Banks, here are accounts and challenges. Fabi report

Numbers, trends and scenarios for lenders. The Fabi report which will be at the center of the 127th Fabi National Council, in Milan, from 13 to 15 June.

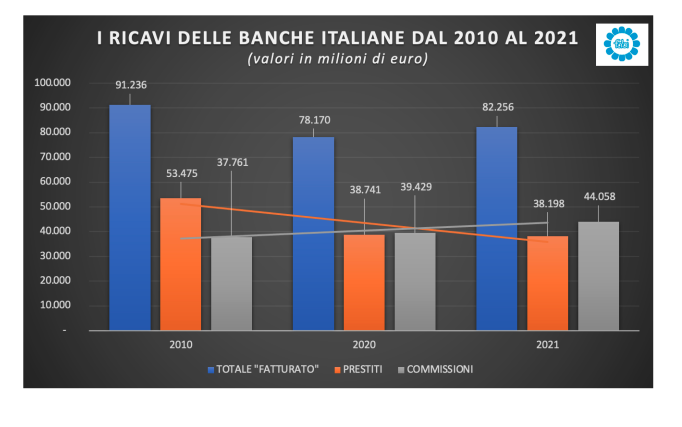

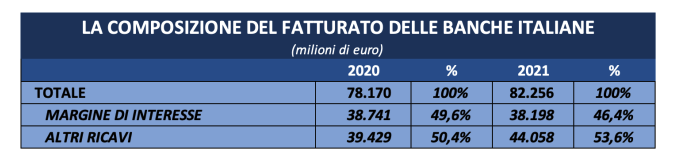

Less credit and more financial products: the gap between the two main areas of activity of the Italian banking sector widens dramatically. Last year, out of the total of 82 billion euros in revenues (+4 billion on 2020), those related to commissions reached 53.6% (44 billion) of the total, compared to 46.4% (38 billion) income attributable to loans granted to businesses and households.

In total, revenues from the sale of financial and insurance products, from the management of the sale of credit cards, from managed savings rose by 4.6 billion and amply compensated for the decline in income from loans (minus 543 million ). In 2020, the gap was less than one percentage point (50.4% versus 49.6%): 39.5 billion versus 38.7 billion. The gap between commissions and loans went from 688 million to 5.8 billion in just 12 months. In percentage terms, the gap has gone from less than one point to over seven percentage points.

The topic will be at the center of the 127th National Council of the Fabi, in Milan, from 13 to 15 June. Three days of work which, among other things, will also offer the opportunity for a direct confrontation between the representatives of Fabi and the heads of personnel and trade union relations of the main banking groups in the country on this very topic, the subject of an investigation by the Parliamentary Commission investigation launched on 17 May.

HERE IS THE FABI FULL REPORT:

An evident withdrawal from credit and an objective aimed at financial products: the gap between the two main areas of activity of the Italian banking sector is visibly widening, with agencies now increasingly similar to financial shops.

Last year, out of the total of 82 billion euros in revenues, those related to commissions reached 53.6% (equal to 44 billion) of the total, compared to 46.4% (equal to 38 billion) of attributable income. to loans granted to businesses and households. The sudden evolution of Italian banks emerges plastically from the photograph that Fabi manages to take with a detailed research on the revenues of the sector.

In 2020, the gap was less than one percentage point (50.4% versus 49.6%): 39.5 billion versus 38.7 billion. The gap between commissions and loans went from 688 million to 5.8 billion in just 12 months. In percentage terms, the gap has gone from less than one point to over seven percentage points.

With the big Internet companies that have already entered the digital payments market for years and are now taking their first steps in the field of consumer credit, "attacking" market shares of banks, the Italian banking sector is profoundly transforming and the change affects both employees and customers closely. The push to sell financial and insurance products, in fact, increases the undue commercial pressures exerted by group leaders on female and male workers precisely to increase revenues linked to commissions on financial and insurance products and services.

2021 therefore saw the revenues of the Italian banking sector grow, increasing by over 4 billion with a growth of 5.2%: it is a pity that the key to success of the income statement of Italian credit institutions is increasingly due to the dizzying increase of commissions paid by customers. The risk is that, in the absence of interventions, the situation could lead to two frailties, on the one hand the employees of the banks, on the other the customers.

