All SoftBank troubles with Didi, Arm and Alibaba

SoftBank thud on the Tokyo Stock Exchange between Didi delisting and stop Arm disposal. Facts, numbers and insights

Black Monday after a difficult week for SoftBank.

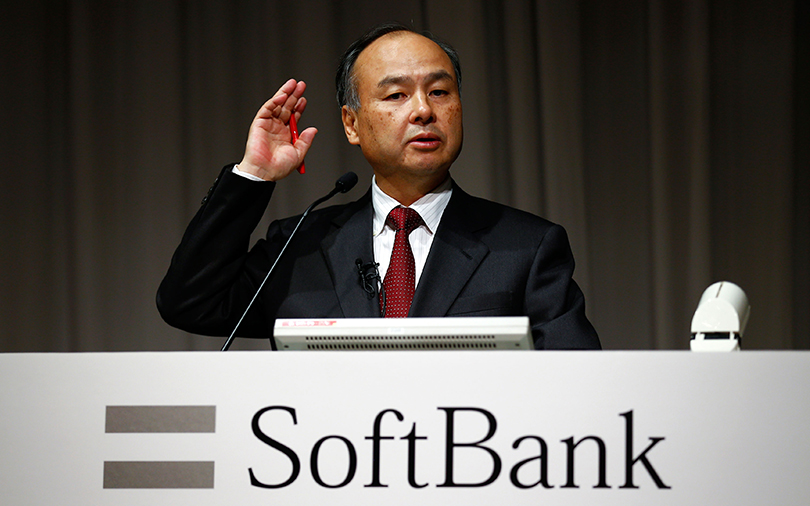

At the Tokyo Stock Exchange, the Japanese giant led by Masayoshi Son has sold 8.2% after the session.

For the Japanese conglomerate it is now the seventh consecutive day of losses, reports Radiocor . The group thus reached its lowest level since June 2020.

The company, in fact, in the last session ended up in the eye of the storm in relation to a series of operations of its subsidiaries in the portfolio.

First, the Federal Trade Commission (FTC), the federal agency that deals with consumer defense and antitrust matters, filed a lawsuit to block the $ 40 billion acquisition of Arm (owned by SoftBank) by by Nvidia last Thursday.

Then Singapore-based transportation and delivery company Grab – in which SoftBank has a 19% stake – slipped more than 20% on its Nasdaq debut on Friday.

Finally, also on Friday, its subsidiary Didi Chuxing, the equivalent of Uber in its in China, announced the delisting from the New York Stock Exchange.

And this is not to mention that SoftBank's largest asset, that is the Chinese e-commerce company Alibaba today experienced a black day on the Hong Kong Stock Exchange, where it lost 5.6% following the reorganization of the team following the e-commerce.

All the details.

THE DELISTING ANNOUNCED BY DIDI

The launch of SoftBank's sales today was in particular the announcement, arrived last Friday, of the Chinese group Didi, which announced its withdrawal from the New York Stock Exchange, where it had been listed since this summer.

Didi sees SoftBank's Vision Fund among its shareholders with 21.5%.

The Japanese conglomerate, which owns about 20% of the company, has had a tough week: its $ 40 billion sale of British chip designer Arm to Nvidia has just been blocked by regulators and Grab, the company. Singapore where SoftBank has a 19% stake – saw its share price drop 20% after hitting the US stock market.

DUE TO THE REPRESSION OF THE BEIJING REGULATORS

Didi's decision comes a few months after its initial public offering (IPO) in June, one of the largest US quotes of a Chinese company. Just a few days later, Chinese regulators, worried that the company might disclose sensitive data, deleted Didi from the country's app stores and banned it from acquiring new users. The company lost more than 30% of its average daily users in just two months, and its shares dropped by more than 40%.

THE NEXT MOVE

But the Chinese company already has its next destination in mind.

Didi has already announced that it would remove its shares from the New York Stock Exchange and go public in Hong Kong instead.

THE FTC CASE AGAINST NVIDIA'S ACQUISITION OF ARM

A second blow for the Japanese conglomerate then came from the United States Federal Trade Commission which decided to sue the acquisition of Nvidia for $ 40 billion of the British chip maker Arm (another SoftBank subsidiary).

If the deal for Arm fades, it won't just be a rout for Nvidia. According to Reuters , it would be a new blow for SoftBank whose Vision Fund assets plummeted by $ 10 billion last month, due to the slump in valuations for investments in Chinese e-commerce company Alibaba and ride-hailing service. Didi Global Inc.

THE COLLAPSE OF ALIBABA

Today Alibaba, the e-commerce company founded by Jack Ma and the most valuable of SoftBank's investments, is down 8%.

The collapse follows the announcement of plans to form two new units to house its core e-commerce businesses – international digital commerce and Chinese digital commerce – in an effort to become more agile and accelerate growth. As CNBC recalls, the changes come as Alibaba faces headwinds on multiple fronts, including increased competition, a slowdown in the economy and a regulatory crackdown.

AND THAT OF GRAB

Not to mention that shares of Grab, the largest transportation and delivery company in Southeast Asia, plunged more than 20% on Thursday in their Nasdaq debut. SoftBank's Vision Fund is Grab's largest shareholder and owns approximately 18.6% of the company.

REFLECTIONS ON THE JAPANESE SOFTBANK GROUP

All movements that also had repercussions on the financial results of the Japanese group which recorded a net loss of 397 billion yen (3.5 billion dollars) in the July-September quarter of 2021. And the quarterly performance was determined by a loss of $ 10 billion in its subsidiary Vision Fund due to a decline in the value of its technology assets. In particular, the devaluation of assets on the Chinese market caused by the regulatory 'crackdown' which particularly affected the Didi group (acquired for 12 billion at the time) weighed heavily.

THE LOCATION OF MASAYOSHI SON

Although the value of its assets has fallen, SoftBank said its shares are undervalued. Therefore Masayoshi Son has pledged to spend up to 1 trillion yen to buy back nearly 15% of his shares.

"We are in the midst of a blizzard," Son said at a press conference last month, adding that he was "not proud" of the Vision Fund's performance over the quarter. However, he said the company is taking steady steps to double the number of "golden eggs" from last year.

THE COMMENT OF THE ANALYSTS

But analysts remain skeptical at the moment.

"What we have seen is almost a complete reversal of sentiment," said Redex Research analyst Kirk Boodry, reports Reuters . “All the underlying value has been compressed”.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/tutti-i-guai-di-softbank-con-didi-arm-e-alibaba/ on Mon, 06 Dec 2021 14:54:02 +0000.