Banks, here are the results of the pincers of shareholders and the ECB

What did the general secretary of the Fabi , Lando Maria Sileoni , say during the meeting in Abi that opened the negotiations on the renewal of the national collective labor agreement for 280,000 male and female bank workers; the contract, which expired at the end of 2022, has been extended several times until next July 31st. Here is the full text

In the last 10 years, the nature, structure and political balance of the banking sector have profoundly changed: from being a territorial presence with attention to the real economy, businesses and households, bank branches have now transformed in financial shops.

THE TRANSFORMATION OF BANKS

This transformation is clearly "written" in the financial statements: in the last 5 years the total revenues of the sector amounted to 413 billion euros: of these, more than half (50.5%) or 209 billion corresponds to commissions; while 204 billion (49.5%) come from the interest margin, ie from loans.

MORE COMMISSIONS AND LESS CREDIT

In 2022, loans returned to being the major source of revenue, thanks to the very rapid increase in the cost of money decided by the ECB, but the trend is the one traced overall in the last five years: more commissions, less credit.

NOT ONLY VALUE FOR SHAREHOLDERS

Banks probably no longer want to represent the transmission belt between finance and territories. We, on the other hand, think that, alongside the legitimate objective of creating value for the shareholders, the social role must continue to exist which, despite the propaganda, has been greatly reduced. The objective of the top management of the banks is: to increase revenues and profits, also by reducing costs, in order to be able to distribute important dividends to shareholders.

SHAREHOLDERS ALWAYS WELL REPAID

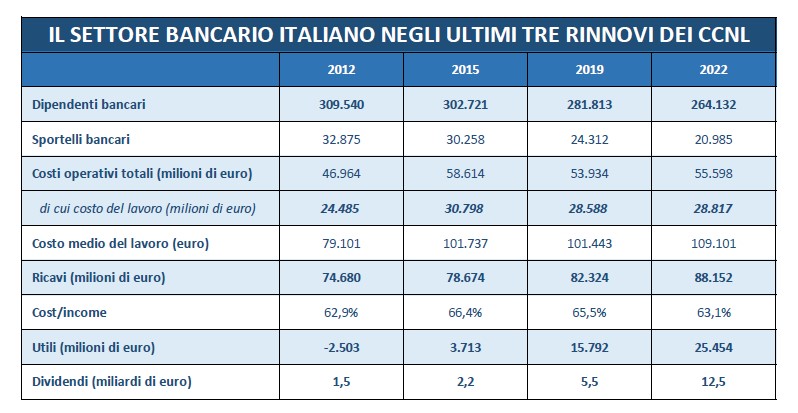

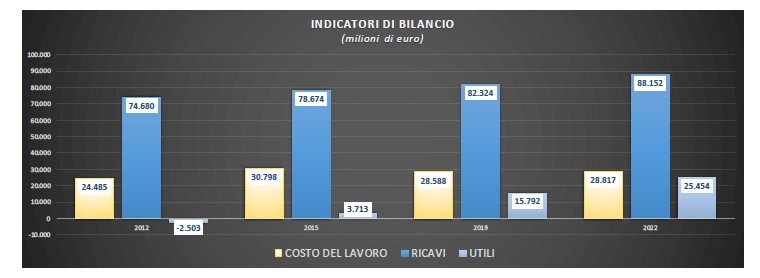

Shareholders have always been amply repaid for their investments with constantly growing dividends: 1.5 billion in 2012, 2.2 billion in 2015; 5.5 billion in 2019, 12.5 billion in 2022.

WHAT WORKERS EXPECT

That's why the time has come to also repay the workers for the sacrifices and efforts that have allowed such high profits with the right economic recognition: the difficulties of 2012 have been overcome, the sector is different from when certain decisions were made on the severance pay , therefore, there are all the conditions for recognizing what has been lost. The severance indemnity has saved the banks around 200 million a year and now there are all the conditions to return to normal. The numbers and the trend of the sector also tell us that the 2019 contract is outdated, it needs to be profoundly renewed.