«Our data allow us to make several considerations. The first is that banks are now giving up on lending and this mainly depends on the fact that loans represent an unprofitable and increasingly complex activity, especially due to the stringent rules of the European Central Bank which does not want burdened budgets. from new sufferings; in short, many costs and many risks, but little profitability. Hence the decision to gradually shift attention to the sale of financial and insurance products, an area in which the risks are effectively reduced to zero, but the economic returns, on the other hand, are very important. The second consideration derives from the effects, in my opinion dangerous, deriving from the entry of large internet operators into the market and into the business of the banks themselves: after payments, now, it is the case of Apple, there is consumer credit and all this will exacerbate the unbridled competition between Italian banking groups, with negative repercussions also for customers; I am referring, in this case, to the subject of undue commercial pressure of which I spoke, documenting before the Parliamentary Commission of Inquiry to explain above all that it is a question of a social nature and not just strictly trade union. If the giants of the web, favored by the substantial absence of rules, erode the market shares of the banks, the latter will increasingly focus on the sale of financial products. The risk is that the banks will no longer play that important social role of the past and the damage will be touched on the territories »comments the secretary general of Fabi, Lando Maria Sileoni.

What do the revenues of the Italian banking sector tell us in 2021? It is an overall two-sided balance sheet that demonstrates the change of skin already started in recent years: more profits from the sale of financial and insurance products and services, less and less income from credit intermediation activities to households and businesses. For the entire national banking system, the overall picture of revenues is certainly positive, thanks to an overall growth in “turnover” of 4.1 billion euros. This increase brought the total "turnover" of the country's banks to over 82.2 billion last year, up by 5.2% compared to 78.1 billion in 2020. It is a pity that the key to success of the income statement of Italian credit institutions are taking steps more and more due to the soaring increase in commissions paid by customers. In 2021, the contribution to the growth of income linked to the interest margin, i.e. the side of income linked to loans, was almost neutral (543 million down) while the contribution of revenues (+1 billion) weighed positively on the result. ) and, for the most part, the commission portion which represents, with 3.5 billion, 88% of the higher revenue recorded in 2021: in total, revenues from the sale of financial and insurance products increased by 4.6 billion , from the management of the sale of credit cards, from managed savings and have amply compensated for the decline in income guaranteed by loans.

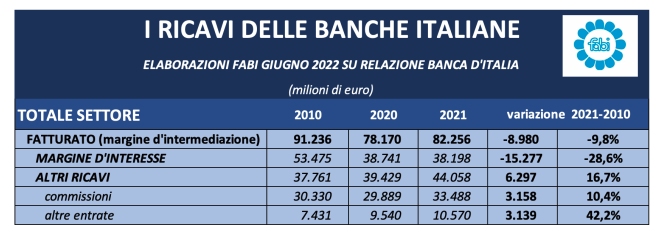

The results for 2021, elaborated by Fabi on the basis of the data reported in the last annual report of the Bank of Italy, therefore confirm the trend of last year, with a now clear acceleration as regards the overtaking of commissions on interest margins and an even greater distance between them. If in 2020 the revenues other than the interest margin represented 50.4% of the total "turnover", in 2021 the percentage rose to 53.6% with a jump of almost seven percentage points compared to the profits deriving from loans. In fact, the contribution of the interest margin to the total revenues of the sector has dropped dramatically and represents just over 46%, compared to a percentage of 49.6% recorded the previous year. In absolute terms, in 2021 alone, banks obtained almost 45 billion in revenues from financial services and products from their customers, while they collected just over 38 billion from traditional sector revenues (interest margin for lending to households and businesses). The gap between the two items of the "turnover" of the sector increases in favor of the "other revenues" and goes from 688 million in 2020 to 5.8 billion in 2021. In fact, income other than interest, on the whole, increased by 12% compared to last year, while the collections linked to the traditional credit activity of loans suffered a reduction of 1.4%. The gap in the composition of the sector's revenues reflects the sudden change in the business model that most of the country's banking groups have been implementing for several years. The comparison with the historical data of the last decade shows how the income deriving from commissions has conquered an increasingly significant part of the proceeds and bank profits. In 2010, bank revenues amounted to 91.2 billion: of these, 53.4 billion came from loans and 36.7 billion from commissions; in 2020, with the "turnover" down to 78.1 billion, the revenues from the sale of financial and insurance products exceeded, for the first time, albeit slightly, the income from loans: 39.4 billion equal to 50, 4% of the total against 38.7 billion equal to 49.6% of the total.

