All the unknowns of the ECB on government bonds

Compared to March 2020 – when it managed to launch the "pandemic" purchases – today the ECB really appears on the corner. Here because. Giuseppe Liturri's analysis

In the week that led to a 0.75% rate hike by the ECB's Governing Council at its meeting on Thursday 8th, we would really like to be wrong, but we really smell the Juncker method. It owes its name to what former Commission President Jean-Claude Juncker told the German periodical Der Spiegel in 1999: “ We make a decision in a room, then we put it on the table and wait to see what happens. If it does not provoke protests or riots, it is because most people have no idea what has been decided; then we go forward step by step to the point of no return ”.

In this case, we refer to the purchases of public securities of the ECB, carried out by reinvesting the proceeds of the securities that are progressively going to maturity, about which worrying signals have arrived with the usual method of " sources close to the dossier " that blurt out to favor of the usual information channels. Until August 18, it seemed a topic not on the agenda, but a long interview given to Reuters by German Isabel Schnabel – a leading exponent of the Frankfurt executive committee – marked a perhaps decisive watershed.

In fact, Schnabel – when asked if, on the occasion of the next council, the time had come to discuss the term of reinvestments – not only did not express a clear denial, but also added that "it is not excluded that some of her colleagues would raise the issue ". The sentence dropped – in perfect Juncker method – was then repeated in another launch on 25 August, in which four confidential sources are cited who confirmed to Reuters that, for now, the rise in rates has priority, but that the reduction of the ECB budget will be the next "natural" step. The story was picked up by the Financial Times in the same terms twice. And, in the afternoon, on Friday 9, for the avoidance of doubt, it was illustrated in detail by a well-informed article in the same City newspaper.

These are not at all technicalities of insiders, but it is essential to understand what the support offered by the ECB will be to the market of public securities and our BTPs in the coming months. If the ECB, in addition to ceasing additional purchases as happened first in March and then definitively in June, even poured tens of billions of BTPs onto the market, draining liquidity, we would be in real trouble. With the ECB net seller of securities, any budget variance would be doomed in the bud and the BTP market, whose liquidity is now dominated by the presence of the ECB, would also be in trouble. That's why those words are tantamount to naming the devil in church, while all the faithful are gathered in prayer. Metaphorically, prayer is the hope that the deficits that governments (we are not alone, fortunately) will be forced to make to mitigate the effects of rising energy prices on businesses and households, will find a market willing to buy that debt. sustainable rates, without excessive turbulence.

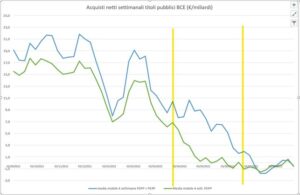

The role played by the reinvestment of proceeds from maturing securities is very significant. The Pepp pandemic program, which ended in March (first yellow line in the graph with 1.665 billion shares purchased, of which 289 are Italian), expects them to continue at least until the end of 2024. The PSPP program (second yellow line in the graph with 2.744 billion shares, of which 450 are Italian) – which ended in June and started in 2015 under the presidency of Mario Draghi – expects reinvestments to continue for " a prolonged period of time after the start of the rate hike". How " prolonged " this time is is not known.

To get an order of the figures under discussion, in the next 12 months the ECB will receive reimbursements for 278 billion under the PSP program. Italy – with 450 billion bonds with an average maturity of 7.1 years – will have to repay an average of 63 billion a year which, to date, the ECB collects and reinvests. This is a sum equal to one and a half times the installments of the NRP that we should receive every year. In this way we would end up in the absurd situation of receiving liquidity with one hand, avoiding resorting to BTP issues and returning it with the other, forcing ourselves to have to find other buyers for our BTPs.

Schnabel's words, but also those spoken by Christine Lagarde in Thursday's press conference, also open up other disturbing scenarios. Regarding the Tpi – new purchasing program announced in June – both were very clear in reiterating that all, without exception, the eligibility conditions (compliance with European budget rules and related accessories) must be met, and has carefully avoided to indicate any countries that are currently in default. In short, he reiterated that it will be an umbrella that will open only in good weather.

Compared to March 2020 – when it managed to launch the "pandemic" purchases – today the ECB really appears on the corner. In fact, it is the only entity capable of financing, by touching the red line of the violation of the Treaties, the spending needs of national governments. They are the only subjects who can intervene quickly and well, in this they cannot be replaced by European plans for elephants. To those who, like Giuseppe Conte, invoke the mythological "Recovery Fund for energy", we remind you that the Recovery Fund required ten months of negotiations to arrive at the regulation of February 2021 which also allocates money with a dropper until 2026. Perhaps to the leader of the M5S it escapes that the quintupled energy bills must be paid in the morning, without being able to wait for the biblical times of the European liturgies.

With the current gas and electricity prices, ten months of waiting would be too long and the Eurotower can only turn around, reopen the purse strings and finance the costs of the economic war against Russia. Unless it wants to seriously damage European industry.

Anyone who wanted an economic war against Russia and wants to keep the front compact must understand that the costs cannot be borne by businesses and families, but it is necessary to support the public budget adequately financed by a Central Bank worthy of the name, which instead today he thinks incredibly about disengaging.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/tutte-le-incognite-della-bce-sui-titoli-di-stato/ on Sat, 10 Sep 2022 05:38:43 +0000.