All the news on pensions explained by Cazzola

Pensions, what's new in the Meloni government maneuver. Giuliano Cazzola's analysis

With regard to the provisions of the budget law on pensions, the European Commission contented itself with marking a few errors in red pencil, because in Brussels they realized that that network of rules will function as a sort of labyrinth in which those who want to leave they manage to find the right path and continue to turn more or less always in the same place. It is also difficult to understand what the government's intentions were: to follow the lines traced at the beginning of the past legislature aimed at favoring early retirement as much as possible or to insert requirements that would make it even more difficult. The result is both combined together like a person having to run with a ball strapped to one foot.

But what is most debatable concerns the distribution of (presumed) benefits and (certain) sacrifices. It's not about making predictions; it is enough to stay with those made by the government in the Technical Report (RT). Who are the beneficiaries of the further experimental transition measure, valid in the current year or those whom the government wanted to protect from returning to the

exit paths under the Fornero reform? Following the debate of recent years, it doesn't take long to understand: the subjects (the male is specific because the vast majority will be men, residing in the North) able to take advantage of early retirement, the same ones for whom the 100 and the contribution requirement necessary for the advance was blocked until the end of 2026, at 42 years and 10 months for men and one year less for women, regardless of the personal one. But how many workers are there who, being able to take advantage of the relative rules) will be saved from the clutches of Elsa Fornero and who will be able to take advantage of the ''flexible early retirement'' (which is not flexible, but that's another matter)?

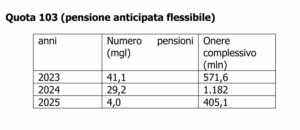

The RT table indicates this clearly, but perhaps with excessive optimism: just over 40,000 in 2023. In order to limit recourse to 103, there is an incentive to remain in service corresponding to the amount of the contribution

social security payable by the employee (9.19% of the salary). RT forecasts do not go beyond 6,500 users.

According to the '' Giorgetti doctrine'', the expenditure increases in the budget law had to be covered with savings drawn from the same sector. As has always happened, there is only one way to reduce pension expenditure with certainty and ''ready cash'': to act on the automatic equalization of current treatments. Almost all governments have done it for decades, albeit with variable solutions but with one point in common: an amount level is chosen that is entirely protected from inflation, while the rates of higher income groups are cut or modified with respect to the mechanism standard of the three bands (100%, 90%, 75%) which had just been restored in 2022 after a long period of tampering. In this year's budget law, the level covered at 100% is equal to 2,100 euros per month (about 1,700 net). For the higher brackets, a decreasing path up to 35% is envisaged. The measure will also remain in force in 2024. According to an estimate by Itinerari previdenziale (it is the most prudent of those in circulation) the cut in revaluation imposed in the budget law will produce individual losses ranging between 13,000 and 110,000 euros accumulated on 10 years for about 3.3 million retirees. Here the first question arises: does it make sense to penalize millions of pensioners to favor a few tens of thousands of pensioners for whom other forms of

outgoing flexibility (such as, for example, the extension of the Ape sociale) one of which is of a structural nature (the so-called forty-unists)?

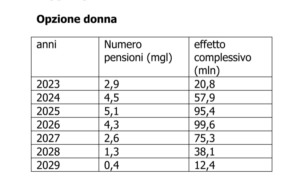

Furthermore, the budget law also extended the ''Women's option'' for 2023, however modifying its requirements and subjecting it to precise conditionalities, which are added to the entirely contributory calculation and to the windows for the related exercise. According to RT, the new rules will result in a marked reduction in the use of this option. In 2020, for example, 19,970 were presented to INPS, equal to 17.6% less than in 2019; 14,510 applications were accepted, of which 16.5% from public sector workers, 21.4% from self-employed women and the rest settled in private sector management. The table is very eloquent in this regard: according to the forecasts contained in the RT, in 2023 services in this respect will not reach the number of 3 thousand.

A clarification is necessary at this point. The provisions in the aforementioned chapters (quota 103, automatic equalisation, women's option) are classified as a greater expense than the legislation in force for accounting reasons. In fact, these are measures that will enter into force from 1 January, replacing those that expired at the end of 2022, which,

law unchanged, would not have involved charges for obvious reasons (a law that no longer exists does not need new coverage). A similar reasoning applies, on the contrary, to automatic equalization.

In fact, putting together the revaluation mechanism in force since 2022 and the increase in inflation (by about 10 points in less than a year) the expenditure would have been much greater. In essence, these measures have served to contain the higher costs that would have resulted with unchanged legislation. The changes to the equalization will also influence the decision to take advantage of the so-called flexible early retirement. To access it, it is necessary to receive treatment up to a maximum of 2,800 euros per month which cannot be combined with other income (except for a limited occasional service). This means that many users of 103 allowances will help pay for it through the lower inflation coverage for 2023 and 2024. Also because the unfavorable equalization will be applied to the entire pension income, and not in brackets.

The 2023 budget law provides for an increase in the minimum pensions for over 75s for each of the months from January 2023 to December 2024. This increase will be 1.5 percentage points for the year 2023 and 2.7 percentage points for the year 2024. As written in the note of the Observatory of social security itineraries, ''the super-evaluation of minimum pensions concerns as many as 6 million beneficiaries including the unfortunate (very few), the tax evaders (most) and even the criminals , while the almost 1.6 million pensioners of the certainly not rich middle class between 2,600 and 5,200 euros gross (from 5 times the minimum up to 10 ) and the approximately 247,000 who earn from 5,200 gross euros per month and up (over 10 times the minimum) and who already pay a mountain of taxes that the 6 million beneficiaries of pensions up to 2 times the minimum do not pay at all and the 6.6 million between 2 and 4 times the minimum pay to a lesser extent''. This is probably a pessimistic estimate, because in the end the beneficiaries will be pensioners (those who receive integrated treatment at the minimum are 2.3 million and those over 75 are even less) not pensions, the number of which is referred to by the Observatory .

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/benefici-presunti-pensioni-tutte-le-novita-sulle-pensioni-spiegate-da-cazzola/ on Fri, 06 Jan 2023 07:34:25 +0000.