch network present in Italy (effectively disguised elimination, since the bank will continue to operate in the area with a large and widespread network of financial shops).

The salient contents of the agreement, which provides for the management of the reorganization procedure opened by the Company pursuant to art. 22 of the ABI CCNL, provide for an exit plan for voluntary resignations with incentives and the opening of the extraordinary part of the Support Fund to the sector income to allow early retirement for up to 60 months to those who meet the pension requirements. The agreement also provides for the possibility of joining the ordinary part of the Fund for 12 months, to be used before accessing early retirement.

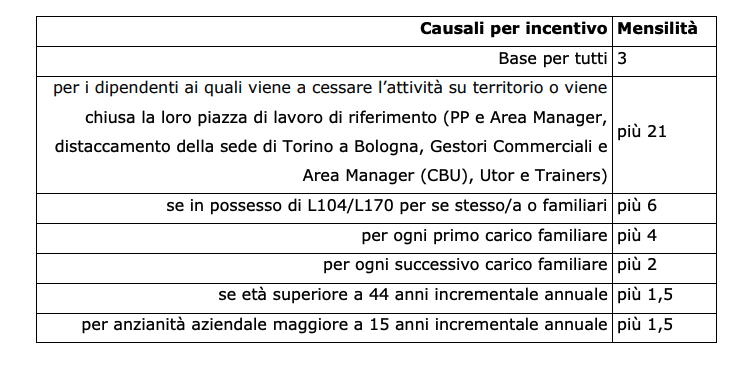

We managed to obtain the recognition of a number of monthly payments significantly higher than the initial proposal and also adequate for those who voluntarily decide to join the incentivized exit plan up to a maximum of 37, according to a modular and incremental criterion depending on how many loads family members have, any presences of law 104, an increase based on age and working seniority, to which a further 3 months are added for timely membership. The total maximum monthly payments, including timeliness, will be 40. In all cases, the monthly salary incentives will be calculated as 1/12 of the RAL, as resulting from the payslip for the month of October 2023. The incentivized exit plan will be open to all colleagues, including those at the Head Office. Details are contained in the table below.

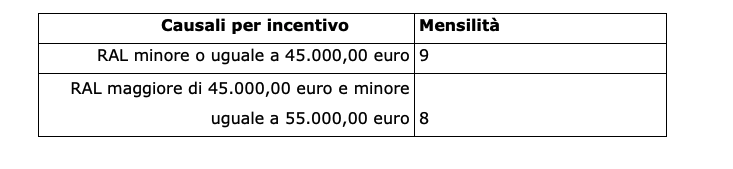

For those who decide to join the extraordinary part of the fund (early retirement) the incentive will be as described in the table below:

The agreement also provides for an incentive plan equal to 24 months' salary for those who are interested in having an agency mandate facilitated by the Bank, following training and registration in the OAM list.

This is a heavy agreement to manage a corporate reorganization which we do not agree with either in content or method, given the economic and financial situation of the Company, which recorded profits of 90 million euros in 2022. A reorganization which appears even more unjustified in the face of an expansive policy also from an employment perspective both within the company itself and in the entire Group.

However, we have faced the negotiation and reached what, at this stage, we believe to be the most protective agreement for workers. The meeting will be an opportunity to go into detail about the contents of the proposed agreement.

COORDINATING SECRETARIAT. FABI SANTANDER CONSUMER BANK

COORDINATION SECRETARIAT FISAC CGIL SANTANDER CONSUMER BANK

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/tutti-i-tagli-in-santander-consumer-bank/ on Mon, 06 Nov 2023 11:46:10 +0000.