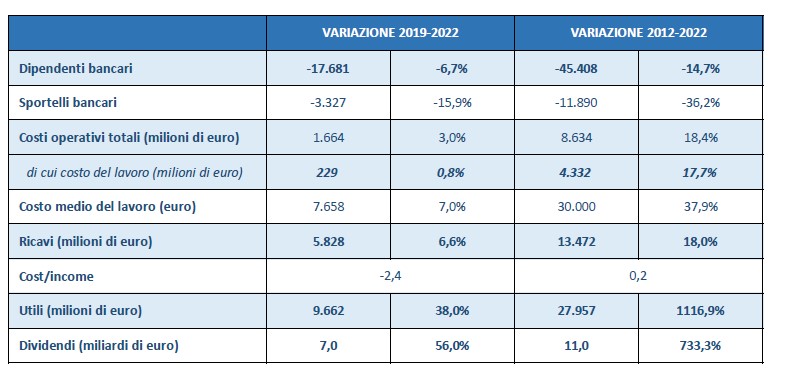

HERE ARE THE TRENDS OF BANKS' FINANCIAL STATEMENTS

According to data referring to the years of previous contract renewals and to 2022, the revenues and profits of the banks have steadily increased. Revenues amounted to 74 billion in 2012, 78 billion in 2015, 82 billion in 2019, 88 billion in 2022; in 10 years +18%. As for profits, after the overall loss of 2.5 billion in 2012, they amounted to 3.7 billion in 2015, 15.7 billion in 2019, 25 billion in 2022; in 10 years +1,000%. Compared to the growth in profits, personnel costs have grown much less: in 10 years only +17%. The cost-income ratio, i.e. the ratio between costs and "turnover", has also progressively improved in recent years: it was 66.4% in 2015 and 65.5% in 2019, today it is 63.1% among the best data at the European level.

