All the EU’s mistakes and delays on electric cars

Any European tariffs on Chinese electric cars will not be enough to close the competitiveness gap with China. The EU risks losing the industrial battery revolution. Conversation with Alessandro Aresu, geopolitical analyst and author of “The dominion of the 21st century”

During the latest State of the Union speech, the President of the European Commission made a very important announcement : an anti-subsidy investigation into electric vehicles from China will be opened. “Global markets right now,” explained von der Leyen, “are flooded with cheap Chinese electric cars. And their price is kept artificially low by huge state subsidies. This distorts our market."

A PRECEDENT: SOLAR PANELS

“We don't want Chinese electric vehicles to benefit from our climate policies,” added Manfred Weber, the president of the European People's Party, whose group is the largest in the Parliament. “We must activate our trade defense tools to avoid another attack like the solar panel attack.”

Weber refers to a crucial episode in the recent history of European industry. In 2013, the Commission imposed duties on Chinese photovoltaic components, which were exported to Europe at a price much lower than their actual market value ( dumping , in jargon) and had driven several companies into bankruptcy. However, the tariffs were abandoned in 2018 under pressure from Germany, which feared trade repercussions with China, its main partner. The European Union therefore decided to focus on the massive importation of low-cost (Chinese) panels to encourage the installation of solar parks, while renouncing manufacturing.

WILL THE GREEN DEAL DELIVER EUROPEAN INDUSTRY TO CHINA?

Solar panels, like electric cars, are two of the main pillars that support the Green Deal, the European plan for carbon neutrality by 2050 which provides for the installation of a lot of energy capacity from renewable sources and the electrification of mobility: from 2035 Furthermore, the registration of vehicles powered by petrol or diesel in the territory of the Union will be prohibited.

Brussels wants to make the ecological transition, but risks finding itself dependent on Beijing, which dominates the manufacturing and supply chains of almost all "clean technologies".

THE EXISTENTIAL COMPETITION ON ELECTRIC CARS

Germany had an important solar industry (something remained, such as the fundamental Wacker Chemie, a polysilicon producer) and today has an important automotive industry well rooted in China: in 2022 the Chinese market was worth 40 percent of global sales from Volkswagen , for example. In this sense, the words of Weber, a German, might surprise. But the competition over electric vehicles is an existential competition: at stake is the relevance and survival of a fundamental sector for the economy and employment of the Old Continent.

The problem is that European companies cannot compete with the production costs of Chinese brands such as BYD (which has also dethroned Volkswagen in terms of number of sales in China), Nio and Xpeng, which for years have been able to count on both generous manufacturing subsidies and on purchase incentive measures that have allowed it to spread and expand in China. Today the country alone is worth 54 percent of global sales of electric vehicles.

Nonetheless, the Chinese automotive market no longer guarantees the same numbers as it once did, also due to the general economic slowdown. Thus, electric vehicle manufacturers have started a “price war,” cutting sales prices with the aim of eliminating competition. Now they are applying the same tactic abroad. According to analysts at UBS , Western automakers risk losing a fifth of their market share due to affordable Chinese electric vehicles.

A few months ago the founder of Nio said that Chinese companies have a cost advantage of about 20 percent over Western competition. Thanks to the subsidies, but not only. The Chinese can in fact produce at lower costs because the costs of energy, labor and components are lower: China is the largest refiner of critical metals (lithium, nickel, cobalt, graphite) and clearly the largest producer of batteries . Virtually all electric vehicles circulating in China use Chinese batteries; the battery accounts for approximately 40 percent of the price of an electric car.

DO EUROPEAN DUTIES ON CHINESE CARS ARRIVE (IF THEY ARRIVE) TOO LATE?

Following von der Leyen's announcement, the Commission will collect information to determine whether China has indeed violated anti-subsidy rules. If this were to be established, the European Union could decide to impose duties on imports of Chinese electric cars; depending on whether they are preliminary or definitive duties, the times vary from nine to thirteen from the formal start of the investigation.

Brussels and Beijing are likely to discuss the issue at the EU-China high-level dialogue on 25 September. Additionally, Trade Commissioner Valdis Dombrovskis will leave for China next week “to discuss trade and economic opportunities and challenges. We want to keep the dialogue open,” he said, “to reduce risks, not to decouple.” Yes to de-risking on some critical sectors, in short, no to total decoupling .