IN 11 YEARS, THE TURNOVER FROM LOANS TROUBLE BY 15 BILLION

In the last 11 years, the entire Italian banking circuit has in fact burned more than 15 billion of that part of the “turnover” linked to loans (interest margin) for the benefit of “other revenues”. The sudden changes in strategy, also in response to the still low levels of interest rates, together with the greater involvement of credit institutions in more profitable activities, have reduced the appeal for loans in favor of commission-based banking services. The possible future recipe on the revenue front could pass through the expected rise in interest rates and an ever-imposing role of wealth and asset management, an area in which consulting will require broad, diversified and valued skills because the goal will not be the sole management of the savings but the use of the liquid assets accumulated on current accounts, in increasingly profitable and long-lasting investments.

CREDITS AND THE EFFECT OF PUBLIC GUARANTEES

Loans to customers, both businesses and households, grew by just over 60 billion in 2021, going from a total of 1,517.1 billion to 1,577.7 billion. This increase, however, must be included in a "special" regulatory framework: it should in fact be remembered that also in the past year some measures were in force during the economic emergency caused by the pandemic, in particular the public guarantees on new loans, both those granted through the Central Guarantee Fund and those insured by Sace . From March 2020 to January 2022, the total amount of public guarantees granted exceeded 250 billion (253.3 billion): the increase in loans recorded in 2021 falls within this context and was only possible thanks to a non-financial instrument. ordinary, a public parachute that the banking sector has also exploited for operations to replace old loans, less guaranteed and more expensive for the banks themselves, with new lines of credit granted in fact without risk, but also with little profitability. In any case, it is an instrument that has allowed the banking sector, also thanks to the daily commitment of male and female workers, to support the economy, with the State having absorbed the credit risk, limiting if not eliminating , in some cases, the impact on the capital ratios of the same institutions. This is a timed situation which, moreover, is destined to run out shortly, considering the deadlines imposed by the European Commission on member countries to benefit from exceptions to the ordinary regulatory framework which significantly limits state support to the economy.

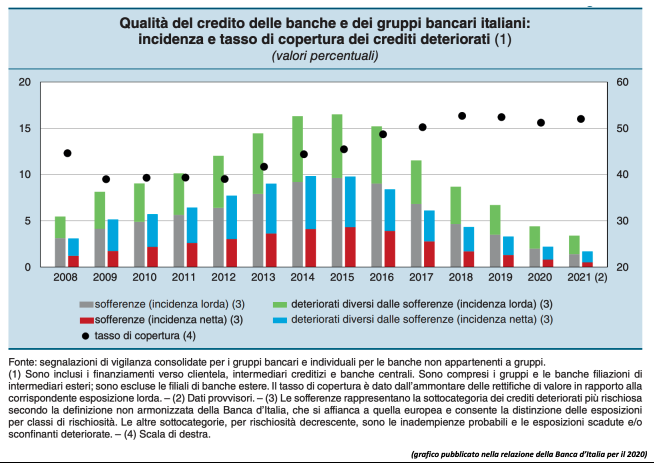

BAD LOANS DOWN BY 5 BILLION

In the course of 2021, as proof of the stringent rules that the ECB imposes on banks in the management of bad credit, net bad loans fell further: from 20.9 billion in December 2020 to 15.1 billion in December 2021 with a reduction of 5.8 billion overall. Gross non-performing loans, those not covered by collateral, also decreased further: those attributable to businesses, for example, decreased by almost 11 billion, from 33.3 billion to 22.4 billion. However, in the last period there has been a reversal of the trend in relation to loans not repaid by families, in particular mortgages: the unpaid installments increased, from September 2021 to March 2022, by 1.6 billion, from 10.5 billion billions in total to 12.1 billion.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/banche-ecco-conti-e-sfide-report-fabi/ on Fri, 10 Jun 2022 06:00:49 +0000.