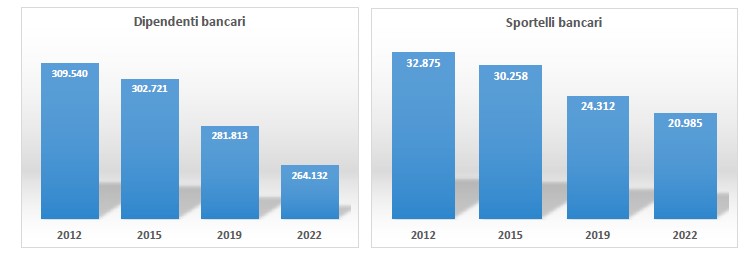

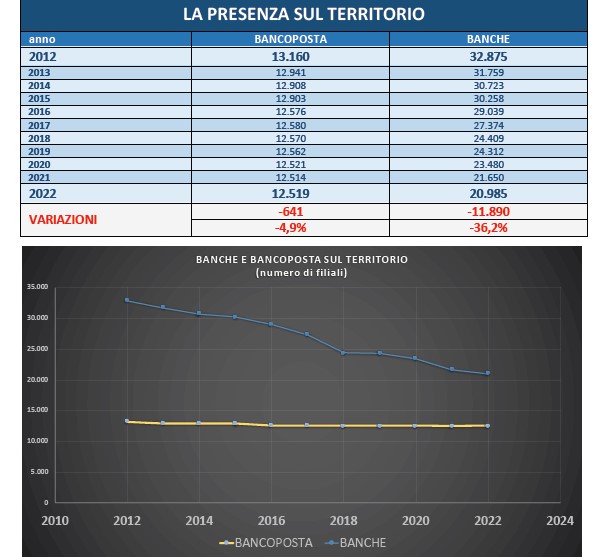

EMPLOYEES AND BRANCHES FALL, OPERATING COSTS GO UP. THE SPACE LEFT FOR BANCOPOSTA

In 10 years, bank employees have decreased (-14.7%) and also branches (-36.2%), but operating costs have grown by almost 20%: staff savings and network cuts have been to cover consultancy, legal fees and other costs. Cutting costs, including personnel costs, is no longer a necessity for the sector. The increase in the average cost of labor (30,000 euros in 10 years) is justified by increasingly higher wages for some categories of employees and not for all. In 2012 the banks had 309,000 employees and 32,000 branches throughout Italy. After 10 years, bank employees have fallen to 264 thousand (minus 15%) and bank branches below 21 thousand (minus 36%). BancoPosta, in the same period, effectively left its territorial presence intact: there were 13,000 branches and today they are 12,500 (minus 5%). The space left to BancoPosta is intentional, not accidental: banks prefer to focus on activities that guarantee higher revenues (the sale of financial and insurance products) leaving more expensive and less profitable activities to Poste. At the same time BancoPosta becomes an alternative distribution channel for some large banking groups that also sell their credit products to Poste customers.

POLICIES AND OBSESSIONS OF THE ECB

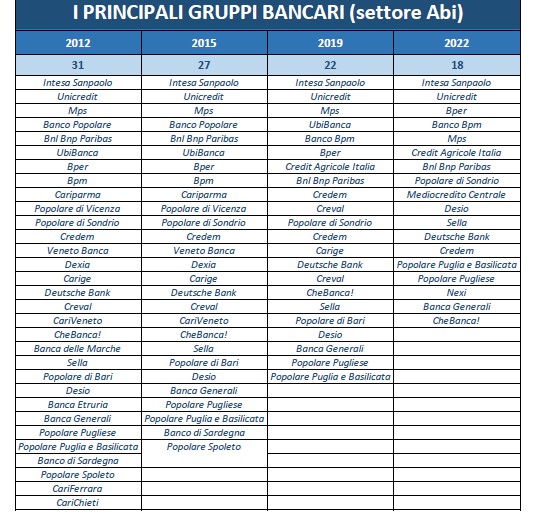

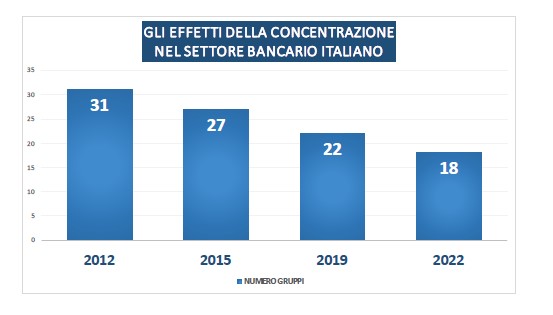

Starting in 2014, the supervision of Italian banks, with the exception of the smallest ones, moved from the Bank of Italy to the European Central Bank which drastically changed the supervisory approach: zero dialogue, more rigid rules. Objective: fewer banks, few large and more solid groups, with more robust assets capable of withstanding even global financial shocks because the bankruptcy of Lehman Brothers in 2008 had left its mark. In particular, the ECB demanded a significant reduction in non-performing loans: from 2008 to 2014, banks' non-performing loans had gone from 131 billion to 350 billion euro (200 billion were non-performing loans). Today, net non-performing loans are equal to approximately 15 billion, while the total of non-performing loans is 55 billion. In short, the quality of credit has become an obsession and the ECB has effectively forced the banks, in order to lighten their balance sheets, to transfer tens and tens of billions of non-repayable loans to debt collection companies (moving the problem from banking sector to the territories). Mergers and combinations, in some cases necessary to avoid bankruptcies, have led to a significant simplification or rationalization of the sector, in line with the clear and clear indications of the European Central Bank. The main groups in the Abi sector were 31 in 2012, 27 in 2015, 22 in 2019 and there are 18 today. This strong concentration has led the banks to have more and more power, which allows the top management of the sector to significantly influence politics and institutions.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/rinnovo-contratto-nazionale-bancari/ on Wed, 19 Jul 2023 13:24:49 +0000.