ALESSANDRO ARESU'S ANALYSIS

Possible European tariffs on Chinese electric cars would like to restore a level playing field between the European Union and China. But is "peer to peer" competition possible, given China's dominance of the battery metal supply chain?

“We will see how the initiative announced by the Commission will materialize, but its meaning is clear: the approach with which the so-called Green Deal started between 2019 and 2020 has forgotten the industrial aspects, wrapping everything in rhetoric, while the future of mobility is also an essential industrial and political competition issue,” Alessandro Aresu, Limes ' scientific advisor and author of The Domain of the 21st Century , explained to Startmag .

“The industrial aspect has been strongly and culpably underestimated by the approach pushed by Timmermans, as noted for some time by numerous critics, and therefore represents a serious problem for Europe, which must be addressed with intellectual honesty. For this reason, I predicted both in The dominion of the 21st century and in my essay with Alberto Prina Cerai for Le Grand Continent that Europe would not wait to see its automotive corpse pass over the river and would announce some retaliations", continues the analyst.

“In any case, a lot of time has already been wasted unnecessarily and intervening in this period is obviously more difficult, also due to the effects on prices. We should have thought about it first. I remember, for example, that Paolo Bricco had done an enlightening interview with Alberto Bombassei on these topics almost five years ago now”.

“What to do, then, in this context? First of all, I think that European regulations must carry out a rigorous analysis of the functioning of the automotive supply chain and the importance of chemical processes, to therefore avoid punitive measures that could harm European competitiveness. Even fixating on dates is not good, it is counterproductive and will certainly generate political problems, it will be a theme of the 2024 European elections campaign. The future of our continent also depends on a cultural approach in which we frankly analyze the functioning of an industrial supply chain , and its chemical and electronic aspects (which require considerable investments) instead of living with the self-defeating illusion (the result of 'magical thinking', as it has been written) according to which we push a button and make everything electric free, while the rest of The world makes fun of us for this."

“Moreover”, concludes Aresu, “European automotive companies must begin to diversify their reference markets, they must have 'diversification anxiety', so as not to be victims of an 'illusion' relating to the enormous Chinese market and their real possibilities in it. It is not a question of overloading the issue with ideological factors, but of looking at the reality of the facts. The fact that China is the most important car market in the world does not mean that that market is 'ours' because the Chinese perspective is to make it increasingly controllable by Chinese companies, which have important capacities for innovation and the creation of products".

THE PROBLEM OF BATTERIES FOR ELECTRIC CARS

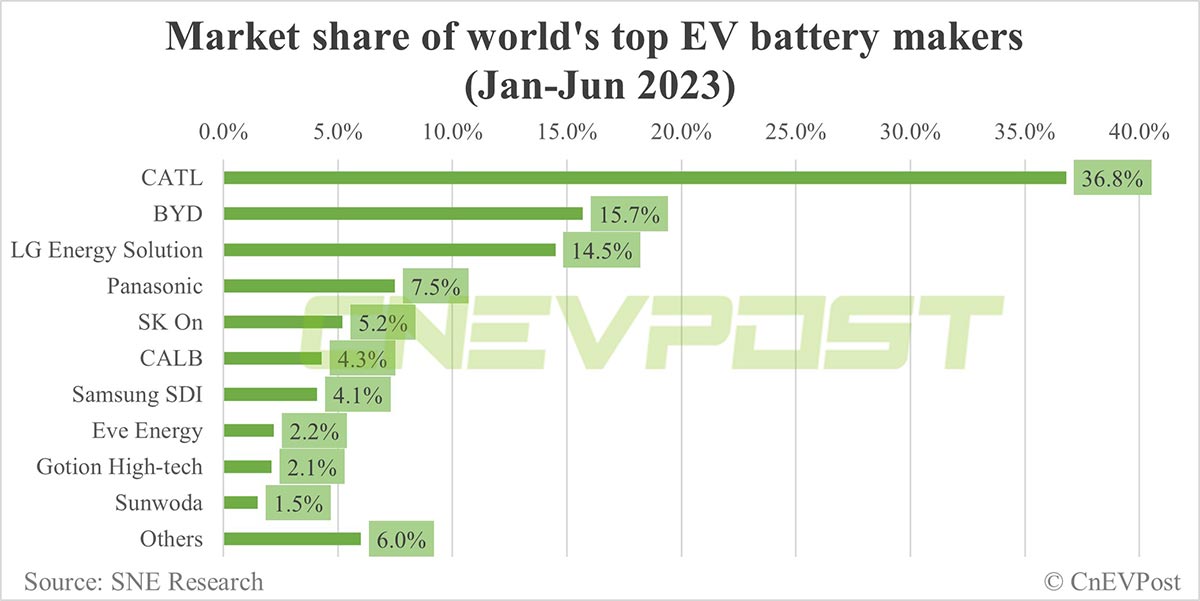

None of the top ten battery manufacturing companies are European or even Western, according to the latest ranking by SNE Research taken from the Chinese site CnEVPost . The top two positions are Chinese: CATL , an absolute giant in the sector, reached a global market share of 36.8 percent in the first half of 2023; BYD, which also makes electric cars, has 15.7 percent. In third place, with a market share that is less than half that of CATL, is the South Korean LG Energy Solution.

Not all of the Chinese companies in the ranking – namely CALB, Eve Energy, Gotion High-Tech and Sunwoda – have as strong an international presence as those in the top three . Or at least not yet. China is in fact building many more battery factories than it needs : according to data collected by CRU Group, this year Chinese factories will reach a production capacity of 1500 gigawatt hours, an amount capable of powering twenty-two million electric vehicles and more than double demand levels.

The fear is that Beijing, to give vent to overproduction and avoid a collapse of its sector, could adopt the same tactic already used in the past with steel or solar panels: that is, it could dump the excess batteries abroad, selling it at prices much lower than those charged by international competitors in order to conquer global market shares more easily. European battery manufacturers cannot compete with the volumes and costs of Chinese companies, partly because they cannot rely on robust domestic supply chains.

CATL, moreover, is expanding in Germany and Hungary.

Possible tariffs on Chinese electric cars alone do not solve the supply chain problem. The battery is the most important part of an electric vehicle; and if the European Union limited itself to assembling electric cars made of Chinese components, from an industrial point of view the situation would still be serious.

THE PROBLEM OF METALS FOR BATTERIES

It is often said that the energy transition could make us move from an oil dependence on OPEC+ to a metal dependence on China, given that almost all new raw materials are refined and transformed in this country with very high percentages (67 percent of the global total for lithium, 73 percent for cobalt and 63 percent for nickel). Is there really such a risk, or does the process of restructuring supply chains have any chance?

“First of all, I don't think OPEC+ will go out of business in the short term,” says Aresu. “The importance and unscrupulousness of the Gulf monarchies, for example, considering their availability of resources and willingness to spend on political objectives, will still be an important factor in international politics in the next decade.”

“Second, China's growth in ecological transition supply chains is real and has certainly exceeded expectations. The International Energy Agency has already certified China's primacy in solar panels, and Xinjiang's role for some time, as I also recalled in my book. CATL and above all BYD, but also Xpeng and many other companies, without forgetting Huawei's investments in the electric car as a reference market and the capabilities of Chinese designers, are already part of the world we live in and its so-called 'markets'. However, we must not forget that this extraordinary Chinese development takes place at a very complex time for Beijing, of economic slowdown and growth in unemployment, especially among young people . All this could negatively influence, even abruptly, Chinese capacity and domestic consumption choices."

“The Chinese bet, however, is that the process of Western restructuring of supply chains is not real, but fake or of negligible extent,” concludes Aresu. “China believes that this process will encounter some bottlenecks – in the permit system, in the construction of infrastructure, in environmental factors related to chemical processes, in population support – which ultimately many countries will not be able to support. Despite its difficulties, in this context, China aims to maintain and reclaim its reputation as an 'achieving power', as a 'champion of doing' at a global level. Having said this, the destructuring of supply chains, even in this sector, still represents a risk factor for Beijing, because it implies a loss of capacity and industrial centrality, especially in large numbers".

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/smartcity/auto-elettriche-ue-cina-politica-industriale/ on Sun, 17 Sep 2023 07:30:09 +0000.